Here Is How To Calculate Your Bank’s Cost Of Capital [Calculator]

As interest rates go back up and volatility continues to remain high, banks’ cost of capital has undergone a significant shift up. Your cost of capital is essential to know for several reasons. Mostly, it gives your board and shareholders a yardstick in which to gauge a bank’s return. Produce over your cost, and you will be able to attract more capital. Produce under, and, well, you are going to have to do some good marketing to talk investors into believing you are better than the next similar investment alternative.

Why Calculate Your Cost of Capital?

While return on equity (ROE) is a good measure of bank performance, it is helpful for bank managers to know the spread between ROE and a bank’s cost of equity. The greater the spread, the greater the value creation and the more a bank is worth. In other words, the spread between a bank’s ROE and the cost of equity multiplied by a bank’s book value is the bank’s economic, or excess, profit.

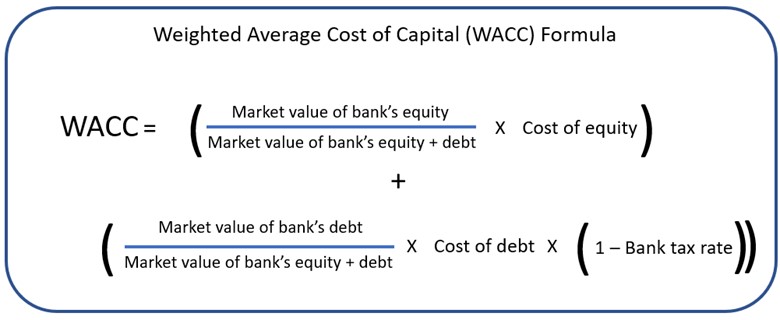

To calculate your cost of equity, you can utilize our calculator adapted from your standard capital asset pricing model. We start with the risk-free rate to proxy the general risk of the market, add a bank’s cost of debt, and then include the risk premium or the expected return above the risk-free rate that investors expect to earn investing in a stock. We then utilize a bank’s “beta” or volatility to the relative market to adjust further for specific bank risks. A beta of 1 means the bank moves approximately with the general market, while 1.2 means it is 20% more volatile.

Here, the more thinly traded or illiquid a bank stock is, the potentially higher the beta (at least in theory). Typically, for thinly traded community banks, the additional beta is approximately 30% higher than for liquid banks. Beta estimates are available from various sources, including us, your friendly investment banker, or from sites such as Finbox (our stock is in there, but you can search for yours) if you are a public company.

What Is The Current Cost Of Capital?

We have calculated the weighted average cost of capital for the average community bank and arrived at about a 10% rate. This is largely in line with community banks’ ROE performance of 11%, which would be consistent with the fact that most community banks trade at a slight premium to book value.

What It Means

Since knowing your cost of capital is the first step in developing a capital plan, it pays to calculate the number quarterly, as most analysts, investors, and astute shareholders look at the current cost of capital and compute future estimates. The cost of capital also comes into play with almost every strategy and asset allocation decision.

Our favorite value from the cost of capital that many banks overlook is used in determining your growth rate. For details on applying the methodology, we wrote an article HERE.

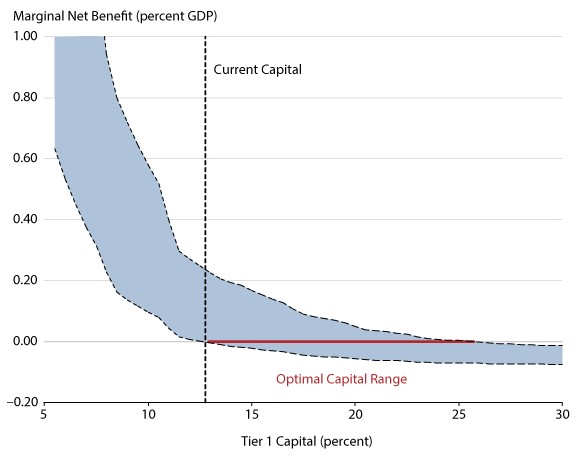

You also need to understand your cost of capital for investments, to evaluate regulatory impact (Fed paper HERE), and you need it to set loan pricing (we discuss the interplay between capital cost and loan pricing HERE). You can reverse engineer it as the St. Louis Fed did (HERE) below and calculate the optimal Tier 1 capital level range to survive a financial crisis.

Banks that are increasing credit or interest rate risk to increase their ROE will find this a fool’s game in the long run. By stepping through our calculator, you realize that increasing ROE through risk is essentially (frequently more than) offset by an increasing cost of equity. Increased earnings volatility results in high beta, which raises the cost of capital and hurts bank equity value.

Of course, the opposite is true as well. Smart bankers will look for ways to increase their risk-adjusted ROE to produce consistent earnings. Making the right asset allocation decisions is the single most impactful decision a bank can make. Banks that know their quarterly hurdle rate can now piece together asset portfolios that best achieve a consistent return above the cost of capital. Every product, every asset, and every liability needs to either produce over your capital cost or reduce the risk so that another endeavor can.

To this end, the top five tactics that can significantly reduce your expense of capital all revolve around improving risk-adjusted performance and stabilizing return. These include:

- Increasing investment in process/technology to reduce cost

- Understanding how to drive risk-adjusted ROE through loans

- Increase business line diversification

- Increase resources to specialty lines of business

- Enhancing relationship profitability with more cross-marketing

Download our easy calculator (Bank Cost of Capital Calculator SouthState Bank v1_5) and better understand how risk and return intimately dance at your bank.