3 keys to understanding blockchain

Payments Dive

SEPTEMBER 11, 2020

Blockchain technology can be very difficult to understand, but it doesn't have to be. You just have to grasp three basic key facts.

Payments Dive

SEPTEMBER 11, 2020

Blockchain technology can be very difficult to understand, but it doesn't have to be. You just have to grasp three basic key facts.

Accenture

SEPTEMBER 11, 2020

What drives change in an industry? Businesses? Consumers? Government regulations? In the case of touchless payments in the United States, change has mostly moved at a glacial pace—until COVID-19. Touchless payments have expanded rapidly in countries throughout the world—and the benefits are significant—so why did it take a global pandemic to move the needle in….

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Source

SEPTEMBER 7, 2020

Biometric cards have garnered more attention in recent times through various trials, but the coronavirus pandemic looks set to accelerate their adoption with a series of major card issuers beginning to roll out the technology.

Perficient

SEPTEMBER 9, 2020

As an avid at-home cook and lover of food, the office potluck always brings me great joy. I love when I can try other colleagues’ favorite things to cook and share mine as well. However, this year office potlucks have gone on hold and so has that connection. Provisioning Virtually. With everyone working from home, our colleagues in Chicago wanted to provide a way that they could stay connected with each other.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

PYMNTS

SEPTEMBER 9, 2020

Mastercard has announced a new virtual testing platform for Central Bank Digital Currencies (CBDCs). In a Wednesday (Sept. 9) news release, Mastercard said a recent survey revealed 80 percent of central banks are engaged in some form of CBDCs, while 40 percent have moved from research to experimenting with concept and design, according to by the Bank for International Settlements.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Bobsguide

SEPTEMBER 7, 2020

As the new generation of customers increasingly relies on tech, expectations from the services that banks offer are also expected to change – particularly as Gen-Z and millennials focus in on financial wellbeing. “Gen Z and new consumers in the marketplace want to put so much trust.

Perficient

SEPTEMBER 9, 2020

Calling all manufacturers! Come join us for a candid conversation with experienced manufacturing leaders on Thursday, September 10. Hosted by industry veterans Tony Kratovil from Salesforce and Eric Dukart from Perficient, this virtual roundtable event will dive into what’s top of mind in the world of manufacturing and how companies with indirect sales channels can set their dealers and distributors up for success.

PYMNTS

SEPTEMBER 7, 2020

Despite the pandemic, venture capital dollars are flowing freely to nascent firms in Asia that are tackling the need for contactless interactions and platforms that match supply and demand — setting the stage for innovation on the other side of the public health crisis. In an interview With Karen Webster, Craig Dixon , general partner and CEO of Accelerating Asia , an independent startup accelerator based in Singapore, said helping startups scale and navigate the VC realm requires a focus on tel

Payments Source

SEPTEMBER 11, 2020

American Express Co. began reopening offices in New York and London this week even as it told employees that they can continue working from home through June 2021 if they wish.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

Bobsguide

SEPTEMBER 10, 2020

Federal data protection standards must be created to allow open banking to take off in the US, said Abishek Gupta, head of BBVA Open Platform, BBVA during a Fintech Talents North America panel yesterday. “I agree there has to be some minimum standards across all of those principles to.

Perficient

SEPTEMBER 10, 2020

How will you spend your COVID-19 bonus? No, not a fatter paycheck (sorry). I’m talking about the additional resources your CFO may be freeing up for new digital initiatives. A survey of U.S. executives by Duke’s Fuqua School of Business shows that due to pressures brought on by the COVID economy “nearly 2/3 of companies are shifting resources to create better digital interfaces and more engaging digital experiences.”.

PYMNTS

SEPTEMBER 8, 2020

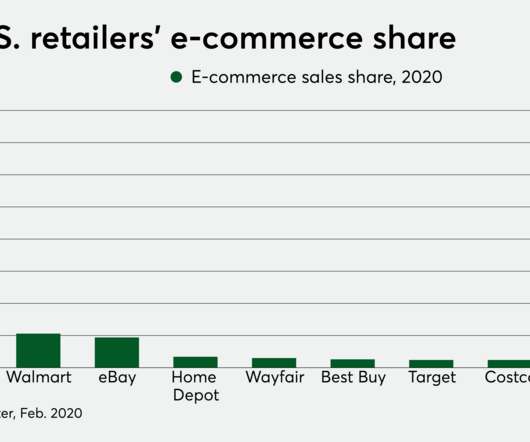

Amazon put a new date on the calendar last week. No it’s not Prime Day. But it has told its sellers that “Black Friday” deals will start on Monday, Oct. 26, leaving the rest of the retail world to read the tea leaves on Amazon’s Q4 plans. According to Tamebay , an Amazon seller news site, Amazon Early Black Friday Deals will start and run through Nov. 19.

