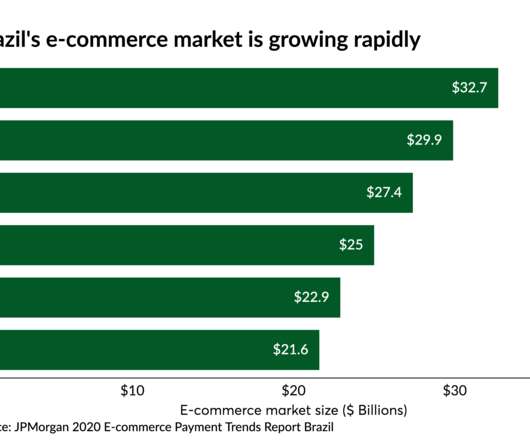

How Brazil's e-commerce market fosters innovation

Payments Source

MARCH 26, 2021

The country has lots of smartphones, few plastic cards, and it's just starting to get rid of cash. ]].

Payments Source

MARCH 26, 2021

The country has lots of smartphones, few plastic cards, and it's just starting to get rid of cash. ]].

Bobsguide

MARCH 26, 2021

Discussions around Europe’s retail payments regulations have become less about the end-user and more about the bloc’s politics, according to Robrecht Vandormael, secretary general at Payments Europe. “Before, this [payments] was regarded as a very technically-driven field, but.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Source

MARCH 26, 2021

Fiserv has agreed to acquire processor Pineapple Payments in a move that will expand its current distributor partner relationship to help its Clover platform while also picking up the payment processing for Pineapple's current customer base. ]].

BankInovation

MARCH 26, 2021

UiPath today filed documents to go public, with a plan to list on the New York Stock Exchange under the symbol PATH, according to the robotic process automation (RPA) vendor’s IPO prospectus, filed with the U.S. Securities and Exchange Commission (SEC). The New York-based UiPath specializes in software that helps companies save time and money […].

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Source

MARCH 26, 2021

China’s central bank said its planned digital currency will coexist with technology platforms like Ant Group’s Alipay, Tencent and WeChat Pay, which currently dominate the online payments market. ]].

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Source

MARCH 26, 2021

Even before digital transactions took off as a result of the pandemic, chargebacks were becoming more common, says Chargehound's Pallavi Kuppa-Apte. ]].

ATM Marketplace

MARCH 26, 2021

Heather McElrath, senior director of communications for NACHA, discusses how the pandemic has changed the payments industry and how NACHA and the ACH network are committed to ensuring payments remained secure, safe and accessible to all.

TheGuardian

MARCH 26, 2021

Liberty Steel founder requests bailout as company cashflow problems are compounded by Greensill collapse Metals magnate Sanjeev Gupta has requested a £170m government bailout to save his conglomerate, owner of Britain’s third biggest steel group, from collapse. Gupta, the founder of Liberty Steel and its sprawling holding company GFG Alliance, sent a letter to government officials late this week to request the cash.

Cisco

MARCH 26, 2021

Get ready to TURN IT UP at our all-digital Cisco Live 2021. We’re excited for the creative experiences, impactful speakers, and thought-provoking sessions slated globally March 31 st – April 1 st. Join us for our engaging industry sessions across financial services and retail. Find a full list of industry sessions and register now. The last year has brought change and innovation.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

MARCH 26, 2021

While many institutions are part of nationwide shared-branch networks, three Southern California credit unions have agreed to share one facility. The arrangement is believed to be the only one of its kind. ]].

BankUnderground

MARCH 26, 2021

Maren Froemel, Mike Joyce and Iryna Kaminska. Introduction. During 2020 the MPC announced a further £450 billion of QE purchases, slightly more than the total amount of assets purchased over the preceding ten years, taking the target QE stock to £875 billion of gilt holdings and £20 billion of sterling investment-grade corporate bonds. We study the high-frequency reaction of gilt markets to these QE announcements in light of the surprises to market expectations of the future QE path.

BankInovation

MARCH 26, 2021

UiPath today filed its S-1 with the U.S. Securities and Exchange Commission, and the initial public offering prospectus is a nearly 200-page document detailing the robotic process automation (RPA) company’s financial and business dealings; some of the biggest banks in the world use the vendor’s products internally, including Bank of America, the Bank of Montreal, […].

