Juniper Research sees digital banking poised for growth

Payments Dive

MARCH 6, 2020

Digital banking is poised to take off as incumbent banks move much of their business to mobile channels to compete against a new generation of digital-only startups.

Payments Dive

MARCH 6, 2020

Digital banking is poised to take off as incumbent banks move much of their business to mobile channels to compete against a new generation of digital-only startups.

Accenture

MARCH 12, 2020

The expectations of customers when it comes to payments have changed radically in recent years. Payments that are instant, invisible and free (IIF) have quickly become the norm, especially in certain segments of the market like airlines, fashion retail, hotels and online travel agents. Non-IIF payments options in these segments and others have all but….

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MARCH 26, 2020

As relief and funding packages are being debated in Washington, the National ATM Council looks to how these new laws will affect business.

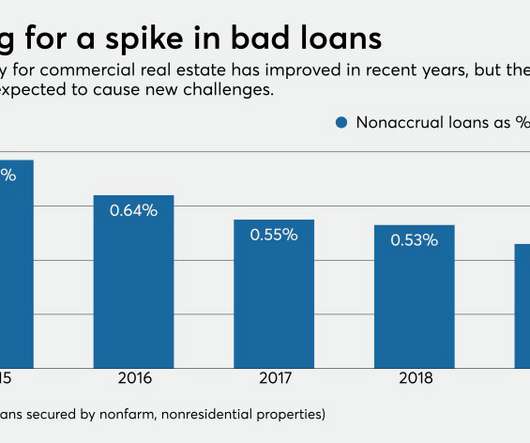

American Banker

MARCH 30, 2020

Commercial real estate lenders have to consider not only how they’ll weather the COVID-19 downturn, but whether worker and consumer habits have changed for good.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Chris Skinner

MARCH 12, 2020

Woke up with a sore throat, stuffed nose and cough. OMG, have I got the coronavirus???? After President Trump’s ban on Europeans last night, the coronavirus madness continues. I know that coronavirus is boring – as it’s non-stop in the news, media, office and coffee shop – but it goes … The post When the world stops, did you want to get off? #coronavirus appeared first on Chris Skinner's blog.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

PYMNTS

MARCH 27, 2020

Who we are, where we’re headed and what this all looks like on the “other side” of the pandemic are topics on everyone’s mind right now. So are vaccines. So is online shopping, with urgency. All of these subjects share a commonality: IDs. In commerce, knowing (and verifying) who’s on the other side of a transaction can mean the difference between a retailer making a sale to a loyal customer or a fraudster.

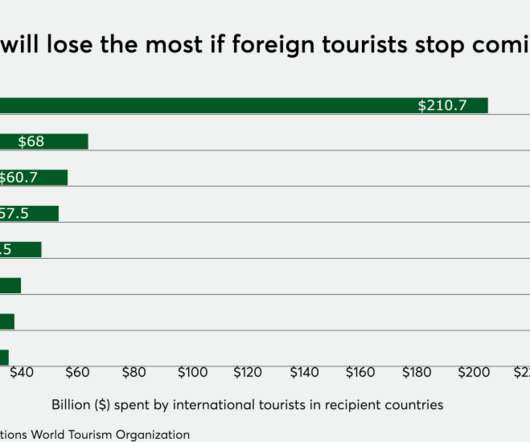

Payments Source

MARCH 2, 2020

Coronavirus, also called Covid-19, is wreaking havoc on the stock market, with a heightened effect on the travel industry. It could also cause a drastic change in payment habits, as consumers shift to digital channels to reduce their risk of infection from handling cash.

Payments Dive

MARCH 16, 2020

Mobile Payments Today is doing its best to provide news and updates regarding how the coronavirus is affecting the payments industry. We'll update this story with the lastest headlines.

Gonzobanker

MARCH 26, 2020

Financial institutions that are not ready to fully serve customers digitally face an existential threat. Hard as it is to fathom, we’ve just seen digital banking morph from “important” to “existential” status in one week’s time, and banks and credit unions that aren’t able to market, sell and serve their customers in an entirely mobile capacity are now facing an existential threat.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

Chris Skinner

MARCH 5, 2020

Who moved my cheese? Like many of us, I am confused about the world, the future, life and everything. All seems good one day. The next, everything is being cancelled, government tells you to self-isolate, your view of everything is challenged and you have to change to fit. Who moved … The post Who moved my cheese? appeared first on Chris Skinner's blog.

Ron Shevelin

MARCH 2, 2020

You've got your Facebook feed, your Twitter feed, your LinkedIn feed, your Instagram, and who knows how many other feeds. Get ready for another one: your financial feed.

