How To Take Advantage of the Yield Curve When Loan Structuring

The yield curve is currently inverted after the FOMC’s last rate increase of 75 bps. The inversion will be more pronounced with next week’s additional rate increase, expected to be 50 bps. The yield curve shape is an excellent opportunity for community bankers to provide sound risk mitigation and balance sheet management advice to borrowers. We see many community bank borrowers desperately seeking a trusted advisor to help guide them through this volatile cycle. With higher inflation, the most aggressive Fed interest rate hiking cycle in modern history, and concern about credit quality, this is a perfect opportunity for community bankers to prove to their borrowers that they are trusted financial advisors.

The Shape of the Yield Curve

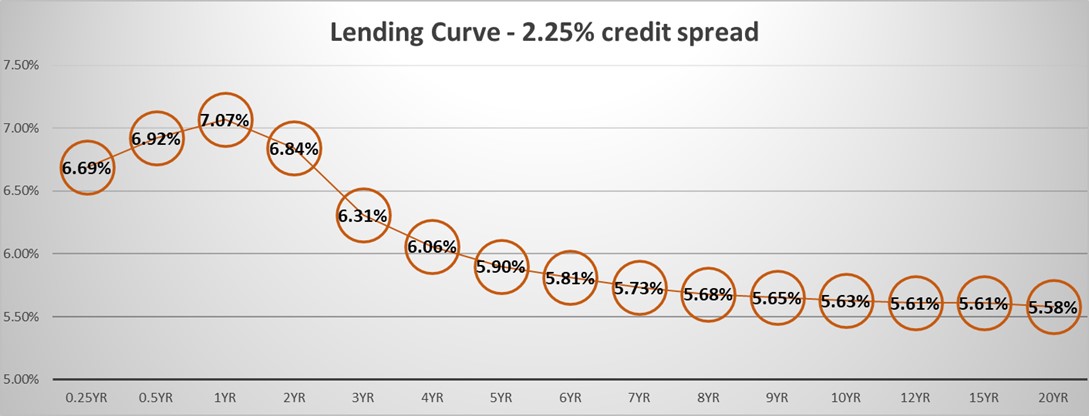

The graph below shows the lending curve from three months to 20 years and demonstrates the average commercial loan rates for different repricing terms. The graph below uses the average credit spread (2.25%) to achieve a 15% ROE for a bankable loan, $1mm size, with cross-sell opportunity and an overall relationship.

There are a few key elements to consider for bankers from the graph above:

- The short end of the curve (to one year) is higher than any other point on the curve. We expect this to become more pronounced over the next few months as the Fed reaches its terminal rate, which the market expects to be 5.00% or another 1.00% in rate hikes.

- Short-term fixed-rate loans are not attractive to borrowers as longer-term commitments are up to 1.50% cheaper in rate. Again we expect this differential to hold or become more pronounced as the Fed reaches and then maintains its terminal rate.

- Banks that rely on a 5-year repricing structure on term loans are at a disadvantage to those banks that can offer longer terms. Banks offering longer-term fixed loans can either price more aggressively, widen their credit spreads, generate more fee income, or all of the above.

- Differentiating your bank by offering longer-term fixed-rate loans can lead to unique benefits in an inverted yield curve environment. These include the following: enhance credit quality by eliminating repricing risk, lengthen and deepen relationships, differentiate from the competition, and increase your borrower’s profitability by decreasing loan payments.

Banker As Trusted Advisor When it Comes to the Yield Curve

Below are the common questions we hear from borrowers and some thoughts on how bankers can address them.

