Synchrony, Bread brace for potential late fee cap impact

Payments Dive

MARCH 3, 2023

If a late fee cap is imposed by the Consumer Financial Protection Bureau, the companies may curtail credit and seek other offsets, executives said this week.

Payments Dive

MARCH 3, 2023

If a late fee cap is imposed by the Consumer Financial Protection Bureau, the companies may curtail credit and seek other offsets, executives said this week.

Perficient

MARCH 3, 2023

In our last blog, How Embedded Finance is Changing Purchasing & Borrowing Behaviors , we looked at embedded payments and loans and why companies would want to offer (increased sales, lower inventory, processing costs, data gathering) these bank-like services. In this blog, we’re going to stay in the world of finance, but pivot to embedded insurance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MARCH 3, 2023

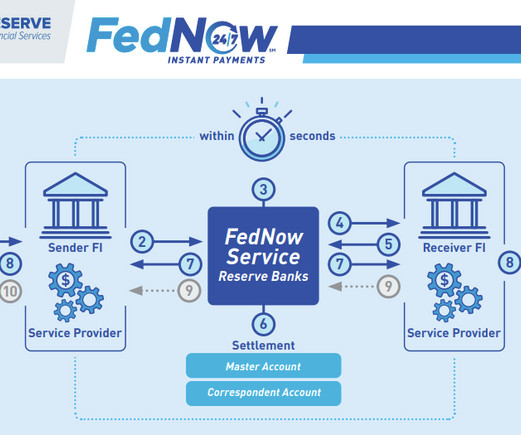

The companies are gearing up to add U.S. real-time services for customers with the mid-year launch of the Federal Reserve instant payments system.

Perficient

MARCH 3, 2023

In our first blog in this series, Blockchain: The Secret Sauce to Supply Chain Visibility , we covered why visibility is so crucial in the supply chain for all parties and gave examples of firms using distributed ledgers to help improve customer service, reduce inventory costs, provide proactive status updates, and help mitigate risk. In our last article, Starting Down the Road to Supply Chain Visibility , we discussed Perficient’s recommendations regarding processes to provide supply cha

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Abrigo

MARCH 3, 2023

Ten red flags to help you identify check fraud A financial institution's guide to identifying mail-related check fraud. You might also like this webinar, "Proactive measures to protect against check fraud and fraud loss." REGISTER now Takeaway 1 Check fraud is one of the more common methods of stealing funds from consumers and businesses. Losses from check fraud total $18 billion annually, representing more than a million checks daily.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

CFPB Monitor

MARCH 3, 2023

The CFPB and other federal agencies with the responsibility to enforce the Equal Credit Opportunity Act (ECOA) and/or Fair Housing Act (FHAct), recently sent a joint letter to The Appraisal Foundation (TAF) expressing concerns with the Fourth Exposure Draft of Proposed Changes for the 2023 Edition of the Uniform Standards of Professional Appraisal Practice (USPAP). .

CB Insights

MARCH 3, 2023

What are payment APIs & infrastructure? Payment application programming interface (API) and infrastructure companies enable small and medium-sized businesses (SMBs) to manage payments by providing APIs and infrastructure tech that act like credit card processors. This technology can handle a wide array of payment tasks — from one-time payments to subscription payments to crypto payments — to create a smooth checkout experience for merchants and shoppers.

The Paypers

MARCH 3, 2023

MFS Africa has partnered with Western Union to enable individuals and businesses across the continent to receive money from more than 200 countries.

CB Insights

MARCH 3, 2023

What is crypto-as-a-service? Crypto-as-a-service companies in the market provide the backend infrastructure enabling businesses to offer end users crypto products. Crypto-as-service powers crypto wallets, trading, payments, rewards, and debit and credit cards. The different types of crypto-as-a-service providers include crypto custodians, exchanges, and middleman API providers.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

MARCH 3, 2023

Charlotte – Fifth Third Bank plans to reduce the footprint of its applications by 30% in the next three to five years as the $206 billion bank focuses on refactoring and rewriting apps for the cloud.

The Paypers

MARCH 3, 2023

A report by Sopra Steria has shown that a third of Germans still prefer direct branch contact for their banking.

BankInovation

MARCH 3, 2023

To succeed in today’s digital-first world, banks are under pressure to orchestrate differentiated customer journeys to attract, win, and maintain long-term loyalty. Troves of real-time customer data and advancements in artificial intelligence (AI) technologies are paving the way for delivering hyper-personalized experiences that are both relevant and timely.

The Paypers

MARCH 3, 2023

The German supervisory authority BaFin has announced that it intends to send a special representative to the Germany-based broker flatexDEGIRO.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

BankInovation

MARCH 3, 2023

CHARLOTTE — Truist launched its commercial digital experience in the cloud and is currently working toward a mobile offering.

The Paypers

MARCH 3, 2023

US-based retail company that operates grocery delivery and pick-up services, Instacart , has recently added OpenAI’s ChatGPT chatbot technology to its grocery delivery app.

The Paypers

MARCH 3, 2023

US-based DocuPhase has purchased accounts payable (AP) automation solutions provider iPayables to enhance its footprint and provide AP automation clients with improved offerings.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

MARCH 3, 2023

Buddy , a budgeting app for young people, has partnered with Klarna Kosma , a financial technology platform, to offer users a better way to track expenses and gain control over their finances.

The Banker

MARCH 3, 2023

Your quick guide to the week ending March 3, 2023, on TheBanker.com. The Banker editorial team reports.

The Paypers

MARCH 3, 2023

Brazil's central bank has approved Meta Platforms ' (META.O) payments launch for SMEs in Brazil via its messaging application WhatsApp, building on the app's existing local peer-to-peer payment system.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

MARCH 3, 2023

Sumsub , a provider of security and transaction monitoring solutions, has launched its Travel Rule solution for the crypto industry, offering a customisable toolkit across the whole customer lifecycle.

American Banker

MARCH 3, 2023

The Paypers

MARCH 3, 2023

Flagright , a Germany-based regtech, has partnered with kevin. , a Lithuania-based enables businesses to accept payments directly from banks.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content