Cyber fraud surges as COVID-19 changes banking, e-commerce

Payments Dive

JUNE 16, 2020

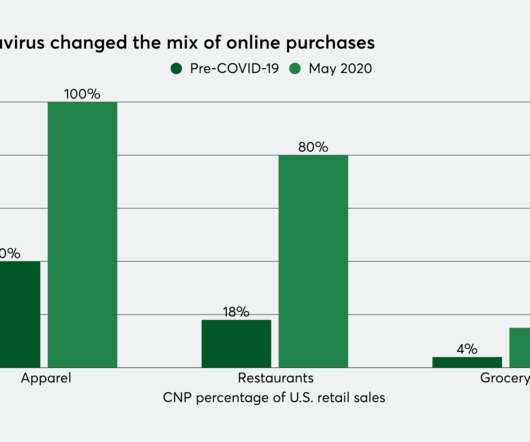

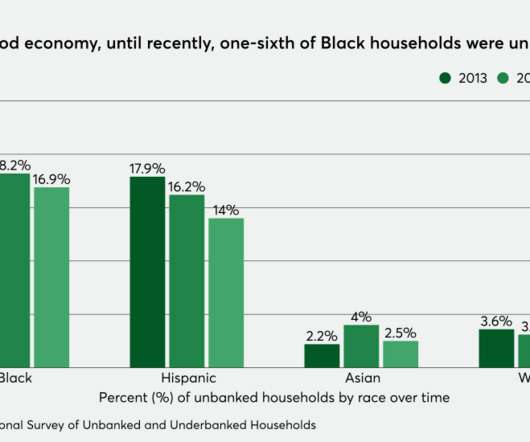

As millions of Americans have shifted their daily workplace and shopping to remote online networks and mobile devices, a new wave of cyber threats have emerged focused on targeting banks, e-commerce and other daily financial activities.

Let's personalize your content