Marqeta to cut workforce by 15%

Payments Dive

MAY 10, 2023

The card-issuing fintech plans to dismiss about 150 employees in an effort to become profitable. It aims to reduce annual costs by as much as $45 million.

Payments Dive

MAY 10, 2023

The card-issuing fintech plans to dismiss about 150 employees in an effort to become profitable. It aims to reduce annual costs by as much as $45 million.

CFPB Monitor

MAY 10, 2023

The CFPB has filed its brief with the U.S. Supreme Court seeking reversal of the Fifth Circuit panel decision in Community Financial Services Association of America Ltd. v. CFPB. In that decision, the panel held the CFPB’s funding mechanism violates the Appropriations Clause of the U.S. Constitution and, as a remedy for the constitutional violation, vacated the CFPB’s payday lending rule (Payday Rule).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MAY 10, 2023

The “first-of-its-kind” model will enable buy now, pay later loans to be factored into lending decisions, Affirm’s CEO said.

CFPB Monitor

MAY 10, 2023

Auriemma Roundtables, a leading provider of business intelligence solutions to the consumer finance industry, together with First National Bank of Omaha and a group of several other premier consumer financial services firms, has filed a comment (the “Auriemma Roundtables Comment”) on the credit card penalty fees proposal (the “Proposed Rule”) issued by the Consumer Financial Protection Bureau (CFPB). .

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

MAY 10, 2023

More shoppers turning to short-term loans to buy groceries could signal a permanent shift in how people think about paying for essential goods, experts say.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankInovation

MAY 10, 2023

NEW YORK — Wells Fargo Auto is looking to the bank’s enterprise-level AI for potential applications. “For the auto business, we have the benefit of being able to leverage those tools that are being developed at the enterprise level,” Head of Wells Fargo Auto Tanya Sanders said today at Fintech Nexus.

TheGuardian

MAY 10, 2023

Boss of industry body UK Finance accuses tech companies of ‘profiting’ from scams on their platforms The boss of the banking industry body UK Finance has called on social media companies to reimburse victims of online fraud, accusing them of “profiting” from scams taking place on their platforms. Figures from its fraud report show that 78% of authorised push payment scams, where a victim is tricked into approving a transaction, started online in the second half of last year, with about three-qua

BankInovation

MAY 10, 2023

Countless American consumers and businesses are struggling to manage their money in meaningful ways that allow them to take advantage of long-term financial opportunities – living paycheck-to-paycheck, operating with minimal to no cash buffers, and trying to borrow without access to affordable credit.

The Banker

MAY 10, 2023

The new regulation indicates increasing market maturity and creates a higher bar for compliance, levelling the playing field. Bill Lumley reports.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

MAY 10, 2023

Payments giant Visa and open-banking platform Tarabut Gateway are coming together to develop products and solutions through open-banking technology. “Together with Visa, we will leverage our data infrastructure to bring new and improved products to customers,” Abdulla Almoayed, chief executive of Tarabut Gateway, said in a release.

The Paypers

MAY 10, 2023

Global wire fraud protection company CertifID has launched its seller identity verification service, built for enabling firms to combat seller impersonation fraud.

BankInovation

MAY 10, 2023

Citigroup Inc. plans to debut a new credit card with multiple retailers that consumers will be able use for larger purchases. The new card, known as Citi Pay Credit, comes from the lender’s retail-services unit and will be digital only, according to a statement Wednesday.

The Paypers

MAY 10, 2023

US-based Splitit has signed a two-year agreement with Visa to provide merchants with a payment instalments solution embedded within their credit card process.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

BankInovation

MAY 10, 2023

First Citizens Bank today announced plans to up its tech focus by leveraging capabilities acquired from its March purchase of the failed Silicon Valley Bank.

American Banker

MAY 10, 2023

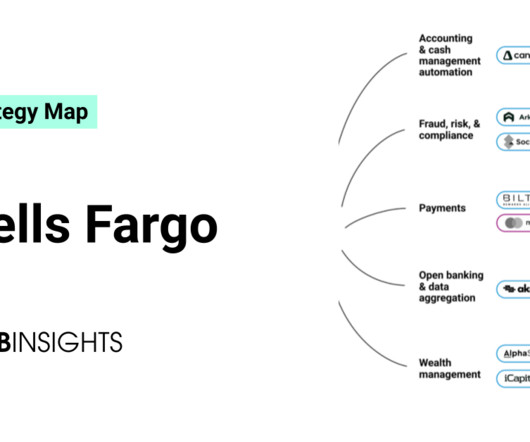

CB Insights

MAY 10, 2023

Wells Fargo is the fourth-largest bank in the US by total assets, with a market capitalization of around $138B. Its customer base of over 70M spans across 8,700+ locations worldwide. Over the last few years, the company has turned to fintech startups to help meet customer demand for secure, seamless, and customized banking experiences. Its recent investments and partnerships have targeted solutions that enhance its offerings to business banking and wealth management clients.

The Paypers

MAY 10, 2023

Tarabut Gateway , an Open Banking platform in the Middle East and North Africa (MENA), has announced a strategic partnership with Visa , the global digital payment provider.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

MAY 10, 2023

Global fraud management service provider iDenfy has partnered with Fincapital Partners to deliver a seamless customer onboarding process with automated KYC and AML checks.

The Paypers

MAY 10, 2023

UK-based payments and gambling compliance company VIXIO has launched Horizon Scanning, a SaaS solution that provides real-time intelligence for payments compliance.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

MAY 10, 2023

US-based cybersecurity company Kasada has partnered with Signifyd to increase retail and ecommerce profit margins while setting new standards for fraud prevention.

The Paypers

MAY 10, 2023

Banking Circle has joined the UK Faster Payments Service (FPS) as a direct participant for GBP, aiming to build a super-correspondent bank for global B2B payments.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content