Payments Source

SEPTEMBER 11, 2020

Citi has teamed with home furnishings giant Wayfair on a pair of credit cards—one cobranded with Mastercard and a private label version—capitalizing on the pandemic-accelerated e-commerce boom.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

BankBazaar

SEPTEMBER 9, 2020

When it comes to financial mistakes, the devil lies in the habits. Luckily, you can get rid of them for good. Read on to find out how. Identifying bad financial habits is a tough task, because they’re never ‘in-your-face’ Unlike the one-off errors that we all make at some point and time, habitual errors aren’t easy to spot in your bank statement or credit report; they’re systemic in nature, and like any other bad rule, they require a revolution to overcome.

Perficient

SEPTEMBER 8, 2020

The Basics of Headless. “Headless” has been a buzzword for more than a few years in the CMS space, but what exactly is a headless content management system? In short, content management systems (CMS) have traditionally handled content management and rendering (creating markup and serving to web browsers or other clients). A headless CMS only handles content management and provides an API for other systems to consume that content.

PYMNTS

SEPTEMBER 8, 2020

The rise of the coronavirus has spotlighted the need for corporate treasurers to make real-time decisions about cash management. JPMorgan ’s Head of Global Liquidity Product Solutions Specialists, Lori Schwartz , told PYMNTS in a recent Masterclass that the very nature of liquidity management is changing — and leading treasury management professionals to pivot to digitization and move from physical to virtual accounts.

Payments Source

SEPTEMBER 11, 2020

The Philippines’ anti-money laundering authority has identified 57 “people of interest,” including foreigners and local bank officers and government officials, whose links to Wirecard AG are being scrutinized.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Bobsguide

SEPTEMBER 8, 2020

The payments industry has undergone drastic changes in the last decade, making reconciliation critical to cope with huge volume, abundant data sources and a growing number of players involved in each individual transaction. Yet what remains unchanged is the essence – payments are.

Perficient

SEPTEMBER 9, 2020

In the past, ecommerce was believed to be the simple act of building a commerce website for your business and seeing how your customers used it. However, many B2B sites weren’t performing well or able to adapt to this approach because they lacked the specific resources and knowledge needed to be successful, and even felt hesitant to adopt new digital methods because previous of ecommerce site failures.

PYMNTS

SEPTEMBER 11, 2020

The great digital shift in the quick-service restaurant (QSR) space shows no signs of stopping. To that end, Bloomberg reported that Chipotle Mexican Grill CEO Brian Niccol estimated the firm’s digital sales could be as much as $2.4 billion in 2020, leagues higher than the $1 billion seen in the previous year. And in a nod to the fact that mobile and online orders are here to stay, Niccol said sales digital sales could be as much as 40 percent to 50 percent of revenues, which Bloomberg noted wo

Payments Source

SEPTEMBER 11, 2020

American Express is expanding into the fast-growing European market for open banking-based payment initiation services with its Pay with Bank transfer platform.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

CFPB Monitor

SEPTEMBER 10, 2020

As part of California’s recent triad of consumer financial services legislation, including AB-1864 , which creates the Department of Financial Protection and Innovation and the California Financial Protection Law, and AB-376 , which includes a new Student Loan Borrower Bill of Rights. California is also on the cusp of enacting a law requiring licensure of persons who are engaged in the business of collecting, on behalf of themselves or others, debts arising from consumer credit transactions wit

Perficient

SEPTEMBER 7, 2020

Healthcare marketers used to discuss the “patient experience” within their health system. These days the focus has shifted to “consumer experience.” The reason is obvious. Retail giants like Amazon and CVS keep pushing deeper into the healthcare space. And they’re bringing retail practices and improved consumer experience with them. It’s true that before a person becomes a patient, they are a consumer – shopping around, as they would in other retail sectors – for the best healthcare option.

PYMNTS

SEPTEMBER 8, 2020

Apple Pay users may soon be able to use a feature in the Wallet app to make payments by scanning a QR code. AppleInsider reports the new method would no longer require near field communication (NFC), the wireless data transfer that enables nearby devices to communicate without an internet connection. Since its launch, Apple Pay transactions at brick-and-mortar retailers relied on NFC and an iPhone near the payment terminal to make a contactless purchase.

Payments Source

SEPTEMBER 11, 2020

When Jane Fraser takes the reins of Citigroup in February, she will have to tackle the company’s cards slump, lagging performance metrics and challenges presented by employees’ return to the office.

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

Let's personalize your content