Deposit Pricing Basics Part 1: The Concepts

The art and science of optimized deposit gathering is a declining skill set among bankers. Banking schools don’t teach it, conferences don’t showcase it, and internal bank educators no longer train in the discipline. It is ironic as no other banking endeavor can build long-term franchise value like deposit gathering. Further, deposit gathering and its associated pricing strategy are among the most arduous efforts to understand compared to other industries. In this set of articles, we will cover the basics and the advanced practice of deposit pricing and gathering. We will start with the basics and then look at modern techniques around hyper-personalization leveraging both artificial intelligence and machine learning.

The Challenge with Deposit Pricing

Unlike selling widgets, deposit pricing has dimensions of time and volume. Sell a deposit account once, and customers can add or subtract volume over time. A deposit account can start as profitable and quickly turn unprofitable as a bank trains the customer to be more interest rate sensitive. Few other product sales efforts have these dynamics.

Unfortunately, when faced with raising deposits, most banks use the least profitable tactic – offering a higher rate deposit to non-interest rate-sensitive customers. A deposit promotion based on the rate is often the go-to solution to raise liquidity. Raising deposits with rate can have disastrous effects as it cannibalizes other depositors while training customers and staff that marketing on rate is acceptable. Instead of adding deposit value, bank franchise value is often subtracted both short and long-term.

Promoting a deposit campaign based on rate to non-sensitive customers is often followed by the second least profitable tactic – selling a high-rate deposit to rate-sensitive customers. Banking history is littered with examples where high market rates were used to gather rate-sensitive customers, and volume increased. Management teams high-fived themselves over their success, not knowing that their strategy sowed the seeds of their destruction. Rate-sensitive customers are a hard to retrain cohort, and many a bank has spent resources to acquire the customer, paying them a high rate to the point of unprofitability only to see them walk out the door to a higher-rate paying institution when their current bank attempts to lower the rate and retrain.

As we will delve into in future articles, every product, customer, and channel has some inherent rate sensitivity. The goal of bank management for all products is to limit resource sensitivity so that the bank can spend the least on rate, marketing, sales, branches, and other inputs while still providing the desired customer and employee experience.

Understanding the Multiple Dimensions of Deposit Gathering

Optimizing the gathering of deposits is about having the right strategy, using the right tactic in the right channel for the right product at the right time for the right customer, and being serviced by the right employee support. While there are many things to get right, few banks take the first step to even try to understand the interplay of price, interest rate sensitivities, and non-rate sensitivities on behavior psychology which impacts volume and, therefore, value.

The Four Key Concepts of Deposit Performance

Before you can understand deposit pricing, you must understand four key concepts that we will build on for this series.

Cost of Funds: This is the concept most bankers are familiar with and often the only dimension where many banks focus. For most deposit gathering efforts, banks will talk about the “simple cost of funds,” which is the direct cost of money usually expressed as a non-compounded annual rate to the account holder or in total dollars of interest on an actual/360-day count basis.

As an aside, it merits a bank’s effort to ensure that a standard day count is used to calculate loan, deposit, and fee interest at some point during the management cycle. Unfortunately, it is common for banks to mix day count calculations up when reporting. Banks either want to make sure all their instruments are standardized or that they handle the adjustment to standardize during reporting. Next to actual/360, many banks use actual/365, actual/actual, and then 30/360 as their standard reporting convention. While it doesn’t much matter the method, being consistent does, as it plays into the quality of the decision.

Of course, the concept of simple cost of funds is incomplete for decision making. In addition to the interest rate to the account holder, a bank also pays customer acquisition costs, onboarding expenses to bring that customer onto a system, servicing costs, and FDIC insurance costs. Finally, we will add the cost of capital for any reserves required to support the deposits. This calculation is a bank’s “total cost of funds” and is the more accurate way to measure deposit costs. Hopefully, a bank utilizes a funds transfer methodology and understands the supporting cost of deposits, but if not, we often provide averages for both loans, deposits, and fee lines. These can be found in our profitability model (Loan Command) or usually annually on our blog (HERE).

