How Do You Select the Best Digital Banking Platform?

BankInovation

APRIL 4, 2023

Why you need one, what to look for and how to select the best digital banking platform to support your digital banking strategy heading into the new year.

BankInovation

APRIL 4, 2023

Why you need one, what to look for and how to select the best digital banking platform to support your digital banking strategy heading into the new year.

South State Correspondent

APRIL 3, 2023

In recent articles ( here and here ), we discussed why banks that take the interest rate movement risk demonstrate lower performance as measured by return on assets (ROA). Empirical evidence, historical bank failures, and common sense teach us that many risks do not translate to higher yields. The second article compared and contrasted community banks’ pay-for-risk and relationship business models.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

APRIL 3, 2023

The instant payment floodgates are about to open when FedNow launches in July, giving banks a chance to win back customers lost to fintechs, says one GFT Group executive.

Accenture

APRIL 5, 2023

There’s a lot of buzz about next-gen payments rails globally, but where does North America stand when it comes to adopting these new options? Accenture’s recent consumer payments research—which you’ll find in our report, Payments gets personal: strategies to stay relevant—revealed that North Americans have a clear preference for payment methods they trust, from providers… The post Americans value trust above all in payment options appeared first on Accenture Banking Blog.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Abrigo

APRIL 7, 2023

Making a case for greater efficiency Loan review automation eliminates manual processes, saving time and reducing human error. Here's what to say when presenting a case for software at your institution. You might also like this whitepaper: "2022 Loan Review Benchmark Survey Results." DOWNLOAD Takeaway 1 Loan review automation can help reduce or eliminate common efficiency problems that financial institutions face.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

APRIL 5, 2023

No arrests have been made in the Tuesday morning death of Bob Lee, the chief product officer at crypto firm MobileCoin, police said.

ATM Marketplace

APRIL 4, 2023

What's driving the bitcoin ATM market? There are several factors to consider including security and accessibility. However, there are also issues holding it back. Let's take a look at both.

BankBazaar

APRIL 5, 2023

One of the most highly acclaimed films of the year, RRR is much more than its entertainment value. The film also offers valuable lessons about finances and money management. In this listicle, we’ll take a closer look at what RRR teaches us about finances and how we can apply these lessons to our own lives. Set Clear Goals In RRR, the characters – freedom fighters Komaram Bheem and Alluri Sitarama Raju – have clear goals and motivations that drive their actions throughout the film

CFPB Monitor

APRIL 5, 2023

The CFPB has filed a Notice of Appeal with the U.S. Court of Appeals for the Seventh Circuit from the district court’s decision in the CFPB’s enforcement action against Townstone Mortgage (Townstone). In the case, the district court ruled that a redlining claim may not be brought under the Equal Credit Opportunity Act (ECOA) because the statute only applies to applicants.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

Payments Dive

APRIL 5, 2023

The leader of one of the biggest asset managers in the world doesn’t think the U.S. payments system is keeping pace.

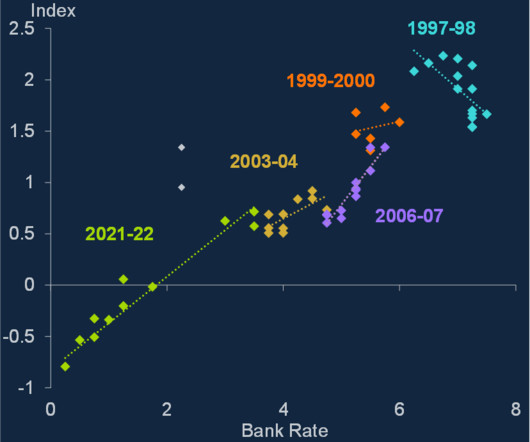

BankUnderground

APRIL 6, 2023

Natalie Burr The challenge of measuring financial conditions Imagine you were tasked with thinking about how financial conditions have changed over a policy tightening cycle. Different economists would come to very different conclusions, and none would necessarily be wrong. Why? Because measuring financial conditions is challenging – for a variety of reasons.

ATM Marketplace

APRIL 7, 2023

Video banking is a now a multi-billion dollar industry. Where's it headed? ATM Marketplace takes a closer look.

