4 Ways To Quantify Loan Prepayment Protection in 2023

In a previous article (here), we discussed why commercial loan prepayment protection would be a critical return on asset (ROA) driver for community banks in 2023. We outlined the four main reasons why prepayment provisions increase profitability for banks. We also discussed the four standard prepayment provisions for commercial loans (step-down, lock-out, defeasance, and symmetrical breakeven provision). We believe any prepayment provision is better than none, but we acknowledge that banks are challenged in the market to obtain borrower acceptance of some of these provisions. Most borrowers often negotiate away the prepayment provision since many banks cannot quantify the economic value of a prepayment provision. In this article, we will quantify the value of a prepayment provision and compare the value of a step-down to a symmetrical break-even provision.

Four Ways to Quantify Prepayment Protection Value to Lenders

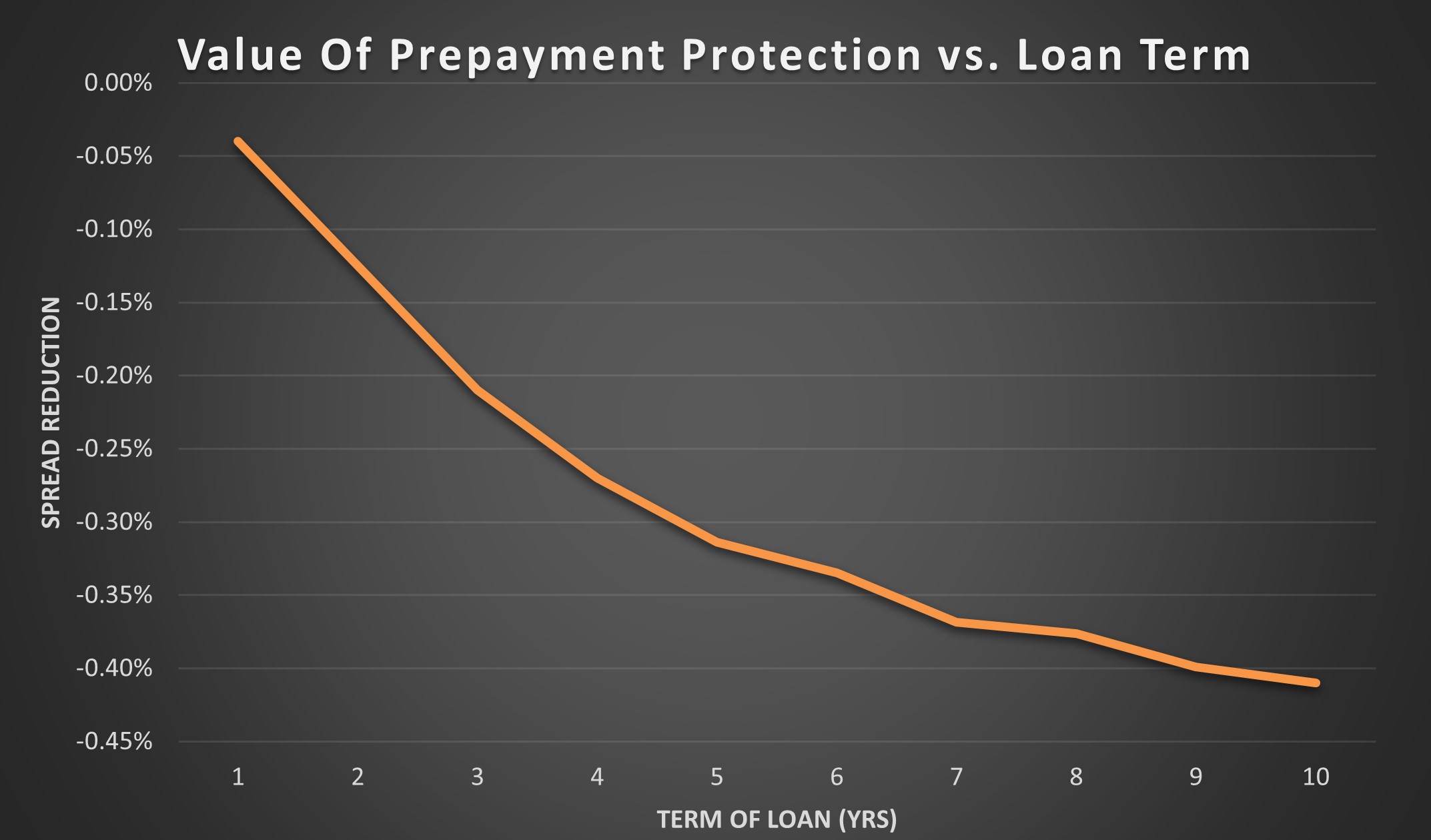

The first benefit to a bank in obtaining prepayment protection is the opportunity cost of committing to a credit and giving the borrower the unilateral right to prepay when changes in future interest rates or credit spreads make it more beneficial for a borrower to do so. We can measure this cost using simple capital market tools (the option to prepay can be approximated with swaption pricing using the volatility surface of forward rates and credit spreads). This cost to the bank is shown in the graph below.

