Consumers use cash to forget, study shows

Payments Dive

MAY 30, 2023

New research suggests consumers’ payment method choice can depend on what they’re buying, especially if it’s a guilty-pleasure purchase.

Payments Dive

MAY 30, 2023

New research suggests consumers’ payment method choice can depend on what they’re buying, especially if it’s a guilty-pleasure purchase.

South State Correspondent

MAY 30, 2023

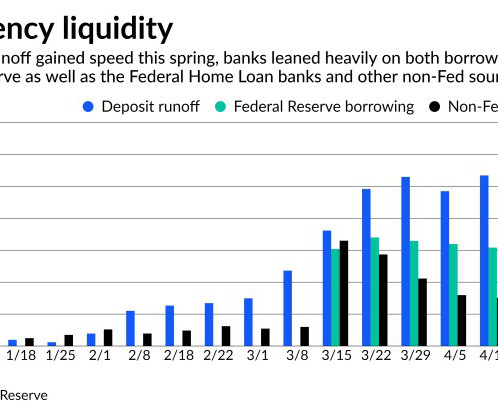

The yield curve is currently inverted, and the FOMC may take a pause at its next meeting in June. Uncertainty about the evolution of the economy and the path of future interest rates and the unusual inverted yield curve shape affords a prime opportunity for bankers to provide sound, trusted advice to clients. This is the time for bankers to offer loan structuring solutions to help customers solve business problems, mitigate risk, and manage balance sheets and cash flows.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MAY 30, 2023

The modern card-issuing company is closing its outpost in Australia as part of its cost-cutting campaign.

Abrigo

MAY 30, 2023

Timelines for small business loan data collection and reporting Deadlines for complying with the new CFPB section 1071 rule requirements for financial institutions to collect data on small business loan activities. You might also like this one-page summary of key dates and deadlines for complying with the 1071 rule. DOWNLOAD Takeaway 1 The effective date of the CFPB's new rule based on Section 1071 of the Dodd-Frank Act is June 28, 2023.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

BankBazaar

MAY 30, 2023

Travelling abroad soon? Don’t leave without knowing the new TCS rule applicable on Credit Cards, forex cards, debit card transactions, and currency purchases. There is some unfortunate news for travellers who use international Credit Cards while abroad. The Reserve Bank of India (RBI) has included international Credit Card transactions under the Liberalised Remittance Scheme, and as a result, every dollar spent abroad will now incur a 20% Tax Collected at Source (TCS).

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankBazaar

MAY 30, 2023

Discover the awe-inspiring story of Parashar, a trailblazer who has rewritten the rules of success. From her groundbreaking role as the youngest CRO to her stellar sport career representing India, Parashar’s journey is a testament to her determination and resilience. Armed with linguistic prowess and an unyielding drive, she is redefining what it means to excel.

ATM Marketplace

MAY 30, 2023

2023 is shaping up to be another year of uncertainty. There is no “new normal”, only more change. We’ve created this guide to look at the key trends and issues facing testing operations in the financial services industry in 2023 and will impact your people and your organization.

TheGuardian

MAY 30, 2023

Rates rising for new fixed-term home loans, figures from Moneyfacts show Nearly 800 residential and buy-to-let mortgage deals have been pulled during the past few days by UK banks and building societies amid concern surrounding future interest rate rises, data has revealed. The figures from the financial data provider Moneyfacts also show rising rates for new fixed-term home loans, after last Wednesday’s inflation figures moved markets to bet that the Bank of England will raise the cost of borro

William Mills

MAY 30, 2023

This year marked BankTech Ventures second annual Limited Partner Summit. BankTech Ventures is the first venture fund created specifically by and for key leaders in the community banking landscape. Launched in 2021, over 100 banks are now part of the fund, with 11 investments already made and over 100 companies in its current pipeline ready to continue fueling the innovation ecosystem for community banks.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

MAY 30, 2023

Clients are used to having fragmented experiences across their banking relationships, whether it’s their credit card, debit card, auto loan or mortgage, but with a modern tech stack in place, clients can have all of their products on one platform, which will increase loyalty.

The Paypers

MAY 30, 2023

The Digital Currency Monetary Authority has announced a pilot for a point-to-point implementation of Unicoin in Latin America and Africa.

BankInovation

MAY 30, 2023

Regulatory technology and fraud prevention are two areas that financial institutions should be investing in now to reduce losses and overhead costs.

The Paypers

MAY 30, 2023

The government of Russia has given up on its plans to create a national cryptocurrency exchange and will direct its focus elsewhere.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

MAY 30, 2023

The National Australia Bank has welcomed Annature , an Australia-based eSignature solution provider, in its rewards programme for NAB business transaction account holders.

American Banker

MAY 30, 2023

The Paypers

MAY 30, 2023

India-based fintech Razorpay has launched Turbo UPI to allow customers of online merchants to make UPI payments with redirection to a third-party UPI app during checkout.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

MAY 30, 2023

Germany-based embedded finance integrator AAZZUR has partnered with Salt Edge to enrich its Open Banking offers and accelerate go-to-market for its clients.

The Banker

MAY 30, 2023

Seven years after the Panama Papers, the country is still on Gafilat’s grey list for deficiencies in combatting money laundering. Barbara Pianese reports.

The Paypers

MAY 30, 2023

France-based payment platform Sylq has partnered with SaaS AML transaction monitoring and screening solution ThetaRay AI to improve its onboarding process.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

American Banker

MAY 30, 2023

The Paypers

MAY 30, 2023

Colombia Fintech Association , FinTech México , Belvo , and other associations have partnered to propose joint standards for Open Finance in LATAM.

The Paypers

MAY 30, 2023

German software company Mambu has announced its partnership with Mia-FinTech for accelerating the delivery of digital financial services and solutions.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content