So far, in this series of blogs on the evolution of banking operations for the digital era, we’ve looked firstly at how banks can gain competitive advantage from bringing ops and tech closer together and then at how operations can help design and deliver compelling digital experiences for customers. In this third instalment, we home in on the implications for operations talent and skills.

To set the context, try asking yourself two questions. First, how proficient is your current core banking operations team in the use of the latest technologies like AI/ML, analytics and APIs? And second, how much weight do you attach to tech savvy when hiring new operations team members?

How do you stack up on digital skills?

The answers will provide a good indication of where your ops function currently stands in terms of digital and technology skills. And, as with the other aspects of operations that we examine in this series, our European Banking Operations Study—conducted in November 2021 by Accenture and The Banker among 102 banks in 12 countries—provides some useful supporting insights.

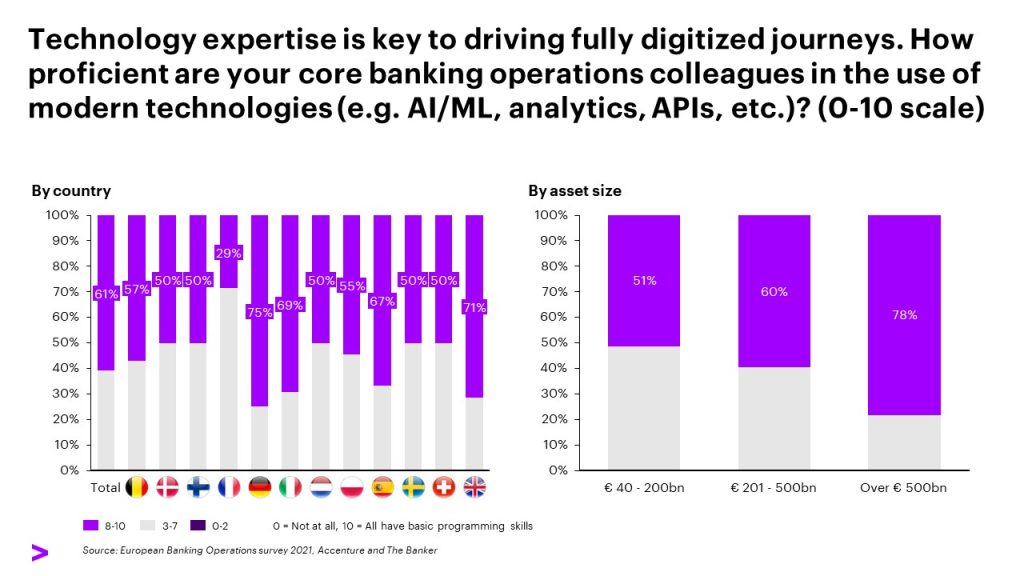

Examples? Take the findings shown in Figure 1. Across the board, the respondent banks in our study reported that they have tech-savvy ops teams—with 61% of the entire sample across all asset sizes saying their operations colleagues are highly proficient in using modern technologies. However, the distribution of these skills is heavily skewed, with smaller banks appearing to struggle the most with the tech expertise of their core ops colleagues.

Figure 1. Smaller banks seem to struggle the most with the tech expertise of core ops colleagues. Source: European Banking Operations Survey 2021, Accenture and The Banker.

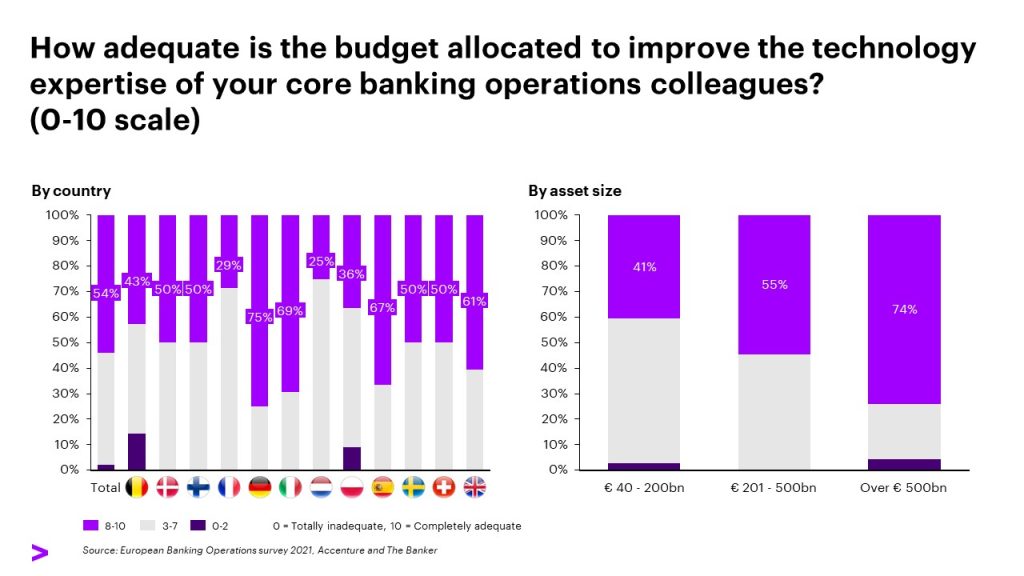

Perhaps unsurprisingly, a similar divergence emerges when respondents are asked about tech training budgets for ops staff. Asked to rate the adequacy of the budget allocated towards improving the technology expertise of their core banking operations teams, respondents at the larger banks are far more confident that sufficient money is being targeted to do this (see Figure 2).

