Deutsche Bank report sees mobile payments surge, but cash remains critical

Payments Dive

JANUARY 24, 2020

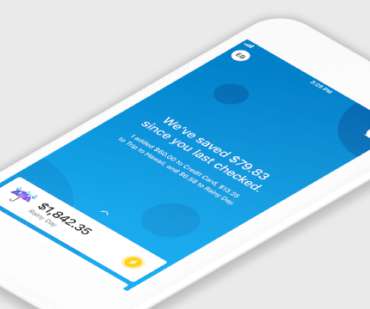

A new report from Deutsche Bank says that mobile payment adoption will surge in the next five years, but cash will remain a critical part of many economies. In the developing world, underbanked consumers are moving straight from cash-based economies to mobile adoption, and skipping over the adoption of plastic credit and debit cards.

Let's personalize your content