As the 21st century began, banks revolutionized bill payments by introducing online bill pay. Customers could finally ditch their check books and stop licking stamps. They simply had to log on, enter their biller information and make payments electronically. Customers loved the convenience of paying their bills in one centralized place, banks created more loyal customers, and both banks and billers reduced check processing costs.

Fast-forward 20 years, and little has changed with bank bill pay. Today, almost three-quarters of all U.S. customers pay their bills via automatic or recurring payments. However, 80% of those payments are made via biller websites, not online banking. Despite this trend, few banks are making significant changes to their bill pay sites. If banks continue to deprioritize bill pay, will bank bill pay customers stay loyal or leave their banks behind? Let’s examine what has changed in online payments in the past two decades.

New players

Billers and fintechs have worked diligently to create better user experiences than most banks are offering. Customers can easily view billing details, pay with their favorite credit card, and see their payments post in real time. This non-bank innovation is a major reason why payments made directly to biller sites have grown by 123% in the past decade. Over that same period, banks’ share of online bill payments shrank from 38% to 22%. This decrease is no surprise, given that bank bill pay sites are commonly referred to as “clunky.”

Some users call bank bill pay sites “click and pray,” because receipt of payment isn’t transparent and can take up to five days.

Clunky or not, bill pay represents a unique opportunity for banks to engage their customers. To capitalize on this opportunity, banks must strive to give bill pay customers the same levels of speed, convenience and transparency they experience in other parts of their digital lives—the same quality of customer experience the new players are offering.

New features

Let’s look at some of the enhanced bill pay experiences that exist in today’s market. These solutions have arisen—and thrived—in direct reaction to banks’ lack of attention and investment in bill pay.

|

Get rid of unwanted subscriptions: Subscription-based products and services are extremely popular. Most customers have several of them and dread the awkward process of cancelling them, or simply lose track of what they’ve subscribed to. Most Americans (84%) underestimate what they spend on subscriptions, with 27% underestimating the costs by $100 to $199 per month. Fortunately, several companies have built innovative solutions that find and track your subscriptions and then cancel unwanted subscriptions for you. |

|

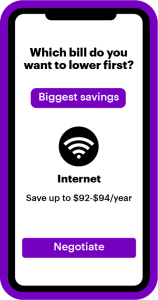

Negotiate without confrontation: Most people either lack the know-how or aren’t comfortable enough with confrontation to pursue discounts on their recurring bills. A few bill pay services will tap into their vast knowledge of discounts, rebates and market comparisons to fight on customers’ behalf to get them better rates. Cell phone, internet, cable, and even car insurance bills can be lowered this way. Better yet, most of these services charge customers only if they succeed in lowering their bills. |

| Pay with cards: It’s no surprise that 84% of consumers want the option to pay bills by credit card—and yet this is a rarity on bank bill pay sites. A growing number of non-bank solutions can aggregate your billers’ sites into a single sign-on digital experience, track due dates, and enable payments via automated clearing house (ACH) or credit and debit cards, all free of charge. Although paying bills by credit card is not innovative, offering card payment options on bank bill pay is. | |

|

Use your digital wallet: The average app is deleted less than six days after download, which suggests that bill payment apps (among others) may be frustrating customers. To bypass the threat of deletion, several solutions are making their home in the smartphone’s native digital wallet and offering centralized bill management with convenient payment options. Bill payments could be the next popular digital wallet occupant, joining digital transit passes, drivers’ licenses, credit cards, tickets and digital cash. |

|

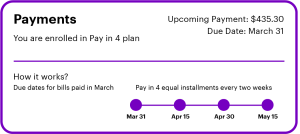

Bill now, pay later: Though it’s mainly used for retail purchases, buy now, pay later (BNPL) is gaining a foothold in bill payments. Consumers can get an interest-free credit line applied to one or more of their monthly bills and pay it off through a defined number of equal instalments. |

India has created a one-stop ecosystem for both digital and in-person bill payments across banks, billers and payers. This centralized system boasts over 20,000 billers and processes over 2.5 million bill payments a day. Its success is largely due to the many payment methods and channels available.

New attitude?

The positive news for banks is that bank bill pay still has a sizable and loyal following. Furthermore, bank bill pay is not broken—although it does require an attitude adjustment. Banks would benefit from recognizing that their bill pay solutions are not mere retention tools. Customers expect these solutions to match the speed, convenience and transparency they experience in other parts of their digital lives.

There are innovations already in the market that meet or exceed these expectations, as our examples illustrate. Several may be value-added next steps for some banks, while others might not logically fit into a bank’s bill pay strategy. Fortunately, if banks simply applied the same levels of funding and focus to bill pay as they do their other digital experiences, they could transform bill pay into a loyalty-inducing differentiator.

We are ready to work with your team to assess your current capabilities and co-create the right bill payment solution to make customer experience the top priority at your bank. Contact me to get started.