Finally, before we leave this topic, we often talk about a bank’s “effective cost of funds,” which is the total cost of funds presently on its balance sheet. Sometimes we talk about the “marginal cost of funds,” which is the current cost of the next dollar of deposits. We can also speak in terms of “projected cost of funds,” either on an “effective basis” (usually when talking about the total balance sheet) or on a marginal basis (usually when talking about a single instrument), which is the cost of funds projected into the future for its expected life. We usually use the forward curve and calculate the cost of deposits for each month before we discount the string of cash flows back to arrive at the “expected cost of projected deposits.” These projections can be “static,” or without expected volume changes, or “dynamic” to include an assumption about deposit changes.

We will delve into each of these calculations and their associated philosophies for use later, but we wanted to get the concepts defined first. While a deposit’s total cost of funds is essential, it is just one of the many components of deposit performance. Elasticity, or a deposit’s sensitivity to interest rate movement, is the next most vital component to understand when managing deposits.

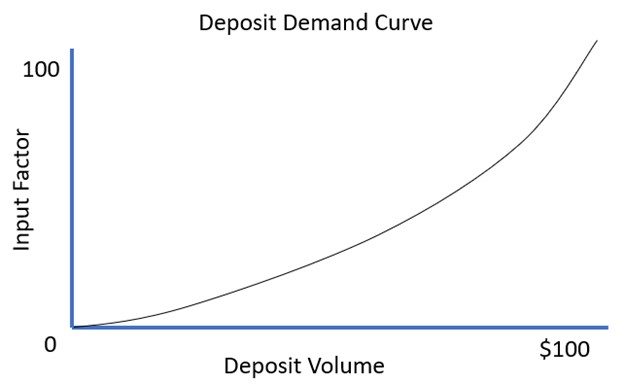

Elasticity: In intro economics class, you might have learned the law of demand. This primary tenant of economics states that the amount of a good demanded is inversely related to its price. The lower the price, the more demanded. To calculate how sensitive a customer is, we can observe a change in price and see the change in quantity demanded. A hot dog vendor offers a dog for $10, and it sells 100 units in a day. It then drops its price to $5, selling 200 units. The elasticity can be calculated by the formula below to determine that the elasticity is 20.

For deposit pricing, we will modify the equation slightly, and instead of price, we will consider the expenditure of all resources to include rate, product support, marketing, sales, and management. For example, you may want to hire more relationship managers to gather deposits, spend more on marketing or add more branches.

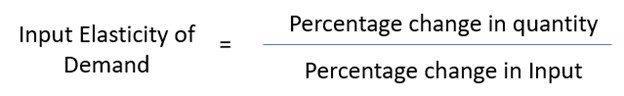

More importantly, where price and demand or INVERSELY correlated to most goods, deposits are the opposite – they are POSITIVELY correlated. Increase the rate or marketing spend on a deposit, and volume should increase. Regardless, we can still use the same formula that looks something like the below:

Because of this positive relationship, the demand curve is upward-sloping, whereas, for most non-bank products, it would be downward-sloping.

In deposit pricing, one of the concepts we will teach is how banks can run experiments to quantify the elasticity for any given deposit promotion precisely. Before running a deposit campaign, we will promote the act of testing and then use the output to model the effectiveness of the marketing effort in reaching the campaign’s goals. In general, we want to understand the shape of the demand curve for that campaign at that time. Below is a typical deposit demand curve for deposits.

As a rule of thumb, banks want their customers to have low elasticities so that a minimum input in cost will result in a significant change in quantity demanded. Examples of “inelastic” deposits are health savings accounts, transaction accounts, and goal-oriented savings accounts.

There are a couple of things to observe with this curve. As alluded to above, the curve is upward-sloping which is the opposite of a traditional demand curve. This represents the fact that the more inputs your bank provides, the more deposit volume it should expect.

Another important point is that while we talk about deposit dollars regarding input factors or resources expended, they may or may not be dollars. While we usually try to talk about and quantify the total dollar cost of input factors, it may only sometimes be the case. A bank can gather deposits just by word-of-mouth based on its service quality. While we will capture the service cost in total deposit cost, we may or may not be able to capture the expenditure of customers or partners talking about the bank and helping with deposit referrals. In future articles, we will attempt to quantify some of these efforts and will term these as “non-dollar resource inputs.”

The third important aspect to point out is that a bank can gather some level of deposits without spending incremental resources. This is why the above demand line is not at the “zero” position on the graph and shifts to the right. This shift results from a bank’s fixed cost, including its charter, FDIC insurance, branches, brand, personal network, and other factors. In the future, we will move this line to zero for convenience of discussion, which would be the case for banks that fully allocate corporate overhead costs among all their products and efforts.

