WASHINGTON — A new effort by the Federal Housing Finance Agency to examine membership rules for the Federal Home Loan Bank System is reigniting an argument over whether policymakers should expand access to the system or impose tougher barriers.

In a recent request for feedback, the FHFA said

The review has produced two competing takeaways: Some see the FHFA as trying to stamp out backdoor efforts by ineligible entities to benefit from the system, but some in the mortgage sphere see the effort as a hopeful sign that more nonbanks might get in through the front door.

At issue is whether entities like independent mortgage banks and real estate investment trusts should be allowed to tap the low-cost liquidity available through the Home Loan banks.

“Allowing well-managed independent mortgage banks and REITs into the Home Loan Bank System could stabilize the mortgage market and make it less susceptible to a potential liquidity crunch,” said Pete Mills, senior vice president at the Mortgage Bankers Association.

But Karen Petrou, managing partner of Federal Financial Analytics, says the FHFA's recommending expanded Home Loan Bank System membership would be contrary to FHFA Director Mark Calabria’s stated goal of limiting Home Loan bank activity to the system's core mission of furthering housing and community lending.

Easing the membership rules would not correspond with "Mark Calabria's comments ... about mission-driven reforms,” she said. “Expanding the system to REITs is not clearly mission-driven.”

In a statement accompanying the request for information, Calabria said, “There is no predetermined outcome for this RFI, other than to ensure that membership rules are clear, consistently applied to all applicants, and that access to the Banks’ low cost advances do not jeopardize the System’s role as a key source of liquidity to support housing finance.”

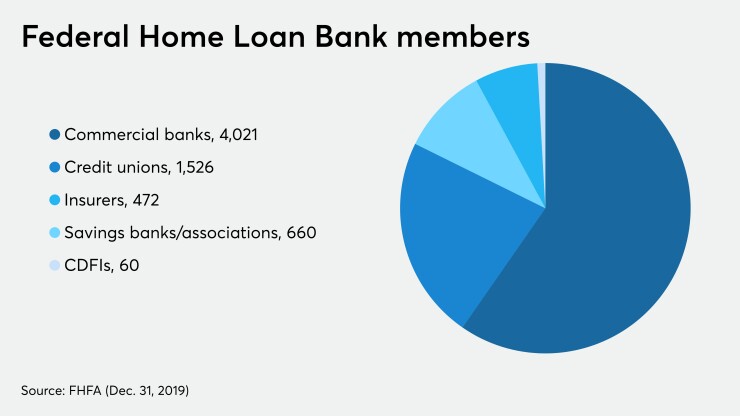

Although the Federal Home Loan banks fly under the radar compared with the government-sponsored enterprises Fannie Mae and Freddie Mac, they are an important source of low-cost liquidity for their members including federally insured banks and credit unions, nondepository community development financial institutions and non-federally insured credit unions.

Mills said the FHFA review is a good way for the agency to establish clear boundaries around who benefits from the system.

The way Calabria "has talked about this is evaluating the Home Loan Bank System for mission and safety and soundness,” Mills said. “I think they want to make it very clear who can and cannot be a member and what their obligations are once they become members in terms of both safety and soundness and mission focus.”

Up until 2016, real estate investment trusts and similar funds were able to gain access by establishing captive insurance companies that could in turn become Federal Home Loan Bank members, but the FHFA that year issued a rule prohibiting captive insurers from gaining entry to put a stop to such arrangements.

Yet REITs and other companies have since attempted to get around that rule by establishing entities such as CDFIs and special-purpose banks to obtain the benefits of Home Loan Bank System membership, the housing agency said. It is unclear, however, if any such venture has succeeded in accessing the system.

The FHFA "has encountered instances in which entities that are ineligible for membership have attempted to gain access to FHLBank advances through the use of conduit arrangements with other types of affiliates that may themselves be eligible for membership," the request for information said. Calabria told reporters that the agency has only seen a “handful of instances” of this, but that it was enough for the FHFA to get more involved.

But the questions for public comment identified two diverging paths forward: either banning more types of institutions to stop conduit deals, or changing the eligibility requirements to allow more nonbanks to become members. The latter outcome would require congressional action to change the statute.

For example, the agency asked whether or not it should ban “otherwise-eligible entities that are most susceptible to being used as conduit vehicles,” which could include CDFIs and special-purpose banks.