Figure 2. Tech training budgets vary widely across countries, but the larger banks have set aside the sufficient money to develop the expertise of core operations staff. Source: European Banking Operations Survey 2021, Accenture and The Banker.

Approaches to reskilling

These responses need to be seen in an industry context where the technology savvy of operations teams is increasingly important to their ability to deliver effectively. And taken together, the findings point to two stark messages for smaller banks. First, they’re struggling to infuse digital skills into their operations teams, perhaps partly because they lack the resources to attract and develop top talent. And second, they face falling increasingly further behind as their reskilling and upskilling budgets for operations staff are outgunned by bigger competitors.

What to do? Our everyday client conversations reveal many ways banks of all sizes are working to improve digital skills in operations. One is reorientating the recruitment criteria for ops staff away from traditional banking experience and towards technology-related capabilities—including the aspiration and adaptability to absorb and apply new skills at pace. Another is launching function-wide reskilling programmes in areas like data engineering and analytics. A third is collaborating with—and maybe investing in—innovative fintechs to gain access to digital skills from outside the bank.

Alongside these initiatives, a further lever that banks across the size range can pull to attract and retain digital talent in operations is the creation of an enhanced employee offer. These days, employees—especially younger talent—are keen to work for organisations that mirror their own values and desire to make a positive difference. They also value flexibility in how they work, including remote working and even the possibility of a four-day week. All of these inducements and more are being used today by banks to win the tech talent they need.

Ops can take the lead in digitisation—by removing siloes

But why is having that tech talent in operations so vital? Essentially because operations teams really understand what customers need, from first-hand experience working with data and interacting with customers on a regular basis. So, given the right tech skills, they’re uniquely placed to drive the digitalisation agenda and help to optimise customers’ digital journeys because they’ve lived through the customer pain-points of the past.

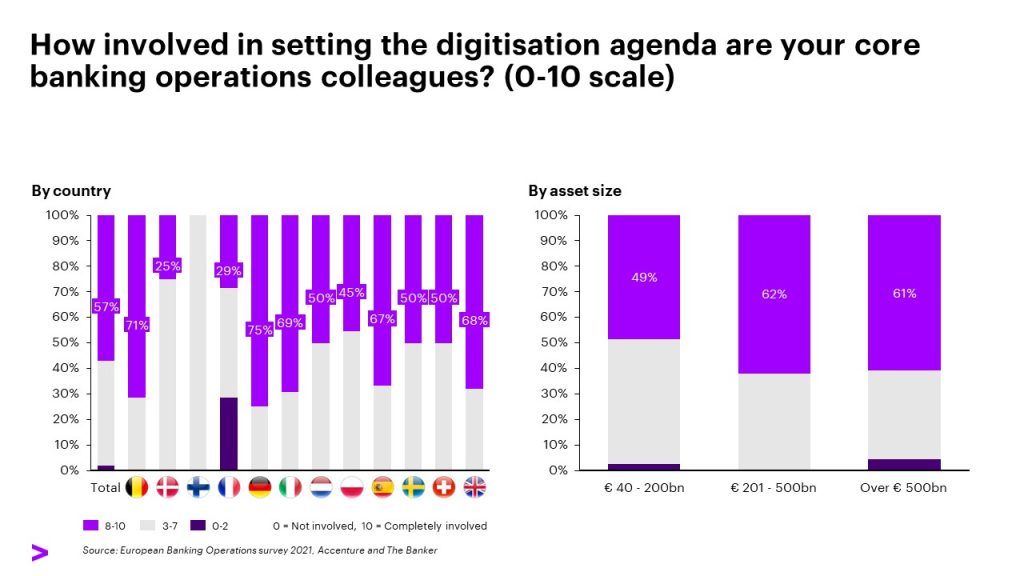

The implication? To keep exceptions to a minimum and maximise customer’ digital engagement and adoption, it’s key that ops people are integrally involved in designing those journeys. Here again our research findings suggest bigger banks currently have the edge. Figure 3 illustrates that over 60% of larger respondents rate their operations teams’ involvement in setting their digitisation agenda at eight out of 10 or higher.

Figure 3. Operations teams in the larger banks are more involved in designing and implementing their digitalisation agenda. Source: European Banking Operations Survey 2021, Accenture and The Banker.

Again, this is a gap that smaller banks need to close. And the rewards for doing so are clear. As banks are increasingly finding, some of their customer experience specialists often come from operations teams and roles—and someone doesn’t need to be a technologist to be a change-maker. Operations teams are also fiercely passionate about making things better for customers.

Transformed banking operations can help banks stay ahead of the competition and anticipate customer needs, as a European bank found by gaining over 40% in productivity.

To harness this passion to the full, we believe banks need to move away from the old silo-based mentality of front office and back office. To draw an analogy, they should change gear from front-wheel drive or rear-wheel drive to a 4×4 model: a new configuration where ops and IT work together as a single unit, with a common commitment to delivering the best possible digital experiences for customers.

Watch episode 4 of Accenture’s Tomorrow, Today video magazine to learn more about the future of banking operations.

Coming up next

In the fourth and final blog post in this series, I’ll tackle the thorny issue of operating and sourcing models—and investigate our findings on how the sourcing spectrum from in-house onshore to outsourced offshore is shifting. So stay tuned. In the meantime, if you’d like to discuss anything in any of these posts, please reach out.