IdentityMind On The Need For FinTech Compliance Marketplaces

PYMNTS

SEPTEMBER 6, 2018

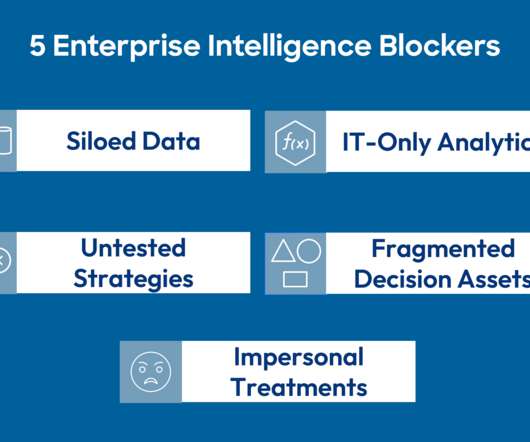

For FinTech firms, doing the chasing all on their own is a losing proposition. SaaS, the distribution model where providers offer a central location for their customers, can offer FinTech firms a way out of inefficient processes, say some supporters. FinTech firms can browse and research what they need and pick it up on the fly.

Let's personalize your content