Data Presentation Like a World-Class Banker

South State Correspondent

APRIL 14, 2022

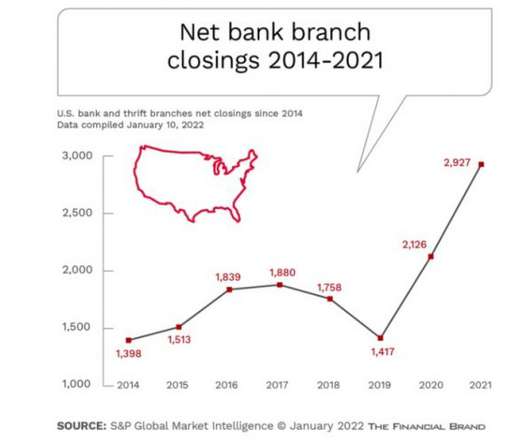

This week is the start of bank earnings week, and the best bankers on earth will be presenting their results. It doesn’t matter if you are in front of your shareholders, equity analysts, or boss. Sooner or later, you will need to present data to showcase your results. When making a data presentation, there is a boring way and an unforgettable way to do it.

Let's personalize your content