FICO

APRIL 3, 2023

Home Blog FICO Advancing the Science of Optimization: FICO & Zuse Institute Berlin FICO partners with Zuse Institute Berlin on critical research into mathematical optimization FICO Admin Tue, 02/18/2020 - 14:57 by Oliver Bastert Vice President, Product Management expand_less Back To Top Mon, 04/03/2023 - 11:45 As a result of the pandemic, interest in mathematical optimization has risen to new heights.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

Payments Dive

APRIL 3, 2023

Even with the backing of the nation’s largest banks, the platform, set for a June launch, will have adoption and security hurdles to overcome to grab a slice of the digital wallet market, industry experts say.

TheGuardian

APRIL 4, 2023

Company’s own website went down and internet was inaccessible for several hours. Follow all our live coverage of business, economics and financial markets It has not been a great day for companies bearing the Virgin brand. Virgin Orbit, the satellite launch company started by Sir Richard Branson, has filed for US bankruptcy protection. Last-ditch efforts to find funding for the struggling space firm fell through, the Guardian’s Kalyeena Makortoff reports.

ATM Marketplace

APRIL 7, 2023

The LTA-100 provides innovative cassette-based cash recycling technology in a sleek, space saving design. This user-friendly solution delivers optimal efficiency, convenience and security.

CFPB Monitor

APRIL 6, 2023

The CFPB and FTC have targeted the use of “dark patterns” on websites to influence consumer behavior. We first discuss what regulators consider to be dark patterns and why they are a focus of regulatory concern and look at examples. We then discuss the empirical issues and behavioral theories a company should expect regulators to raise if it is the target of a dark patterns investigation or enforcement action, what proactive steps a company can take to reduce the risk of a dark patterns chall

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Payments Dive

APRIL 6, 2023

In an annual letter, the digital payments darling’s co-founders acknowledged a “significant deceleration” in payment volume for 2022 and a tougher environment for startups.

BankBazaar

APRIL 5, 2023

Credit Cards have become an essential financial tool for people across the globe. India, too, has embraced this trend! With the economy growing at a rapid pace, it has become imperative for individuals to own a Credit Card. Here’s why you need a Credit Card. We’ve listed out several top reasons why the right Credit Card can benefit you and your finances in more ways than one.

William Mills

APRIL 5, 2023

The first in-person edition of Fintech Meetup wrapped up—and what a show it was! The industry’s newest fintech conference, described by some as “ the future of fintech events,” took place at ARIA Resort & Casino in Las Vegas on March 19 th -22 nd. The event was organized by the team behind the original Money 20/20 and had 3,000+ attendees, 40% of which were fintech founders and C-level executives.

CFPB Monitor

APRIL 4, 2023

On March 30, 2023, a three-judge panel of the Superior Court of Pennsylvania held in a precedential opinion that debt collectors can send collection letters to debtors after the expiration of the statute of limitations without violating federal or Pennsylvania law, so long as the debt collector does not file suit in court.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

Payments Dive

APRIL 4, 2023

The payments gateway startup, which handles acquiring and issuing, is positioning itself as a nimbler competitor to the likes of Stripe and Wex.

TheGuardian

APRIL 5, 2023

Still no agreement after 11 months of talks between the postal firm and CWU; Swiss bank UBS faces investors over merger with Credit Suisse The UBS chairman has told investors that the emergency takeover of Credit Suisse last month marked a “historic day” but one that the Swiss bank “hoped would not happen,” as he warned the first-ever merger of two globally systemically important banks came with “execution risk”.

CB Insights

APRIL 3, 2023

Generative AI — which comprises artificial intelligence technologies and applications that generate entirely new content including text, audio, images, video, code, and data — is already seeping into the financial services industry. While big banks like Bank of America, Citigroup, and Goldman Sachs were quick to place restrictions on employee use of OpenAI ’s ChatGPT in February 2023, other financial firms have jumped at the opportunity to leverage the tech.

CFPB Monitor

APRIL 4, 2023

On March 30, the Consumer Financial Protection Bureau issued its final rule to implement Section 1071 of the Dodd-Frank Act. Section 1071 amended the Equal Credit Opportunity Act to require financial institutions to collect and report certain data in connection with credit applications made by small businesses, including women- or minority-owned small businesses. .

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

Let's personalize your content