Bruno Albuquerque

Prior to the Covid-19 (Covid) shock hitting the world economy in March 2020, concerns about US corporate debt sustainability were on the radar of the media and policymakers. Corporates had been accumulating debt at a rapid pace, leading to a record-high debt level of 47% of GDP in 2019. To what extent may the accumulation of debt amplify the ongoing crisis, and delay the US recovery? And what can we learn from past episodes of firm-specific debt booms? In a new paper, I revisit these questions using data for a large panel of US firms from the mid-1980s to just before the pandemic. I find that persistent debt booms led financially constrained firms to cut back on investment, across both capital expenditures and intangible assets.

Large swings in corporate debt are a common feature of US business cycles

The US non-financial corporate (NFC) sector has been accumulating debt – debt securities and loans – at a rapid pace since the end of 2010, reaching a pre-crisis record high of 47% of GDP at the end of 2019 (upper panel in Chart 1). The fast leveraging process since the Great Financial Crisis (GFC) was presumably supported by increasing risk appetite and loose financial conditions, amid an environment of low interest rates.

The large swings in corporate debt are not a unique feature of the most recent cycle. Looking at the past 40 years, leverage typically spikes just before or during a recession, and then declines substantially. One of the concerns, however, is that the rapid accumulation of debt may create misalignments from firms’ fundamentals. The bottom panel in Chart 1 uses two indicators to measure debt imbalances: the debt gap, the cyclical component of the debt ratio computed with the Hamilton (2018) filter, and debt build-ups, which take the three-year change in the debt ratio. Both indicators show that debt grew significantly more than GDP over the period, which has opened up a considerable debt gap in the NFC sector. An open question, which I will discuss below, is whether corporate debt cycles may amplify business cycles through their impact on investment.

Chart 1: US corporate debt and debt imbalances

Does corporate debt overhang matter for investment cycles?

Debt plays an essential role in modern economies. For instance, credit deepening and the quality of financial intermediation create the conditions for faster investment and economic growth (King and Levine (1993) and Levine (2005)). But the literature has found that rapid accumulation of debt by households is associated with large future consumption cuts and economic slowdowns (Mian and Sufi (2010), (2011), Schularick and Taylor (2012), Jordà et al (2013), (2015) and Albuquerque and Krustev (2017)). It is an open question whether this debt overhang effect – the process through which indebtedness takes away resources from the economy – may also be at play for corporates.

On the one hand, debt overhang can weigh on aggregate demand via weaker investment growth. Myers (1977) hypothesised that a highly leveraged firm is unable to raise debt to finance new projects, as the profits are appropriated by existing debt holders, not potential new investors. Follow-up papers have confirmed Myers’s hypothesis by showing that highly leveraged firms tend to experience weaker investment (Lang et al (1996), Hennessy (2005), Hennessy et al (2007), Campello et al (2010), Giroud and Mueller (2016) and Kalemli-Ozcan et al (2019)). Other indirect effects of debt may include the impact on long-run productivity growth, and financial stability risks of debt build-ups leading to a wave of defaults.

The findings above have recently been challenged by Mian et al (2017) and Jordà et al (2020). Using cross-country aggregate data for several advanced economies, they find that only household debt booms are associated with lower future medium-term growth, while fluctuations in corporate debt are not. Jordà et al (2020) suggest that debt of firms in financial distress can normally be restructured and liquidated quickly, unlike household debt, allowing firms to resume investment quickly.

Uncovering the debt overhang effect

I combine four main ingredients to improve our understanding on the association between US corporate debt overhangs and future investment.

First, I account for the substantial heterogeneity in corporate balance sheets by using Compustat firm-level data for a panel of 4,742 US non-financial listed firms. Second, I use data over 1985 Q1–2019 Q1, spanning several episodes of firm-specific debt build-ups. A long-time series overcomes the challenge of extrapolating findings that focus on a particular episode, such as the GFC. Third, I measure debt overhang with a concept of debt booms or debt build-ups by taking the accumulation of debt relative to assets over the preceding three years. This variable tries to identify the emergence of debt misalignments that sow the seeds of damaging and costly financial crises (Kindleberger (1978)).