Petrou said such a conservative step would be consistent with the administration's recent stategic document for housing finance reform.

“It's very similar to the approach to Fannie and Freddie in the administration plan last September, which I would call a strictly constructionist approach: agreeing to the mission, but narrowly defining the mission and seeking to confine the housing GSEs to as small a class of firms as possible in defining with whom they do business,” she said.

But the request for information also asked whether granting direct access to now-ineligible entities would further the system's mission.

"What would be the safety and soundness risks, if any, to the FHLBanks or the System of making such institutions eligible for membership? What impacts, if any, would allowing such institutions to be members have on the System’s cost of funds and ability to provide low-cost liquidity to current members?"

CDFI participants, meanwhile, are raising concerns about being in the spotlight.

Jennifer Vasiloff, the chief external affairs officer at the Opportunity Finance Network, a national association of CDFIs, said she has heard conversations “around the edges” about nonbank mortgage lenders creating affiliates that would be eligible for FHLB membership.

“It sounds very cumbersome to me, but it could be concerns that I share obviously, from the CDFIs' point of view, that we have a pretty great brand and CDFI certification really is a mission test that we don't want to see exploited or taken advantage of by unscrupulous actors,” said Vasiloff.

Joe Neri, the chief executive of IFF, a community development financial institution in the Midwest, said he does not think there is an appetite to ban institutions like his from the FHLB system. Instead, he says, the FHFA is just looking at how to keep REITs and other ineligible entities out.

The Home Loan banks and CDFIs "have actually come to a place of really much better understanding of each other, laid out the places where there's more risk, if you will ... so I'm really actually not worried," Neri said.

The CDFI Fund, which is managed by the Treasury Department, should bolster its review process to ensure that entities using "conduits" are not eligible for CDFI funding, let alone Home Loan bank membership, he added.

But some in the industry actually saw the request for informaiton as the FHFA looking to open up the “front door” for REITs and similar funds that may have been using these conduit arrangements to gain access.

The outcome of the FHFA’s request for information could be that the agency asks Congress to open up the Home Loan Bank System to REITs, said Mills.

He said expanding membership eligibility could reduce concentration risk of the Home Loan Bank System being dominated by a few large entities.

"Expanding membership opportunities for entities that are both mission-focused and can meet safety and soundness standards might actually mitigate some of that risk by bringing new members into the system," Mills said.

The question of nonbank originators' involvement in the Home Loan Bank System is critical for the Trump administration to address, Bose George, a managing director at Keefe, Bruyette & Woods, said in a research note.

”Director Calabria continues to appear intent on reducing risk at the GSEs and transferring exposure over time to the private market,” he said. “REITs and other nonbanks are an integral and important source of capital to support the administration's policy goals.”

But Neri said that would potentially expand the slice of the mortgage market that the government implicitly backs, which is inconsistent with the stance FHFA has taken since Calabria came aboard.

"Just as an overall approach, adding to the membership of the Federal Home Loan Bank [System] for purposes of advances that theoretically the regulator has implicitly guaranteed ... would surprise me," he said. He added that real estate investment truts don't have a regulator, which is also a concern.

John von Seggern, the president and CEO of the Council of Federal Home Loan Banks, said any entity considered for membership should not threaten the system's safety and soundness.

“The strength and stability of the Federal Home Loan banks flow from our cooperative structure comprised of members of all sizes and many types serving U.S. communities everywhere in all economic conditions,” he said in a statement. “As we go through this process, our guiding principle will be that any consideration regarding membership must not impinge on the Federal Home Loan Banks’ safe and sound business practices.”

The FHFA also asked in its request for information whether it should limit the amount of advances a Home Loan bank should have outstanding to a single member, regardless of conduit activity.

Some Home Loan banks have granted large advances to a number of big banks, which has raised the question of whether all of that money is really being used for mortgage finance purposes.

“Behind it is the view that you want the system to be as limited as possible,” Petrou said.

It could be difficult for a bank to prove that all of the money provided by a Home Loan bank is going toward housing. But limiting the amount of advances could force the bank to be more careful about how it uses the money.

But this could also result in a huge loss for the Home Loan banks, Petrou said.

“The business of the Home Loan banks themselves would be dramatically redefined, not by virtue of new restrictions on nontraditional members, but by concentration limits outstanding on advances to existing members,” she said. “And that’s the hidden, really big question in the RFI.”