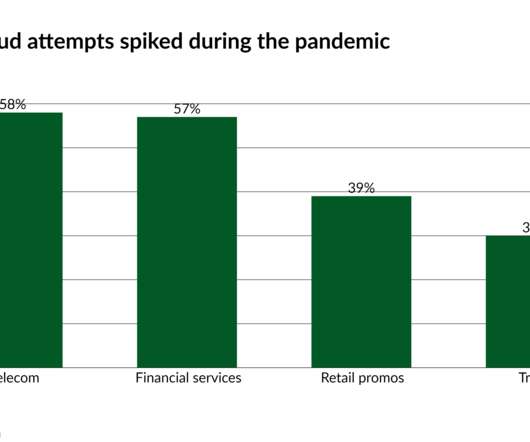

American Banker

MARCH 26, 2021

The abrupt shutdown of retail a year ago led to a rise of digital shopping — and fraud. And the most tech-savvy consumers may be the most vulnerable, according to TransUnion data. ]].

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

BankInovation

MARCH 26, 2021

UiPath has been busy this week; the robot process automation (RPA) software company today filed its Initial Public Offering (IPO) prospectus with the U.S. Securities and Exchange Commission, and also announced its March 19 acquisition of API integration platform Cloud Elements for $40.5 million, a move that will give UiPath more integration and support additional […].

American Banker

MARCH 26, 2021

Matthew Gehman will take the helm at the Lancaster, Pa., institution on April 1, succeeding W. Kent Hartzler, who has been CEO since 2007. ]].

TheGuardian

MARCH 26, 2021

Exclusive: UK’s state-owned bank was concerned over loans to Sanjeev Gupta’s steel empire Britain’s state-owned business bank launched an investigation into Greensill Capital, and loans it extended to Sanjeev Gupta’s steel empire, months before the lender collapsed into administration, the Guardian has learned. The news comes as former prime minister David Cameron was cleared of any potential breach of lobbying rules linked to his efforts to personally influence officials in Whitehall on Greensi

FICO

MARCH 26, 2021

Growing The Business On The Cloud. Avon, part of the Natura & Co Group and one of the largest direct selling companies in the world, has used the FICO® Platform to improve its credit granting in Brazil, reducing its representatives’ bad debt indicators by 72 percent. Avon was also able to automate 90 percent of limit increase requests made by sales representatives.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

FluentBanking

MARCH 26, 2021

Proposed measures in new passport law Passports of loan defaulters to be seized or revoked Foreign travels to be restricted even if loan default is caused by business failures, losses Proposed amendments to the Bank Company Act, Bankruptcy Act, and Finance Company Act also seek punishment for defaulters Bankers, lawyers, and economists say existing laws are enough to be hard on loan defaulters but those are not properly enforced Loan defaulters, no matter wilful or circumstantial, will have thei

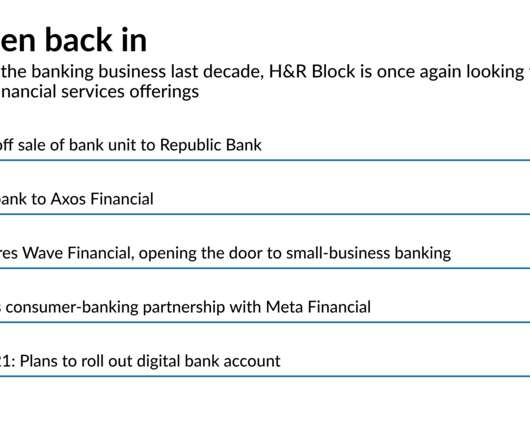

American Banker

MARCH 26, 2021

Six years after unloading its bank unit, the tax preparation chain wants to diversify by launching a digital account targeting low- and moderate-income households. How will it differentiate itself from upstarts like Chime, Varo and Green Dot? ]].

BankDeals

MARCH 26, 2021

Providence Bank (NC) continues to offer top-rate short-term and long-term CD Specials. Minimum opening deposit is $1k, with no stated balance cap.

American Banker

MARCH 26, 2021

The Colorado credit union has pledged to match at least $50,000 in donations to a local foundation assisting with the community's recovery following a mass shooting at a grocery store that left 10 people dead. ]].

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

MARCH 26, 2021

China’s central bank is trying to allay privacy worries associated with its digital currency by promising a system in which the user is anonymous unless suspect of fraud.

American Banker

MARCH 26, 2021

Credit unions were already transforming their home loan operations before COVID-19, but many of the adjustments made as a result of the outbreak are likely to become permanent. ]].

The Paypers

MARCH 26, 2021

Switzerland-based telecommunications provider Swisscom and Switzerland-based financial infrastructure operator SIX have announced a technical cooperation to make their open finance hubs compatible.

American Banker

MARCH 26, 2021

The heads of the Federal Reserve and Treasury are urging passage of legislation that would replace Libor with the Secured Overnight Financing Rate in certain contracts. That would spare banks litigation over trillions of dollars of contracts when Libor expires in 2023. ]].

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content