The graph above shows the economic spread reduction for various loan terms when a meaningful prepayment protection is not present. For a one-year loan, the bank forgoes only three basis points (bps) in yield for not including a prepayment provision. However, for a five-year loan, the bank’s economic cost of excluding the prepayment provision is 31bps in yield, and for ten years, that yield reduction is 41 basis points. Including a prepayment provision in a loan increases the economic value of that asset.

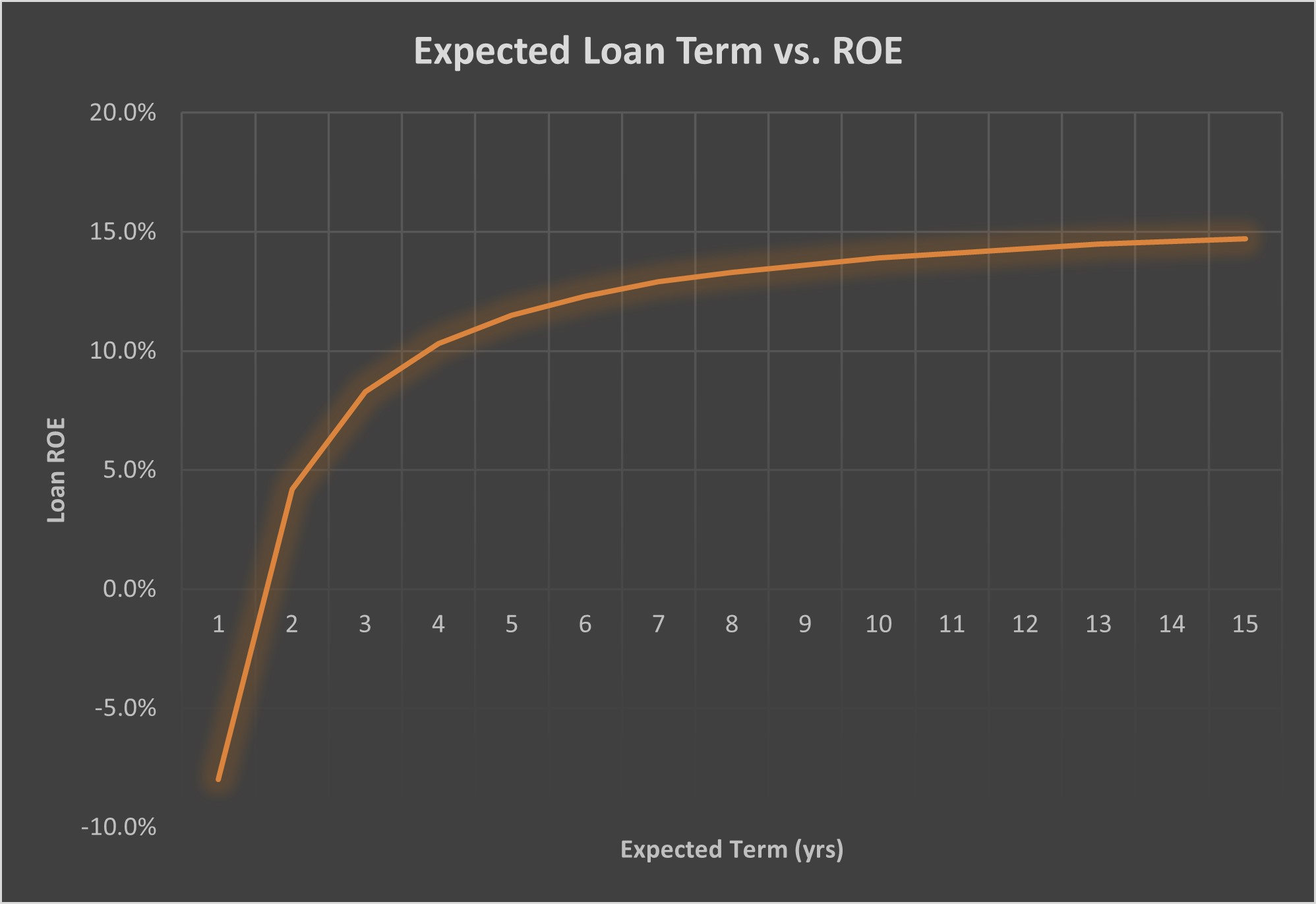

The second benefit to a bank in obtaining a prepayment provision is the extension of the expected life of the loan. Prepayment provisions extend the expected life of the loan and increase profitability. Using a sample $500k commercial credit, credit grade 4, 75% LTV, 1.25x DSC, the relationship between loan term and ROE is shown below.