PYMNTS

MARCH 23, 2020

The way we live — the very ways in which we work, and learn, and spend leisure time, and of course, shop — have shifted markedly over the last several weeks. In the maelstrom of daily life grappling with COVID-19, the rollout of 5G , the fifth-generation network that features downloading speeds reportedly 100 times faster than that of 4G, may accelerate even as economic headwinds gather.

Payments Source

MARCH 19, 2020

The payments industry bridges many markets — including technology and finance — that haven't always demonstrated diversity at their highest ranks. Things are changing, and this year's Most Influential Women in Payments honorees demonstrate the importance of women to all aspects of the payments industry and all corners of the globe.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

Payments Dive

MARCH 13, 2020

The coronavirus pandemic has raised a number of concerns about whether consumers would shift towards digital payments amid concerns about cash handling and interacting with large crowds in banks and retail centers.

Bobsguide

MARCH 3, 2020

Regulatory supervision must evolve to cope with the speed of innovation within financial services, policy makers, supervisors and regulators agree. A lack of “smart” implementation by supervisors will hinder an EU-wide regulatory standard, said Christopher Buttigieg, chief.

Chris Skinner

MARCH 1, 2020

Buzzwords. We have a lot of them. Artificial, autonomous, augmented. Big data, blockchain, bilateral. Crypto, currency, consensus. Distributed, decentralised, democratised. I’m tempted to write the ABC of technology buzzwords, but know there cannot be any that start with X or Z*. However, I’m writing this one today because the word … The post What does ‘digital transformation’ really mean?

Gonzobanker

MARCH 25, 2020

Financial institutions need to talk about the impact of the Coronavirus – when they finally come up for air. In our nearly 20 years of existence at Cornerstone Advisors , we have never seen a crisis like the one we have experienced in the last 30 days. We have also seen the most abrupt change ever in assumptions, goals, impact planning and strategic focus.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

PYMNTS

MARCH 5, 2020

The World Health Organization (WHO) is advising people to not use paper tender and to use as many cashless options as possible to help contain the spread of the coronavirus, according to reports. Officials with WHO say that while cash isn’t more or less likely to spread the disease, it can carry the virus just like door handles and hand railings, and can spread it on contact.

Payments Source

MARCH 31, 2020

While much of the world is sheltering at home to deter the spread of coronavirus, there's still a need for essential workers to travel — and an opportunity for the development of in-car payments technology, which could allow consumers to pay for gas or food without handling cash or other potentially infected surfaces.

Payments Dive

MARCH 10, 2020

Amid rapid changes in the cash economy and the rise in digital payments, the ATM is likewise facing challenges that have led to an evolution that will meet the demands of a new generation of customers.

Bobsguide

MARCH 3, 2020

Crypto businesses face a wake-up call following the European Union’s fifth Anti-Money Laundering Directive’s (5AMLD) January 10 deadline, with market participants raising questions over the future function of digital currencies. While some welcome the directive, others fear rule.

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

Chris Skinner

MARCH 2, 2020

I just received a report from Deloitte about credit and debit cards. It says the future is not so bright: “more payment choices, along with changing consumer preferences, are threatening the long-term viability of the credit card business model.” Damn. I said that fifteen years ago. It made me think … The post The end of cards and cash … just fifteen years late appeared first on Chris Skinner's blog.

Gonzobanker

MARCH 23, 2020

In the midst of Coronavirus uncertainty, we must be mindful of what we can control and how we want our story to be read. With a soundtrack of COVID-19 news stories playing nonstop in the background, last week felt like watching a magnitude 9.5 earthquake off the coast of an island: a disaster that we all knew was remotely possible but still felt shocked by with every passing moment.

PYMNTS

MARCH 20, 2020

A police department in California is going to use drones equipped with loudspeakers to help enforce the state lockdown orders imposed due to the coronavirus, according to a report by the Financial Times. The Chula Vista PD has purchased two drones worth $11,000 each. They’re made by DJI, a Chinese company, and the department plans to also add night vision cameras to the flying vehicles.

Payments Source

MARCH 15, 2020

Cobranded travel credit cards — including some of the most popular and profitable in the payment card industry — are looking at darker skies because of COVID-19.

Advertiser: Trellis

Trellis is a state trial court research and analytics platform that provides Real Estate Professionals (Buyers, Foreclosure, Loan Modification, etc.) with LEADS on Pre-Foreclosures, Lis Pendes, Distressed Assets and more — to help uncover **new** opportunities and grow their business. The process is quick and easy — and all in real time. Trellis will supply you with a link to the relevant dockets, a Leads sheet and access to its UI where applicable.

Let's personalize your content