Duration: Unlike other products in the physical world, because deposit volume can change, we talk in turns of the duration or input sensitivity of a deposit account relative to the deposit’s value. Like a loan or a bond, a bank wants the most extended set of cash flows possible from a customer so that it does not have to spend money to acquire a new customer. Unlike a loan or a bond, which are assets, a deposit is a liability or something that a bank owes, so the LOWER the cost of inputs and the lower the sensitivity, the MORE value a deposit has. As a rule of thumb, bankers want the longest deposits possible for the least amount of money. As interest rates increase, those long, low-cost deposits become more valuable. The longer those deposits stick around, the more valuable those deposits become, which will result in a higher duration.

Thus, when we calculate duration, we are calculating the value sensitivity of a deposit, which is the value of that deposit’s cash flows. We will get into the formula in the future, but the concept is that when we gather deposits, we want to track how long those deposits stay on the balance sheet and how the cost and volume change over time.

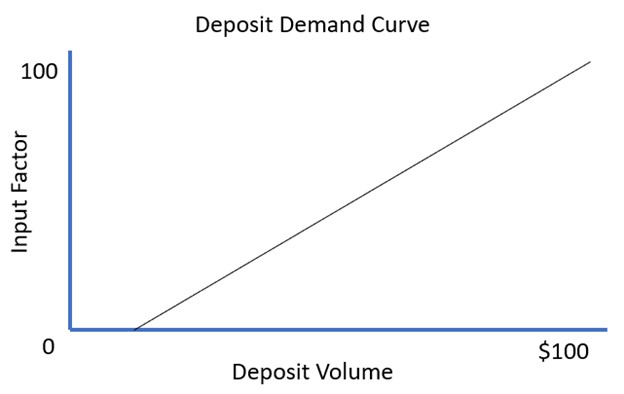

Convexity: The last of the four major essential concepts we want to use as a foundation is the concept of convexity. The reality is that deposit demand is never linear. Customers will add or subtract deposits over time for a variety of reasons. We capture this behavior by modifying the above linear curve to look something like the one below.

Where duration is a linear measure of inputs and value, convexity is the curvature of that demand. Convexity is the recognition that volume can build over time for factors other than bank inputs. Take a transaction account, for example. Part of the poetry of a transaction account is that it should grow in volume as rates increase and the economy does well. The more economic activity for a business or household, the more money the entity should earn and the more money flowing through a transaction account. A transaction account is highly convexed, which is what a bank wants.

Compare a checking account to a certificate of deposit (CD). Unlike a transaction account, a CD has a finite life. As rates increase, that CD holder may break that CD, pay no or limited penalties, and then go to another bank with higher rates. As a result, CDs are slightly negatively convexed. As a rule of thumb, banks want the most positive convexity they can get, so as interest rates go up, the volume goes up, driving up the value of those deposits.

The Deposit Pricing Performance Model

In summary, a bank wants the lowest total cost of funds composed of the least input-sensitive instruments for the largest duration to include the most positive convexity. This calculation provides a unified way to compare deposit strategies and tactics. In future articles, we will be looking at this calculation and then comparing the total cost of funds, adjusted for performance, to a bank’s wholesale funding alternatives.

To the extent a bank can gather deposits below its wholesale cost, there will be positive attribution to its deposit-gathering efforts. Sum up the positive attribution to deposits over the expected life of the bank, and you will be able to quantify the bank’s franchise value driven by deposits. A bank that funds itself with 100% wholesale deposits will have a franchise deposit value of zero.

Our Educational Objectives For This Series

In this series, we will look at how NOT to market on rate when it comes to deposit pricing and then if you must, how to do it in the least damaging way to limit overall balance sheet interest sensitivity. We will explore the interplay of how the environment, marketing, branch availability, service, cross-sell, psychology, and employee behavior impact customer deposit demand. We will look at how banks can leverage various products, channels, and customer segments to lower their cost of deposits.

As we go, we will uncover various concepts, rules of thumb, and tools that any financial institution can put into practice. No matter their role in the bank, every banker should understand what drives bank deposit value. Further, it doesn’t matter if you are a grizzled banking veteran or fresh out of college, deposit gathering is an ever-changing combination of art and science, and there is an array of new tools, tactics, and concepts to learn.