How intelligent prospecting will grow commercial banking

Accenture

SEPTEMBER 2, 2021

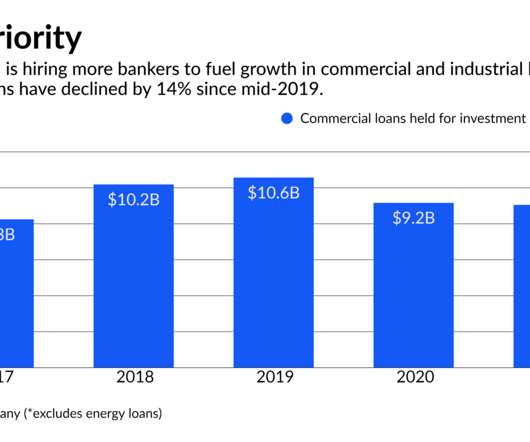

When I started as a commercial banking relationship manager (RM) in the early ‘90s, a big part of my job was prospecting for new customers. This was an era when public information on privately held, mid-sized companies was extremely limited. The filings book I used to search for information—a thick paperback known as the Uniform…. The post How intelligent prospecting will grow commercial banking appeared first on Accenture Banking Blog.

Let's personalize your content