Fourth, I combine the liability and asset side of firms’ balance sheets to better capture financially constrained firms in the data, given the challenge in identifying constrained firms with standard measures of financial constraints, including leverage, size, and age (Hoberg and Maksimovic (2015), Farre-Mensa and Ljungqvist (2015) and Crouzet and Mehrotra (2020)). I combine the leverage ratio (debt-to-assets) with the net liquid asset ratio (cash and short-term investments minus short-term debt relative to assets) to split the sample into three groups. I define vulnerable or constrained firms as those highly indebted firms and with limited liquid assets, which belong to the top third of the leverage ratio distribution and to the bottom third of the net liquid asset ratio distribution. In turn, resilient firms belong to the bottom third of the leverage ratio and to the top third of the net liquid asset ratio. The remaining firms are called other.

Chart 2 shows that the typical US vulnerable firm has experienced large swings in debt build-ups: firms accumulate substantial debt in the run-up to recessions, but then delever sharply as the economy enters a recession. By contrast, resilient firms go through much smoother credit cycles. Vulnerable firms tend to have weaker fundamentals, face high corporate financing costs, have lower ICRs, and invest less (Albuquerque (2021)).

Chart 2: Corporate debt build-ups for vulnerable firms versus resilient firms

Main results

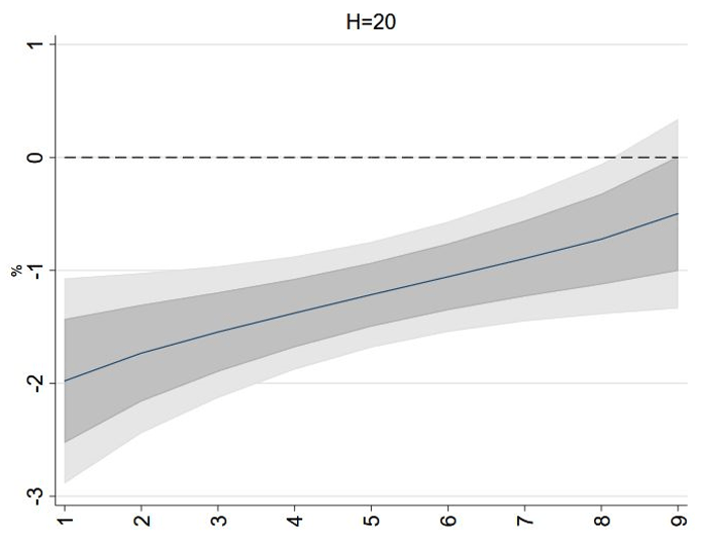

I investigate how investment growth evolves in the aftermath of US firm-specific debt booms by regressing capital expenditures (capex) on the three-year change in the debt ratio and on firm fundamentals. I use Local Projections (Jordà (2005)) which involve running separate regressions for each horizon h=0, 1,. . . , 20 quarters.

Chart 3 shows the main results. I find that sustained increases in debt for highly indebted firms and with low liquid assets are associated with substantially lower investment spending over the medium term: a 10 percentage points increase in debt build-ups is associated with a contraction in investment of around 3% after five years. I show in the paper (Albuquerque (2021)) that financially constrained firms also cut back on intangible assets (investment in employees, brand, and knowledge capital). I also show that borrowing costs increase for vulnerable firms, suggesting a repricing of risk following debt booms. This finding aligns well with a debt overhang effect (Eggertsson and Krugman (2012)): fast build-ups in leverage may prevent firms to raise new debt to finance their activity. In order to avoid insolvency, a firm is left with the option of cutting investment, other costs or downsizing.

By contrast, resilient firms with low debt and high liquid asset holdings actually experience increases in investment in the aftermath of debt build-ups. It thus seems that capital markets do not penalise firms by taking on new debt as long as firms’ balance sheets remain healthy. The 90% confidence bands show a large and statistically significant difference in the investment behaviour between vulnerable and resilient firms: for every 10 percentage points increase in debt build-ups, vulnerable firms experience weaker investment spending growth of roughly 5 percentage points after five years (bottom panel in Chart 3).