Because of the high fixed costs of originating average-sized loans, loans with expected life below three years show suboptimal ROE. The loan we priced (using standard terms and average efficiency ratio assumptions) has a negative ROE until month 14. Prepayment protection extends the expected life of a loan and, therefore, increases profitability. The average expected life of a five-year loan without prepayment provisions is approximately 2.5 years, but with a meaningful prepayment provision, the expected life rises to 4.5 years, thereby increasing the ROE by 5.5% for our sample $500k loan. One of the easiest ways to increase loan profitability is to recognize (not just book) longer credits.

The third benefit to a bank in obtaining a prepayment provision is the forging of a relationship. Three parameters define a banking relationship: 1) cross-sell and upsell, 2) the percentage of customer wallet, and 3) the lifetime value of the account. All three parameters are enhanced because a prepayment provision extends the life of the loan, thereby increasing the chances of cross-sells and the percentage of the customer’s wallet, and increases lifetime value.

The fourth benefit to a bank in obtaining a prepayment provision is preventing negative selection bias in a downturn. In today’s credit environment, most quality borrowers have near-equal access to capital from multiple lenders. Strong and weak borrowers have ample opportunity to refinance their credit needs. However, in a downturn – which will occur, we just don’t know when – only the stronger borrowers can secure alternative senior debt financing. In a downturn, the credit quality of a portfolio of loans without prepayment provisions will degrade faster than the same portfolio with prepayment provisions. The lesser quality credits will not see the same financing options as the higher quality credits. Some bankers will point out that they will not enforce prepayment provisions on poor credit quality loans in a downturn, and bankers have that option, but unfortunately, the substandard credits do not pay off because the competition tightens lending standards in the downturn. The greater fool theory breaks down in a recession.

How to equate step-down provision to symmetrical breakeven provision

The symmetrical breakeven is the preferred prepayment provision for national and large regional banks because it trues up or creates a neutral cost/benefit for a prepayment based on interest rate movements. It allows banks to hedge the loan to make the bank and borrower indifferent to prepayment, whether rates are higher or lower. The provision better aligns with both the lender’s and the borrower’s interest rate sensitivity. However, many community banks cannot hedge all of their commercial loans.

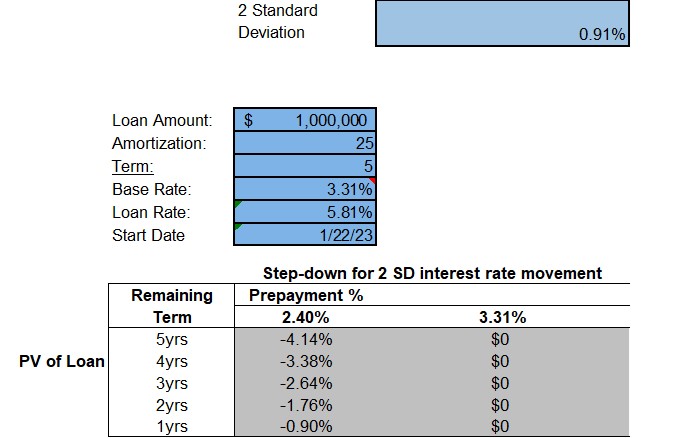

There is a way of solving for the correct step-down percentage for various loan terms to equate to the value of the symmetrical breakeven provision. We can solve for the correct percentage for different loan terms to equate to a two-standard deviation movement in interest rates (the standard value-at-risk interest rate modeling used by many hedging institutions).

The table below shows a $1mm 25 due five commercial loan and the prepayment provision necessary to protect the bank against the borrower’s motivation to pay off the loan against two standard deviation movements in interest rates. The appropriate step-down percentages for a 5-year loan are 4.14%, 3.38%, 2.64%, 1.76%, and 0.90%.

We ran the same analysis for 7 and 10-year loans and found the percentages as follows: 7yr loans – 5.80%, 5.06%, 4.39%, 3.51%, 2.69%, 1.83%, and 0.94%, 10yr loans – 8.13%, 7.44%, 6.87%, 5.99%, 5.24%, 4.45%, 3.64%, 2.80%, 1.91%, and 0.98%. While these step-down percentages provide lenders with equivalent protection value as a symmetrical breakeven provision, we believe that most better quality and sophisticated borrowers will not accept such burdensome prepayment penalties. This is why larger banks prefer the symmetrical breakeven provision. The symmetrical breakeven provision is appealing to borrowers because it provides the upside to the borrower if interest rates are higher and the borrower wants to repay the loan, and it allows the borrower to port the economics of the loan to future credit facilities.

Takeaways

While most community banks measure and emphasize net interest margin, and some value the importance of fee income, very few banks today are measuring the significant economic advantages of prepayment protection in their commercial loans. The proper prepayment provision can double the ROE of a relationship. While obtaining a meaningful prepayment provision is not simple, banks can substantially increase the acceptance of such provisions with the appropriate structure, explanation, and the right borrower.