3 Machine Learning Insights For Deposit Tiering

Last week (HERE), we looked at how deposit account tiering is used, some of the objectives that banks might employ, and the effectiveness of tiering in total. As discussed last week, many banks tier without objective, without data, and without supportive marketing, thus rendering the methodology worthless and possibly hurtful. We challenged several commonly held assumptions and presented data that would indicate that tiering accounts just by account balance may not be all that it is cracked up to be. Today, we explore what other methodologies uncovered with machine learning for deposit tiering we might employ to meet the objectives of greater deposit performance.

The Correlation of Balance, Rate, and Product

It turns out that if you correlate account balances with rate, the relationship is weak at best. While it is true that there is some correlation there, most of that correlation can be explained by economic activity. In the US, when macroeconomic factors such as GDP, employment, and wages increase, deposits increase about 98% of the time, regardless of offered interest rates.

Transaction accounts, for example, usually increase as economic activity picks up largely without the application of having to raise rates. This deposit performance is what makes transaction accounts so valuable and speaks to why every bank should consider making digital account opening and treasury management a priority.

The Takeaway: The takeaway here is that product development and product mix is much more influential when it comes to building franchise value through deposit performance and should be prioritized above focusing on account tiering. This is critical to understand, as many bankers turn to rate and/or tiering off rate before even considering if the bank has the right product and the right product attributes. A bank can modify its tiers all it wants, but that effort pales in comparison to making sure you are driving the right product mix or having competitive products.

Geography

Next to tiering by rate, banks often think about tiering by account balance and then geography. Geography can make a difference – but only slightly. When there is a large difference in rate sensitivities by geographies, tiering by account balance makes some sense. Banks already take advantage of this behavior by posting different rates for different zip codes or areas. Whereas balances explain about 12% of rate-sensitive behavior, geography can explain as much as 15%.

However, if the differential is small, banks do themselves a disservice by having different tiers for different geographies. As you might expect, the rise of digital account opening has dramatically reduced differences in sensitivity between geographies. We see more and more areas reacting the same way. Over the last ten years, banks have reduced the differences in deposit rates between different areas, and now with the rise of technology and more national bank platforms, we see less and less geographical sensitivity to rates. This trend will continue until there is little arbitrage banks can extract over geographies.

The Takeaway: While geography can make a difference, it is only slight and likely going away. It’s better to focus on other areas of deposit sensitivities and not worry about tiering by balance AND geography.

Machine Learning Lesson 1 – Tier By Age of Account

There are still other influences at work. Next to account balances and geography, the age of the account has the next largest influence on deposit performance. As you might expect, the older the account, the less rate/balance sensitive the account is. This brings up the question of whether banks should be tiering by account age. Here, banks can reward newer accounts.

This is counterintuitive, but there is evidence to suggest that if you can market an account that is less than a year old and offer a higher rate if they increase their balances by 10%, you would be more successful when it comes to deposit performance than just tiering regardless of age.

The Takeaway: Consider a tier by inverse age – newer, more rate-sensitive accounts receive higher rates for building balances. Over time, as customers use more products or learn more about the bank’s brand, rate promotions can decrease, thereby “training” them to be less interest rate sensitive.

Machine Learning Lesson 2 – Tier By Number of Products or Customer Segment

The number of products also has about a 3% influence on rate/balance deposit behavior. The more products a customer uses, the less sensitive they become and the more open they are to build balances. Thus, offering rate, waived fees, or a special gift to open up another account may be more effective than tiering. Instead of balances, banks can tier by the number of products used. Each product increases retention and helps extend the average life of the deposit. This helps increase deposit performance.

It also turns out that professionals, in general, are less rate-sensitive than non-professionals. Except for medical doctors, lawyers, accountants, and other professionals tend to be less rate/balance sensitive. Here it makes sense not to employ tiers (except for doctors) for many professions, as marketing will be ineffective and only serve to teach the account to be more rate sensitive.

The Takeaway: Tiering by account balance and rewarding rate makes depositors more rate sensitive. Banks should be careful not to train non-rate-sensitive customers to be rate sensitive.

