Mercury and Brex acquired thousands of ex-SVB clients. Will they stay?

American Banker

MARCH 23, 2023

American Banker

MARCH 23, 2023

Payments Dive

MARCH 23, 2023

Companies partnering with the Federal Reserve to test the real-time payments system see it as a way to draw customers and get an edge on rivals.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

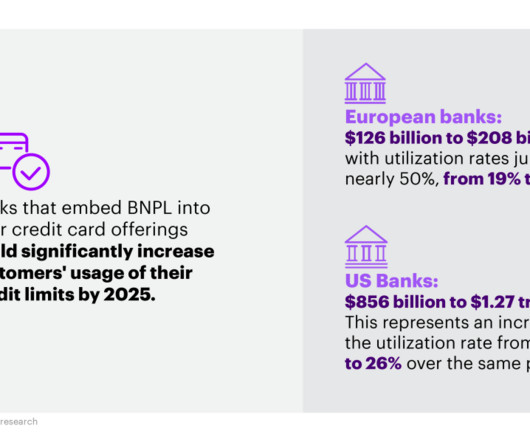

Accenture

MARCH 23, 2023

As consumers experience economic turbulence due to inflation and rising interest rates, they want to be able to pay anywhere, anytime, anyhow. For banks to stay ahead of an increasingly complex payments game and meet these evolving consumer expectations, they will need to innovate and seize emerging opportunities. One opportunity we’re watching closely is BNPL… The post BNPL: Strategies for banks to get it right appeared first on Accenture Banking Blog.

Payments Dive

MARCH 23, 2023

The percentage of online transactions involving groceries where shoppers opted to delay payment grew 40% during the first two months of 2023, according to Adobe data.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Accenture

MARCH 23, 2023

As consumers experience economic turbulence due to inflation and rising interest rates, they want to be able to pay anywhere, anytime, anyhow. For banks to stay ahead of an increasingly complex payments game and meet these evolving consumer expectations, they will need to innovate and seize emerging opportunities. One opportunity we’re watching closely is buy… The post BNPL: Strategies for banks to get it right appeared first on Accenture Banking Blog.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

SWBC's LenderHub

MARCH 23, 2023

As we discussed in part one of our Q1-2 2023 Economic Outlook , the financial sector appears well-positioned for an economic downturn. That being said, we are seeing the deterioration in delinquencies we have been forecasting.

CFPB Monitor

MARCH 23, 2023

On March 20, 2023, the CFPB published a final rule in the Federal Register that makes non-substantive corrections and updates to CFPB and other federal agency contact information found in various regulations, including the contact information that must be provided in ECOA adverse action notices and the FCRA Summary of Consumer Rights. .

CB Insights

MARCH 23, 2023

Vista Equity Partners is a private equity firm with a strong focus on investments in technology. Its portfolio includes several high-valued tech companies, such as Mindbody , Pluralsight , and Ping Identity. how investors use cb insights to improve deal flow Download the deck to see how investors are leveraging the CB Insights platform. First name Last name Email Company Name Job Title Phone number Since the beginning of 2022, Vista Equity Partners has been involved in numerous transactions and

CFPB Monitor

MARCH 23, 2023

The CFPB has announced that it has made changes to its semi-annual survey of credit card term. According to the CFPB, the changes are “designed to increase price competition in the credit card market by allowing people to comparison shop for the best prices and products.” The Fair Credit and Charge Card Disclosure Act of 1988 requires the CFPB to collect data semi-annually from the largest 25 credit card issuers and at least 125 additional issuers selected by the CFPB based on geography and oth

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

MARCH 23, 2023

Stepping off the elevator into the Truist Innovation and Technology Center, I was greeted by a futuristic space equipped with virtual-reality simulators, a 3D-printing area, countless workflow- and idea-filled whiteboards and even a self-service, fully digital snack shop. The Charlotte, N.C.

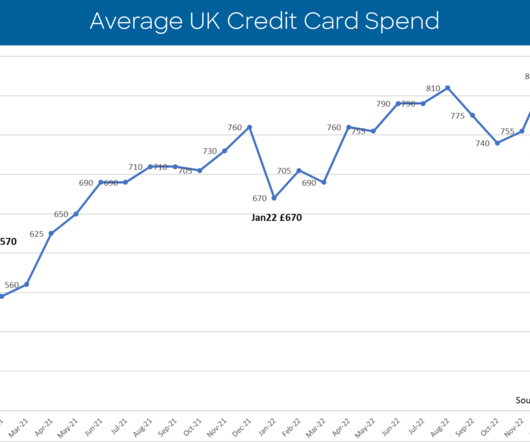

FICO

MARCH 23, 2023

Home Blog FICO UK Cards Data: Increase in Cardholders Missing Two Payments Many UK credit cardholders who missed one payment in December continued to struggle with their debts in the new year, with a marked increased in two missed payments Darcy Sullivan Tue, 11/10/2020 - 12:17 by Liz Ruddick Principal Consultant expand_less Back To Top Thu, 03/23/2023 - 12:45 Our latest on UK card trends appears to reflect the contrasting picture of the economy.

BankInovation

MARCH 23, 2023

Cyberattacks are on the rise, with attempted payment fraud in the buy now, pay later segment seeing a 211% year-over-year increase, attempted payment fraud in fintechs was up 13% in 2022, and payment fraud losses are anticipated to grow 17% YoY to $48 billion by the end of this year.

Tomorrow's Transactions

MARCH 23, 2023

Blog summarising the TTG event in London and some of the topics covered around fare collection The post Transport Ticketing Global – another fantastic year! first appeared on Consult Hyperion.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

MARCH 23, 2023

BISON , the Germany-based crypto platform for private customers of the Boerse Stuttgart Group, has introduced securities trading in cooperation with Sutor Bank and JT Technologies.

The Banker

MARCH 23, 2023

Credit Suisse had bumper years, particularly during the dotcom boom, and it weathered the 2008 financial crisis reasonably better than UBS. But trouble was never far from the bank’s door. Anita Hawser reports.

The Paypers

MARCH 23, 2023

UK-based payment institution Nucleus365 has released a new feature that enables merchants to make large volume payments to businesses and individuals with one online form.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

MARCH 23, 2023

Payment infrastructure provider Mangopay has acquired Ireland-based payments technology company WhenThen to expand its payin capabilities and add new revenue streams.

The Paypers

MARCH 23, 2023

Prepaid debit card and financial education app for kids GoHenry has partnered with the environmental organisation World Wide Fund (WWF) to launch wild card designs.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

MARCH 23, 2023

Payments orchestration platform WLPayments has teamed up with acquirer Truevo to expand the latter’s payment product offering for customers across Europe.

The Paypers

MARCH 23, 2023

EBA CLEARING has announced it will enrich its SEPA payment systems, RT1 and STEP2, with fraud prevention and detection capabilities by November 2023.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content