Chart 3: Impulse responses of investment spending to a 10 percentage points increase in corporate debt build-ups

I also investigate how debt build-ups affect different quantiles of the future conditional investment distribution. Using quantile panel regressions, I find that US corporate debt booms affect more the left tail of the investment growth distribution (Chart 4). This is suggestive of corporate debt booms amplifying downside risks to the real economy in line with findings from Adrian et al (2021).

Chart 4: Impulse responses of investment spending: quantile regressions

Lessons from corporate debt boom episodes

The root causes of the Covid crisis are very different from the previous crises, particularly the GFC. My results suggest that using pre-Covid US data may nevertheless offer some insights about the possible implications of debt booms for the US real economy. While several policy measures, including credit guarantees, the issue of new debt, and the restructuring of existing debt contracts, seemed to have helped firms withstand a severe loss in earnings, a large fraction of firms find themselves with substantially higher leverage than before the Covid shock.

In this context, my results suggest that there is the risk that existing vulnerabilities in US corporates’ balance sheets may amplify the ongoing crisis, and delay the recovery. The rapid rise in leverage ratios may lead firms to shift their focus to meeting debt obligations rather than pursuing new investment projects. In addition, some vulnerable firms may file for bankruptcy, exacerbating the scarring of the Covid shock.

Bruno Albuquerque works in the Bank’s Macro-Financial Risks Division.

If you want to get in touch, please email us at bankunderground@bankofengland.co.uk or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.

Very good article and timely. Global Gross Debt, especially in US/Europe, is significant. A lot of this Debt is not self liquidating and requires more Debt to service existing Debt. We also see the lack of proper Covenants or Covenant Lite Debt. In the end this massive Debt has to be either re-payed or Defaulted Opens up to Deflation and Debt Deflation. The large amount of funds to service this Debt or repay this Debt or Debt Defaults ( Debt Deflation) will take away from future growth investment, expect Global Growth will slow to a crawl going forward.

The Bank Underground paper by Bruno Albuquerque (28th Sept 2021) offers clear evidence based analysis on Debt / Leverage effects – pointing to some timely conclusions. More….

Given that the author works at the BOE, the purpose of this note is to draw out conclusions that the author did not emphasise – perhaps due to a diplomatic sensitivity on Central Bank QE policies, the prolonged period of exceptionally low interest rates and low productivities since the GFC.

His paper generally, points to these conclusions:

a) leverage weakening appetite for long term investment:

b) debt driven business building basis for financial instabilities:

c) cheap debt being fertile ground for increasing risk appetite:

d) risks of low IR / yields (of FED/BOE QE policies) being susceptible overshoot – to market accidents “like a ball deeply submerged in water, moving IR and yields sharply upward – El- Erian” and thereby suffocating productivity initiatives.

It is amply supported by his references: (Myers (1977), Lang et al (1996),Hennessy (2005), Hennessy et al (2007), Campello et al (2010), Eggertsson and Krugman (2012)

Giroud and Mueller (2016), Kalemli-Ozcan et al (2019), Albuquerque (2021) and Adrian et al (2021). Although there are – as to be expected – some parties who are more sanguine on leverage, raised cheap debt etc, as he also referenced – Jordà et al (2020). Mian et al (2017). To this, I might add Haldane of the BOE (Finch Lecture Melbourne 2018) who suggested the BOE’s QE and low interest rates were generally beneficial to the UK community as a whole – whilst UK productivity has flat lined for over a decade.

This work by Bruno Albuquerque might hopefully add to your views: that excessive leverage, high debt, historically low levels of interest rate, combined with our + decade of derivative- – off balance sheet – financial engineering by weakly regulated shadow banking – have been and remain –

A DRAG ON PRODUCTIVITY.

His paper covers the USA, but I venture to say such analysis is perhaps more relevant to the UK’s economy, given the relative structural rigidities of UK businesses and the GB Pound versus USA businesses and the USA Dollar.

Perhaps another Bank Underground paper could focus on the UK applying Bruno Albuquerque’s form of analysis?.

Len Tiahlo