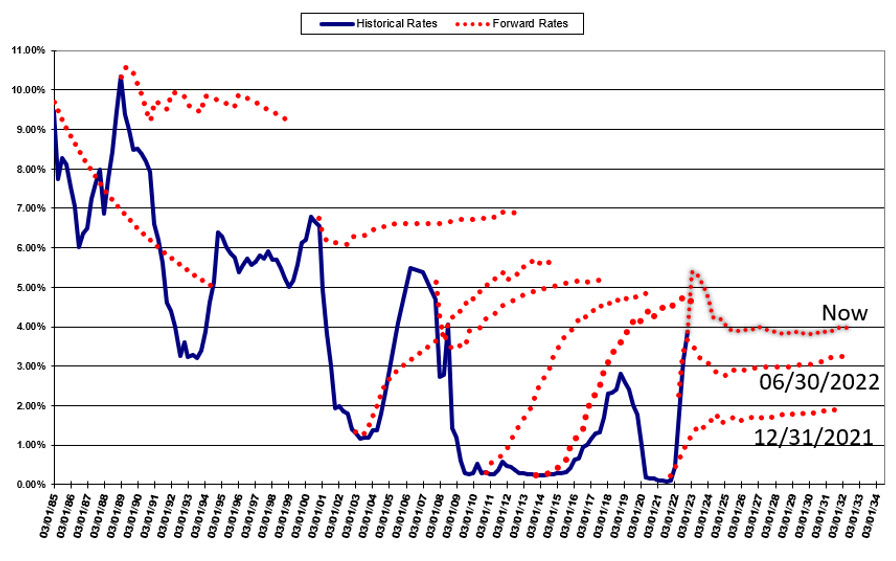

- Why should I seek financing now in such a high-interest-rate environment? Borrowers have seen years of near-zero interest rates, and some have falsely concluded that such an environment is normal. Bankers need to remind (particularly younger customers) that near zero or negative real interest rates are not normal and that today’s 10-year treasury yield is low in a historical context outside a financial crisis and a pandemic. Bankers should be able to share the graph below and demonstrate the current low level of interest rates empirically, especially when adjusted for inflation.

- Where are interest rates heading? This is a loaded question. Lenders need to appear knowledgeable and naturally do not want to come across as not having an opinion – because everyone seems to have one or two. The reality is that no one knows the future path of interest rates, and if they did, they could quit their day job. Below is a graph showing in the blue line where short-term rates have been since 1985 to the present (Prime, LIBOR, or Fed Funds are 99% correlated). In the dotted red line are forward rates at specific periods (the last three red lines are labeled and highlight how quickly the market changed its forecasts). The market is generally wrong but is wildly off during inflection points. But lenders do not need a crystal ball to be valuable, trusted advisors to their customers. Instead, lenders need to analyze a customer’s balance sheet, cash flow, and business model to structure products that insulate customers from adverse outcomes, regardless of what interest rates may do in the future. Eliminating the borrower’s financing and credit risk should be the lender’s primary focus.

- Should I wait for the Fed to start lowering rates because of a recession to finance my assets? This question is a layup for us. Borrowers should refrain from seriously considering new debt in a recession. Lenders should recommend against that as well. With absolute and relative interest rates low, and credit spreads still at historical lows, refinancing debt in a recession (presumably, but not inevitable, that the Fed is lowering rates) is unwise. Many borrowers need to realize that in a recession, liquidity is scarce, cash flow is compromised, and credit spreads widen. The motto should be, take what you can get now if you seriously believe that a recession is around the corner.

- What is the best asset/liability structure for my business? Borrowers should have loan structures that match their asset-liability position. Bankers must provide the proper structure, payment terms, conditions, and maturities for the specific borrower and their personal situation and business needs. Many borrowers do not know if their loan correctly matches their cash flows and if the liability and assets are appropriately matched for their business, and this is the most significant value-add that lenders can provide. For example, real estate is a longer-term asset with NOI that is primarily insensitive to interest rate movement. Therefore, CRE loans are best structured with fixed-rate for longer terms.

- What flexibility do I have in future restructuring or collateral substitution? We have a beef with this particular concept. Community banks pride themselves as relationship lenders. Yet we offer most credit products that are highly transactional. For example, a borrower will commit to some term for a credit facility, but if needs change during the course of the term – for example, loan size changes, collateral substitution is required, a related entity wants to assume the credit, the bank will force the borrower to terminate the loan and reprice. Some national banks, and SouthState Bank, offer credit products that provide built-in future flexibility to allow borrowers to lock in pricing and structure that is tied to the borrower’s balance sheet instead of a piece of collateral that may be bought and sold multiple times in the course of a loan commitment term. We can show interested readers how we handle this concept at SouthState Bank.

Conclusion

The current inverted lending curve is a perfect opportunity for community bankers to demonstrate how they are valuable and credible trusted advisors to their clients. Lenders do not need, nor can, predict the future, but helping borrowers manage risk doesn’t require lenders to be prescient. Instead, lenders provide value by analyzing the borrower’s balance sheet, cash flow, and liquidity positions and offer products that can help borrowers reduce business risk and increase profitability in this current interest rate environment.