Top 5 Emerging Fintech Hotspots in 2018 [Page 1]

Bank Innovation

NOVEMBER 19, 2018

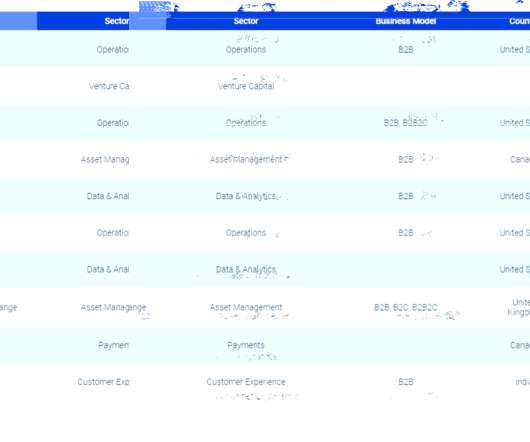

The number of financial technology companies is on a rise, and every year many of these new companies as well as established ones choose to situate themselves in cities that are not San Francisco or New York.

Let's personalize your content