How Banks Use Debt Yield Ratio For Underwriting

In an article last week (HERE), we discussed why real estate loans underwritten at common debt service coverage ratio (DSCR) and loan-to-value (LTV) levels may quickly become substandard credits if capitalization (cap) rates normalize, as expected because interest rates are rising. Credits will deteriorate much faster if an economic downturn stresses net operating income (NOI). We argued that community banks should favor 1.40X to 1.50X DSCR credits, as that is the minimum cash flow required to withstand a standard recession. We pointed out that DSCR and LTV are driven by cash flow (NOI) and that the relationship between cap rates, interest rates, DSCR, and LTV conspires to make real estate lending especially dangerous. Many national and regional banks incorporate a minimum debt yield ratio as an underwriting criterion. Using this metric will protect lenders better than DSCR and LTV standards in an increasing interest rate environment. This article will analyze how a debt yield ratio can help community banks correctly measure the interplay between cap rates, interest rates, and cash flow.

What is Debt Yield Ratio

The debt yield ratio is a property’s NOI divided by the property’s debt. We will assume that no obligations are associated with the property for our discussion. Debt yield measures the cash-on-cash return on the bank’s investment. The ratio overcomes the inherent weakness of DSCR and LTV calculations late in a business cycle and a rising interest rate environment. Further, the metric is not subject to changes in the amortization schedule, interest rates, cap rates, or other variables that can temporarily increase real estate values. The only factor this metric considers is how large a loan the bank can extend compared to the property’s NOI.

The best way to demonstrate the different conclusions lenders can reach between underwriting to DSCR and LTV versus including debt yield is through a specific loan analysis.

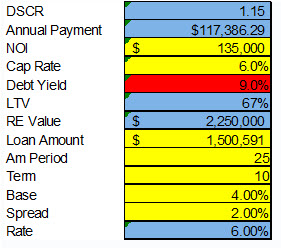

Consider a $1.5mm loan ($2.25mm appraised value), 25 due 10, 1.15X DSCR, and 67% LTV, priced at 6.00%. All the parameters of this loan are listed in the table below and note that the loan has a 9.0% debt yield ratio ($135k divided by $1.5mm).

That is a standard commercial real estate loan in today’s community bank market (1.15X DSCR and 67% LTV). However, this loan structure is fraught with credit problems for many reasons. For example, if NOI declines 14% (not a severe scenario), the DSCR falls below 1.0X, and LTV (assuming the same cap rate) increases to 80%. If the cap rate increases from 6% to 8% (returning to historical averages), the LTV increases from 67% to 95%. If interest rates rise by 2.00% (a standard interest rate stress test), the DSCR falls to 0.96X. What appears to be a typical and safe bank loan can become a problem credit when subjected to credit stress from just one of the above parameters. It becomes a worse outcome if some of the above parameters are correlated and move in tandem against a bank’s credit interests.

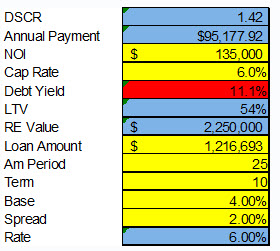

Now let us consider the same loan but assume that the bank had an 11% minimum debt yield ratio. We solved the parameters for this loan to obtain a minimum 11% ratio, as shown in the table below.

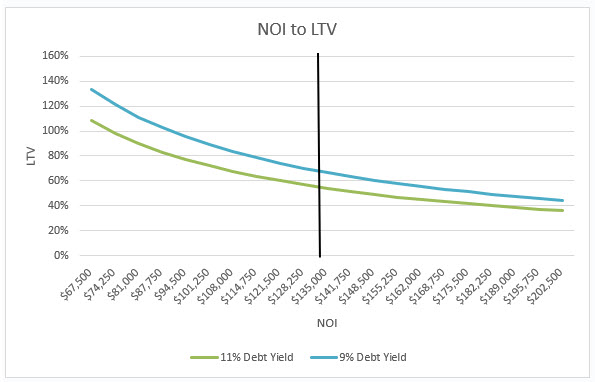

How does this loan compare to the first under various credit stress scenarios? We analyzed the data to compare the two loans with multiple assumptions and present them graphically below.