Other Modern Tiering Ideas

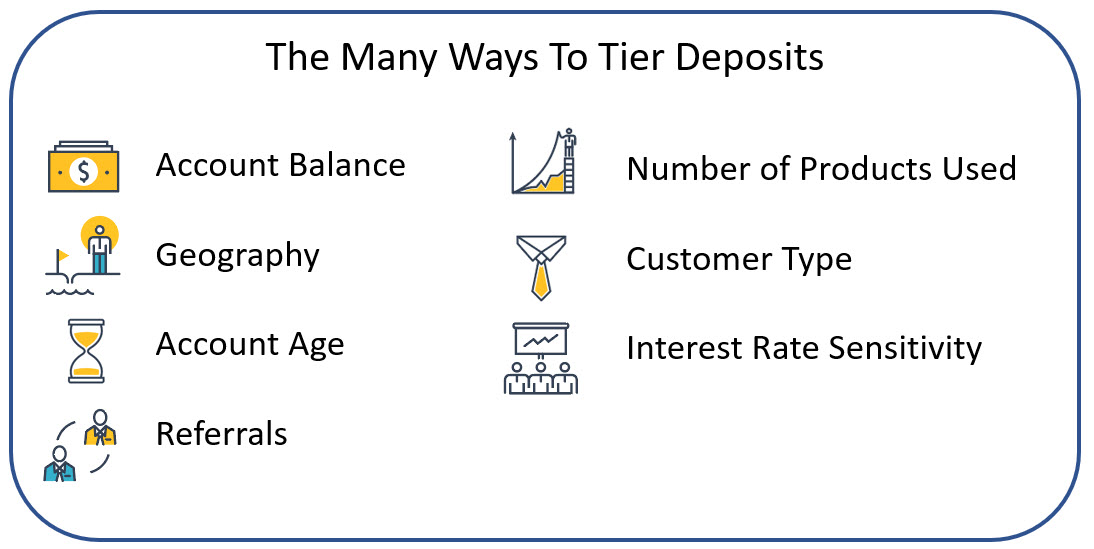

There are hundreds of other attributes that machine learning or basic statistical analysis can uncover. For example, instead of balances, banks can tier by deposit referrals. The more referrals a customer provides, the more of a reward of service, discounts, or rates the customer may enjoy.

There has also been some experimentation that higher rates on higher balances should be offered ONLY if the account is found to have other bank accounts during the account opening process. Offering a limited-time promotion to bring over balances from certain named accounts (such as those at national banks), has proven effective. The significant advantage here is that the bank would know what these national banks are paying and can offer a customized rate that is minimized to move balances.

The Takeaway: There is more to tiering than just using deposit balances. Further, more dynamic tiering is in the future of banking based on the data profile of each customer. Using other attributes such as verified other accounts, homeownership, use of digital accounts, or other markers may be more effective at driving deposit balances than just offering a single tiering structure to all.

Dynamic Pricing

Of course, the best answer to all of this is for banks to move to dynamic pricing. Banks already have enough data to optimize rate and balance down to the individual account level. Every customer, be it an individual or business, faces their own balance/rate sensitivity curve. Understanding each customer’s behavior and then offering a special incentive that may not be rate (and probably isn’t) will be commonplace among community banks in the next five years.

The effort here is to combine experiment automation with a pricing engine with machine learning. What you get is a series of automated experiments where customers are offered certain incentives to bring in new money. Each customer is then rated as to their reaction and sensitivity to certain promotion types. Once a test is successful, other “look-alike” customers are found and tested.

Some banks are already doing this and achieving about 30% better performance as judged by the value of accounts. Deposit balances are larger, interest sensitivity is lower, and lifetime value is greater.

Your Weakness – Your Core System

Your deposit data is readily available from your core system. If you are willing to analyze the data, plus run some experiments, then you may find excellent reasons to tier. The problem is – most core systems do not lend themselves to inspecting a time series of data.

More importantly, few traditional core systems can handle tiering by anything other than balance size. The future is to be able to tier by account age, profession, disposable income, number of products utilized, and geography. This is likely the reason why you should consider a more modern core such as Thought Machines, Finxact, or others.

If done the right way, tiering can serve to increase balances, drive down your cost of funds, and, best of all, decrease interest rate sensitivity.

Conclusion

Our advice is not to put too much effort into tiering – particularly not now when rates are rising and accounts are already becoming more interest-rate sensitive by the day. You may not be able to employ machine learning to deposit tiering, but there are some lessons described in this article that you can experiment with to see if they work for your bank.

In general, tiering increases complexity which jumps operational cost and causes confusion for both the customer and the employee. Take a look and consider doing away with your tiers entirely unless you are committed to marketing and utilizing the tiers how they were designed. To keep or expand your tiers banks should have some evidence that the tiers are helping.

Further, consider other ways to tier and reward your customers. Balance is just one of many factors that contribute to franchise value.

If you are looking for the fastest way to improve deposit performance at your bank, investing resources in your data and deposit marketing without using rate is one of the best investments a bank can make. This is an excellent time to do this – all it takes is a little work and creativity to unlock double-digit value.