The ugly, the bad and the good

Chris Skinner

APRIL 5, 2020

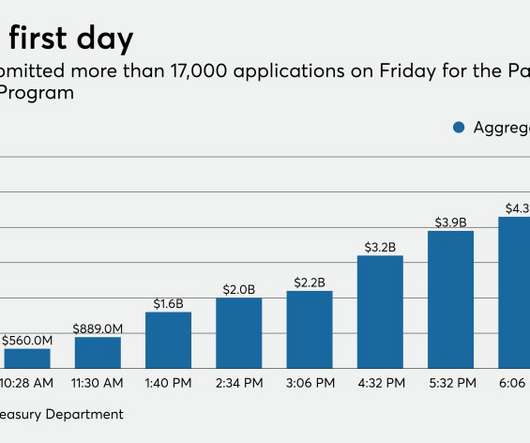

It’s interesting that governments around the world have announced huge stimulus packages to protect workers, small businesses and life in general. Trillions of dollars. Great. The reality is that no one is getting it. You see these announcements and try to get hold of the bank to get the stimulus. … The post The ugly, the bad and the good appeared first on Chris Skinner's blog.

Let's personalize your content