Here Is The Money Leaving Your Bank For Crypto

Last week, JP Morgan opened banking’s first presence in the metaverse within the blockchain-based virtual world of Decentraland (go HERE for a primer). The “Onyx Lounge,” named after the Bank’s blockchain product, comes complete with a roaming tiger greeting visitors and an ironic portrait of CEO Jamie Dimon, who has been a crypto naysayer. Now, if you think authenticating a customer is hard in the physical world, it’s really hard in the virtual one. As such, the move is likely more publicity stunt than the building blocks of the first virtual branch, but time will tell. Regardless of how ephemeral you think the metaverse is, in this article, we wanted to present some very real data on real money leaving your real Bank that is likely to speed up due to the current events in Canada and Ukraine.

Photo credit: Bloomberg

Crypto Banking

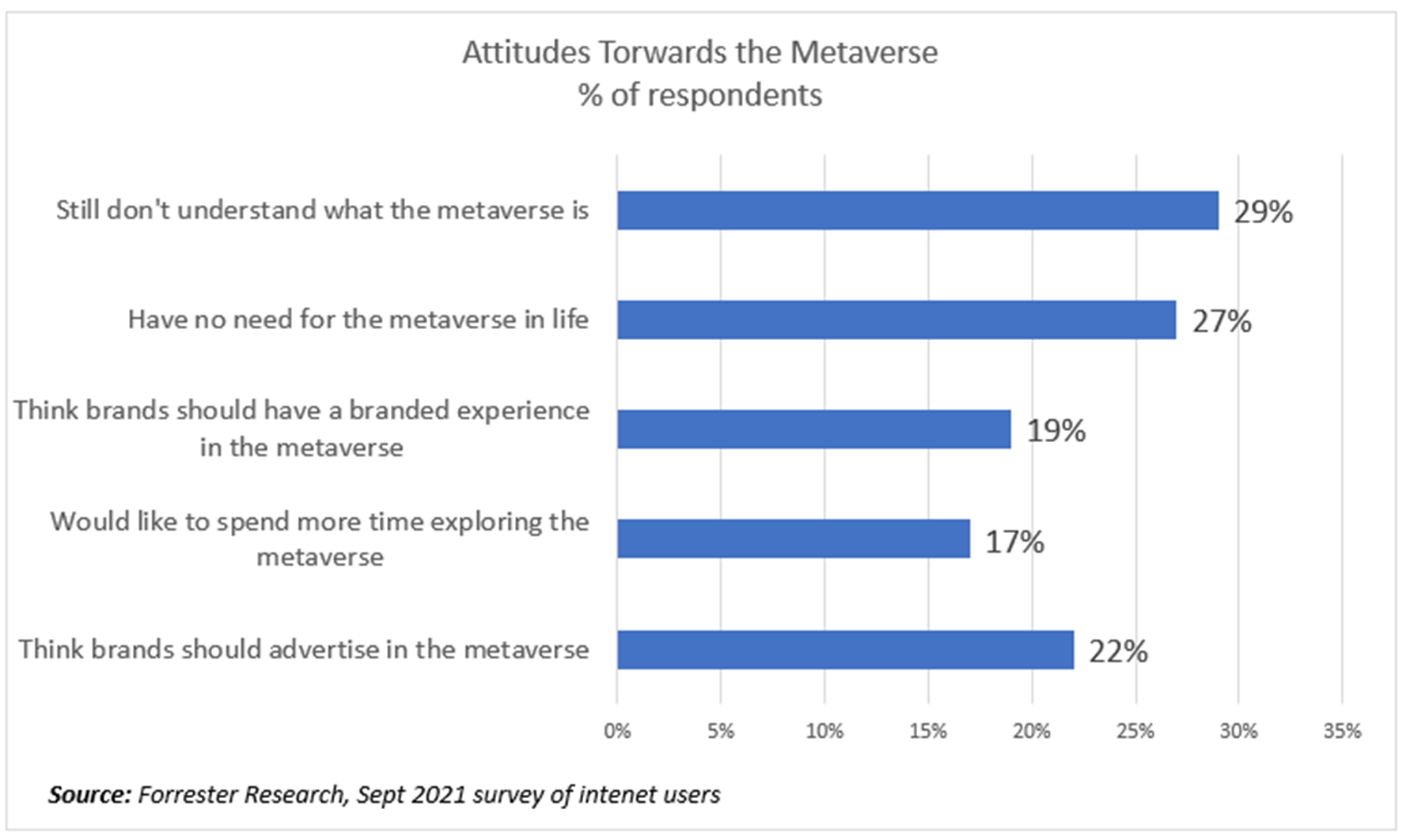

While banks can build their own lounge for about $10,000 of land value and about $15,000 in development cost, it is likely too early for that. Given that most internet users are still skeptical about the metaverse (below) and most bank customers are even more so, there is no need to be on the cutting edge of this trend.

However, before you get to the metaverse, your bank’s position on crypto is likely something management needs to be proactive about.