We first analyzed the impact of changes in NOI on LTV. The graph below demonstrates the relationship between NOI and LTV for both loans, and the black vertical line marks the starting point for NOI at $135k.

The loan with an 11% debt yield ratio in the green line can endure 50% more NOI decrease to breach 100% LTV compared to the loan with a 9% debt yield ratio in red.

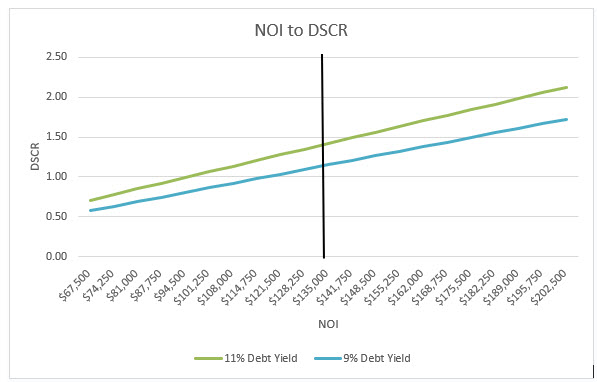

Next, we compared NOI decreases against DSCR levels.

For the loan with a 9% debt yield, if cap rates for this property move from the current level of 6% to 8.4% (not an extreme case), the LTV surpasses 100%. The loan with an 11% debt yield can show sub-100 % LTV beyond 10% cap rates.

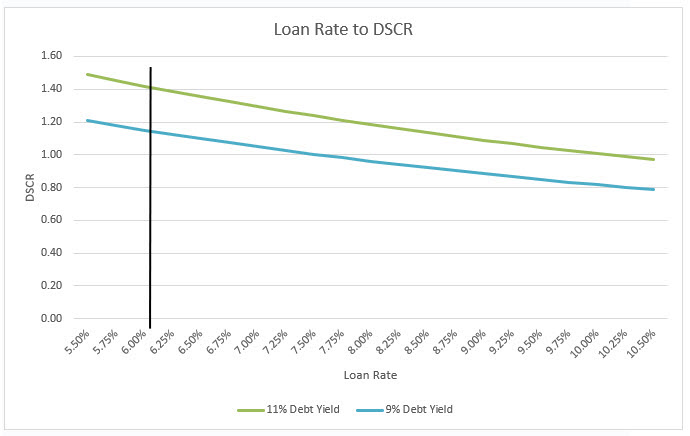

We then considered the sensitivity of DSCR to movement in interest rates for the two loans, as shown below.

Not surprisingly, the 9% debt yield loan demonstrates sub-1.0X DSCR if rates increase by 170ps. The 11% debt yield loan can maintain a 1.0X DSCR to 400bps increase.

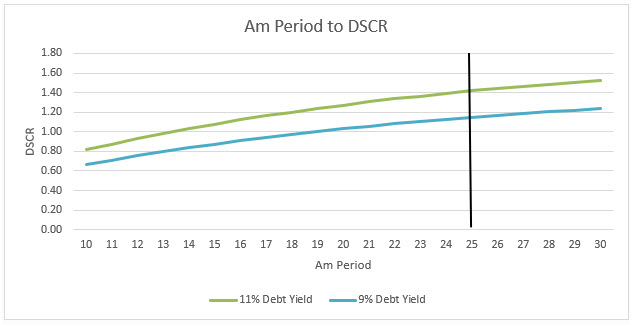

Finally, we considered the sensitivity of DSCR to changes in different amortization periods, as shown below.

While the 9% debt yield ratio loan results in a 1.03X DSCR with a 20-year amortization period, the 11% level can repay the debt over 13 years at 1.0X DSCR.

How to Apply at Your Bank

Banks should be including minimum debt yield ratios in their underwriting standards. Unlike DSCR or LTV, debt yield is unaffected by longer amortization schedules, low-interest rates, low cap rates, or any other variable that can temporarily increase real estate values and the associated risk to creditors. Looking for minimum debt yield is especially important for lenders in a rising interest rate environment. There is, of course, one trade-off to targeting 11% debt yield real estate loans – lower loan yields. But the trade-offs are well worth it, resulting in higher risk-adjusted loan ROE.