How BNPL’s growth is forcing a high-stakes choice on UK banks

Accenture

AUGUST 12, 2021

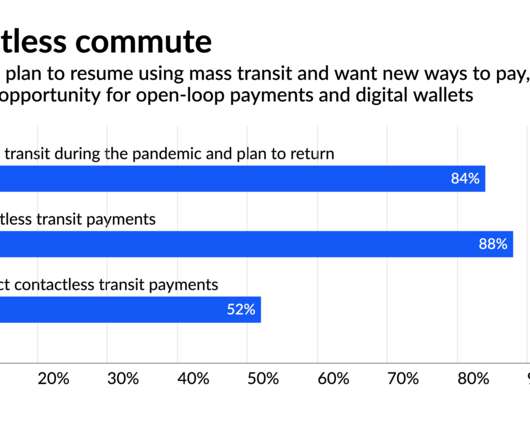

Point-of-sale (POS) financing is one of the most interesting and dynamic areas of payments innovation today. Disruptive new entrants and macroeconomic trends are driving real change across the market. The ‘buy now, pay later’ (BNPL) sector is of particular interest here. The difference between BNPL and older POS credit offerings is that with BNPL the….

Let's personalize your content