Dollars-to-Crypto Leaving The Bank

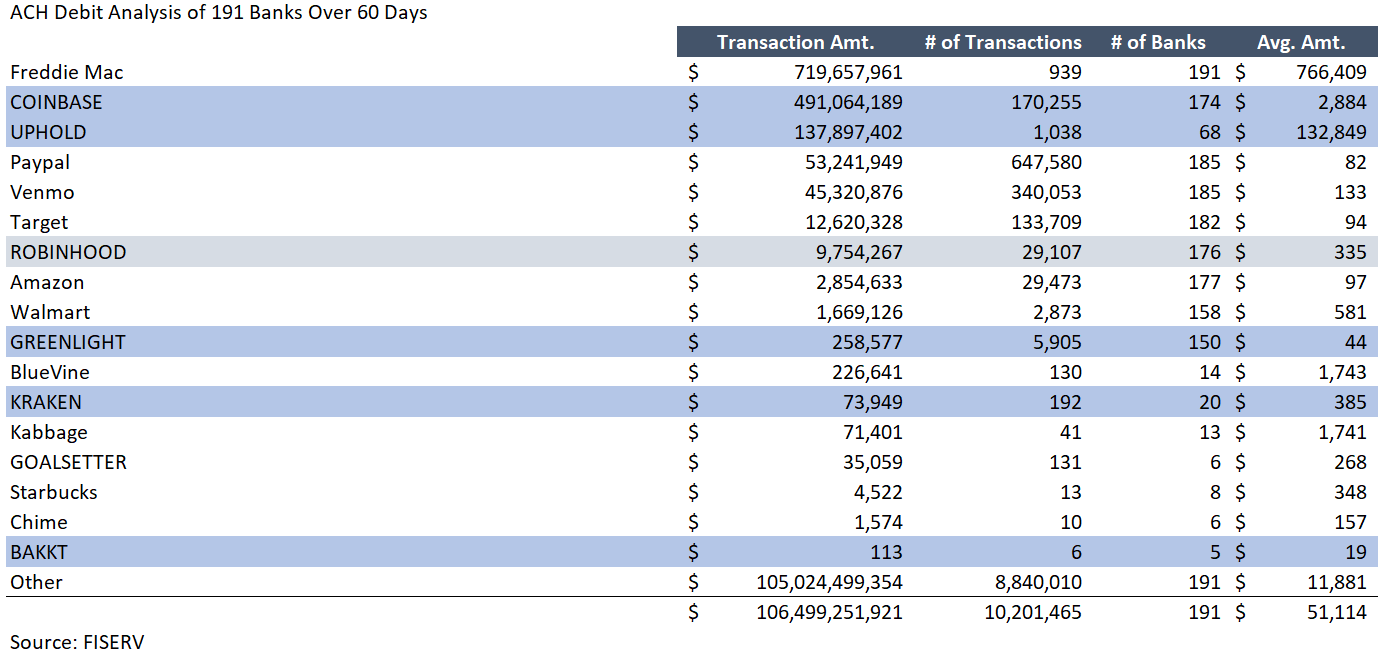

A recent study of ACH transactions by FISERV (below) of almost 200 banks showed that the number of banks that have customers moving money to the crypto channels is at least 91% and likely closer to 100%. In the 60 days surveyed, more money went to crypto than to Amazon, Walmart, and Target combined from just the pure crypt plays such as Coinbase. This doesn’t count fintechs such as Paypal and Robinhood that have at least a material amount of funds being transferred into crypto.

This all points to the fact that there is a large cross-section of a bank’s customer base that is already buying Bitcoin and other cryptocurrencies. Presumably, many of these customers would like to store the crypto with their Bank due to ease of use and the trust factor. Some surveys put that number as high as 80%.

Current Events Are Driving Crypto

The recent trucker protest in Canada and the Canadian Government’s response of threatening to shut down the bank accounts of anyone that donated to the truckers without due process will serve to make many US customers consider having alternative investments in crypto. The same goes for the banning of select Russian Banks from SWIFT and the positioning of greater sanctions that place a burden on legitimate banks and customers alike.

Many legitimate businesses and customers that get caught in the SWIFT ban will seek other alternative messaging channels. Banks are likely to raise some of the international money transfer fees to handle the increased burden of sanctions screening. The net result is a faster movement of customers to alternative payment channels.

A messaging and payments channel built on a blockchain would efficiently allow for more granular and efficient sanctions screening as a variety of Know-Your-Customer, sanction audits, transaction messaging, and monitoring can be quickly automated. This crypto channel based on a stablecoin would lead more customers to purchase crypto for both payments and investments.

Any way you look at it, the future is more customers going into crypto, not less.

Putting This Into Action

If your bank doesn’t have plans to have some crypto offering, then at a minimum, it may want to set a threshold of when it might. This should at least be a serious discussion that includes both education and planning. Will your Bank offer a crypto product when X number of banks offer the product? Will it offer the product when it sees Y amount go out the door? Or, will it offer the product when it can get better than a 17% ROI on the effort? The other critical question is what happens when a bank needs additional collateral for a loan and crypto is the only alternative?

Whatever the metrics, having this discussion can help banks come up with a plan and a general timetable.

Additionally, a bank should have a rough idea of what products it might want to offer so it can start researching now. Does it want to offer crypto custody, the ability to send/receive crypto payments, the ability to take crypto collateral, and/or does it want to offer a crypto product such as a crypto savings account?

Regardless of what it decides, being proactive and having intent around this growing cryptocurrency channel is a hallmark of solid management. Banks should fall back to their purpose, mission, and brand to see if facilitating a crypto offering makes sense. If it does, then setting an approximate direction and timetable will make the project process much more efficient. If it does not, understanding why not may lead to various other decisions and will at least lay the groundwork of when it should consider a new product in this space.

The crypto channels will only continue to expand, and it is now a large enough movement where banks can no longer be passive in this critical decision.