The Five Problems with Adjustable Rate Loans

A common strategy for community banks, when faced with a borrower that wants a 10-year fixed rate loan, is to offer a five-year fixed rate that adjusts in five years. Historically, this has worked for some customers and banks because, over the last 40 years, five-year rates have generally fallen. As interest rates fall, a bank’s cost of funds (COF) decreases, net interest margin (NIM) increases, and on the reset date, the borrower benefits from reduced debt service costs. However, adjustable-term loans have several drawbacks for banks and borrowers, especially in a rising interest rate environment. In this article, we’ll discuss the problems with this type of adjustable-rate loan, and in future articles, we’ll discuss how to correct that problem if this loan is already on a bank’s balance sheet.

The Issue with Adjustable Rate Loans

There are five main problems with loans that are fixed for a period and then adjust on a contractual spread over a predetermined index.

- Prepayment Risk:

No other bank risk is so patently without compensation as loan prepayment risk. Adjustable rate loans increase the negative convexity or prepay risk for a given loan in a rising rate environment. Making maters worse, most banks cannot charge a prepayment on adjustable-rate loans. On a five-year fixed rate loan, if rates increase, the bank will suffer the NIM pressure and the lower prepayment speed. If rates decrease, the bank must be compensated for replacing a higher-yielding asset with a lower-yielding one. However, convincing the borrower to pay this cost as a prepayment penalty is very difficult because most banks cannot quantify that risk and have no way of showing in a tangible way why borrowers must sign up for that cost. Therefore, the prepayment risk on five-year fixed-rate loans falls squarely on the bank without compensation. As many community banks do not hedge or match fund five-year adjustable loans, the lender cannot tie the prepayment penalty to any actual cost of unwinding for the bank, making it much more difficult to transfer the cost of that prepayment risk to the borrower.

Banks that have loans that are priced off two, three, and five-year instruments, are also now exacerbating this negative convexity because of the shape of the yield curve. A borrower with a ten-year loan with a reset in Year Five priced off the one-year US Treasury or swaps curve will ironically find themselves at the highest rate on the yield curve outside of the 20Y point (HERE). These structures almost beg the borrower to refinance.

2. Sales Risk:

Sales risk entails the risk of the bank not obtaining the loans that it wants or being forced to book the loans that it does not want. Most five-year adjustable loans are a poor compromise for both the bank and the borrower – the bank would prefer a one-year or shorter repricing index, and the borrower would prefer a ten-year or a longer fixed-rate loan. This loan structure may be an example of adverse selection bias: borrowers who either will not or cannot obtain their preferred structure from another bank will take a five-year adjustable loan.

3. Credit Risk:

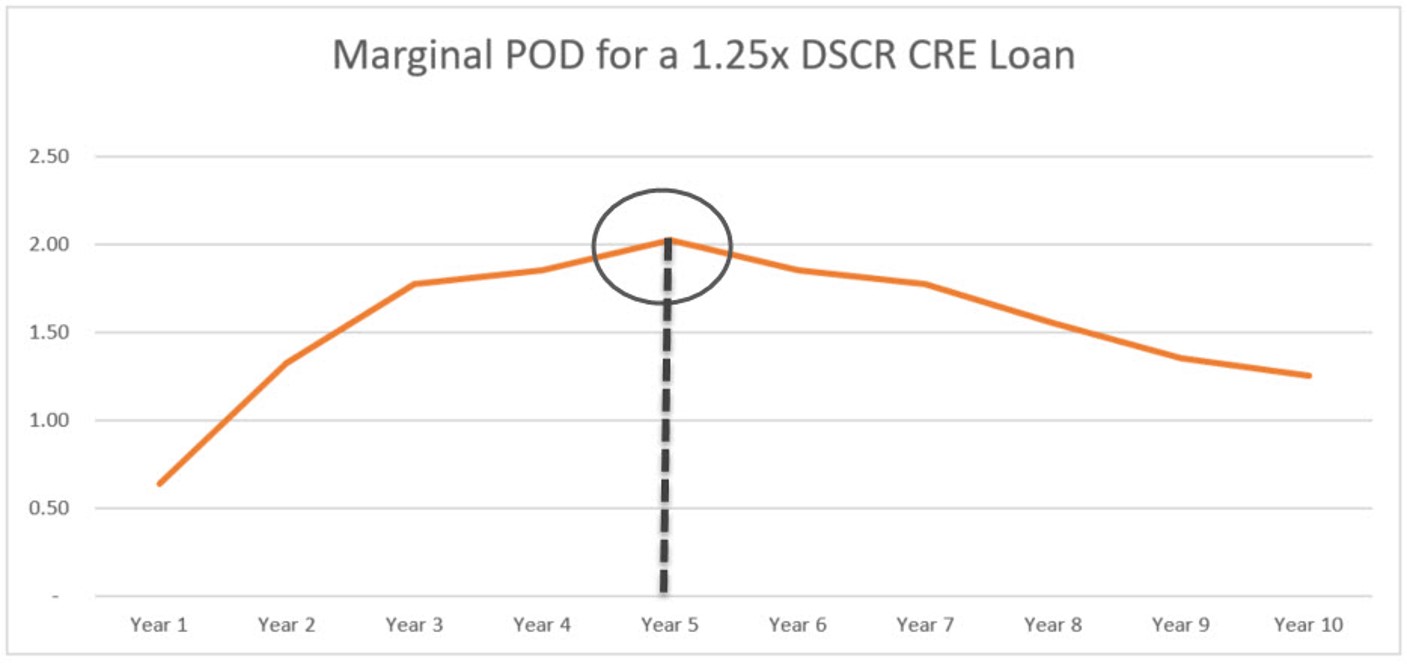

The five-year adjustable-rate loan is a poor credit bet. The adjustment period often occurs right when credit risk is the highest (below).

If rates are higher in the future, the borrower’s debt service coverage (DSC) ratio may not meet the bank’s underwriting criteria, or the ratio may be below 1.0X. Our analysis (HERE) shows that with today’s still low interest rates, high advance rates, and low real estate cap rates, many loans will not cash flow above 1.0X with just a 2.00% increase in the loan rate. Further, on a two, five-year amortization schedule, the principal repayment in the first five years is less than 10% of the starting balance – the loan has not seasoned enough to reduce the LTV sufficiently to make up for the rate reset risk.

4. Pricing Risk:

One of the perplexing issues with the five-year adjustable-rate loan is that banks price the first five-year segment at a lower equivalent spread than the future resetting segment. There are two reasons for this: First, it appears that banks are pricing to compete and win the business, and to do so, they price the initial rate aggressively. On the other hand, the borrower believes that on the reset, the loan will be renegotiated or refinanced. Second, some lenders play games with loan pricing models to obtain the desired ROE by increasing the spread on the back end of the loan, knowing that the borrower is free to renegotiate the pricing on the reset date. Regardless of how the loan is priced, we do not know the lending environment in five years and the condition of the borrower, therefore, the bank is taking the risk that the loan is mispriced to the borrower’s advantage in the future (if the loan is mispriced to the bank’s advantage, most borrowers will ask the bank to re-write the terms and rate of the note or find an alternative financing option).

5. Free Borrower Option:

We feel this is the most germane and hidden risk of the adjustable-rate loan. In addition to the free interest rate option, the structure creates a credit option for borrowers that banks give away for free. Suppose the borrower’s credit deteriorates over the initial fixed-rate period or pricing for similar credits is below market in five years. In that case, the borrower will choose to renew the loan at the contractual spread over the index. The borrower will have no better options in the market. Conversely, if the credit improves or pricing is above market, the borrower will attempt to renegotiate terms and pricing or refinance the loan with a competitor. This scenario creates higher prepayment speeds, lower relationship values for banks, and adverse selection bias. The bank loses on almost every outcome.

Adjustable Rate Loan Conclusion

The five-year adjustable-rate loan structure suffers from several shortcomings. This structure often is the result of banks inadvertently creating an array of risks in an attempt to avoid interest rate risk. The structure is especially problematic in a rising interest rate environment. In a future blog, we will discuss how banks can mitigate the risks of these loans already on the books.