Card CEOs react to macroeconomic threats

Payments Dive

JULY 29, 2022

Amid talk of a recession, executives with Visa, Mastercard, American Express and Discover are keeping a close eye on inflation, consumer demand and unemployment levels.

Payments Dive

JULY 29, 2022

Amid talk of a recession, executives with Visa, Mastercard, American Express and Discover are keeping a close eye on inflation, consumer demand and unemployment levels.

ATM Marketplace

JULY 29, 2022

The banking industry has had to make significant adjustments in recent years in response to both the COVID-19 pandemic and changing economic and customer expectations. The Bank Customer Experience Summit, being held from Aug. 31 to Sept. 1 in Chicago, will cover all aspects of current innovations in banking.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JULY 29, 2022

A new bill to curb Visa and Mastercard’s dominance of credit payments is likely to rev up a long-time battle between merchants and card companies.

BankInovation

JULY 29, 2022

Americans are leaning into technology to better understand their finances, keep track of their net worth and reach long-term financial goals. People of all ages are leveraging financial apps to manage their money in fact, 58% of Americans surveyed believe that financial apps, including investment, management and banking apps are important factors in achieving their […].

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

JULY 29, 2022

CEOs of three payments companies share how macroeconomic headwinds are affecting their businesses and how they’re seeing their firms through the uncertainty.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

CFPB Monitor

JULY 29, 2022

On July 20, 2022, the Federal Trade Commission (“FTC”) and 18 state attorneys general led by New York Attorney General Letitia James announced that they have entered into a settlement with Harris Originals of NY, Inc. and related entities (collectively, “Harris Jewelry”), a national jewelry retailer that markets and sells military-themed gifts, to resolve their lawsuit which alleged that Harris Jewelry had engaged in unlawful sales and credit practices targeting servicemembers.

Jack Henry

JULY 29, 2022

Community financial institutions are known for their personal service. Tellers know your name. You know theirs. Real relationships form. But what happens when a pandemic breaks out, schools shut down, and we’re all told to shelter at home? Pandemics test the limits of customer service. As visits to the branch dip, the personal service that financial institutions offer inside the branch can no longer remain confined there.

CFPB Monitor

JULY 29, 2022

On July 20, 2022, the Connecticut Department of Banking (the “Department”) issued a Consumer and Industry Advisory on Money Transmission (the “Advisory”). The Department believes the Advisory was necessary for two reasons. First, the Department notes the “significant disruption to traditional money transmission systems” caused by the “increased use of technology to enable immediate payment mechanisms” and “the explosion of virtual currency.

Jack Henry

JULY 29, 2022

I grew up in payments. In the mid-90s, I cut my teeth on Standard Entry Class codes, Return Reason codes, and the logistics of batch clearing and time-based risk in ACH. I know. Sexy, right? In Payments Land, geeks like me loved to talk shop. Still do. Comic-Con and Star Trek conventions have nothing on regional payments conferences where payments nerds brandish obscure acronyms and flex arcane knowledge in passive-aggressive conversations about who’s liable for fraud in unusual transaction scen

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

The Paypers

JULY 29, 2022

The Paypers has launched the 7th edition of the Payment Methods Report 2022 , which offers a detailed look at the latest developments in the payment methods space and the new technologies that these methods rely on.

Jack Henry

JULY 29, 2022

As someone who reads this blog and follows the industry, you’ve likely heard a lot of talk about open banking recently. Headlines with references to “Open APIs” and “Shared Data” continue to appear in inboxes and popular topics with industry reports. We know that in today’s market, consumers don’t compare financial institutions (FIs) so much as they compare experiences.

TheGuardian

JULY 29, 2022

Bank to hand dividend to shareholders despite dip in second quarter profits and economic ‘uncertainty’ The UK government is in line for a £1bn payout from its near-50% stake in NatWest Group, despite a dip in the bank’s second quarter profits and “uncertainty” over the UK’s economic outlook. NatWest revealed on Friday it was poised to issue dividends worth 20.3p a share, after reporting “strong growth” in lending and deposits across the business, thanks in part to rising interest rates that mean

Jack Henry

JULY 29, 2022

Cyber threats are becoming increasingly sophisticated, complex and pervasive, leaving financial institution (FI) and consumer data more vulnerable than ever before. As risk proliferates, it is no longer a question of if an attack will happen, but rather when fraudsters will strike. FIs, as a result, are challenged to keep up with evolving cybersecurity initiatives, IT regulatory compliance demands, and critical disaster preparedness issues – all while staying within budget and focusing on other

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

Bussman Advisory

JULY 29, 2022

FinTech Ecosystem Insights by Bussmann Advisory is our weekly newsletter with over 40’000 subscribers across different social media channels, summarizing relevant news and reports related to ecosystems around disruptive technologies, highlighting key updates from the industry as well as our portfolio companies: US regulator raises concerns over Apple’s foray into short-term lending Barclays takes stake in crypto firm Copper Jack Ma to give up control of FinTech giant Ant Group.

BankInovation

JULY 29, 2022

Citi’s investment in early-stage companies has paid off for the bank, providing them an insider’s view before determining the long-term visibility of a strategic partnership. “The bigger role of a strategic investor is not really to find unicorns … the goal should be around finding a good company early and helping them build a product […].

ABA Community Banking

JULY 29, 2022

As a former engineer, Jennifer Schmidt brings an understanding of systems and integration to her work as a community bank chief compliance officer. The post Podcast: Engineering a framework for enterprise risk appeared first on ABA Banking Journal.

The Paypers

JULY 29, 2022

The Spanish Ministry of Economy has announced plans to limit commissions of credit and debit cards from the current 2 percent to 0.3% and 0.2%, respectively.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Banker

JULY 29, 2022

Inflation and the rate hikes are likely to dominate Mexico’s economic landscape this year, although foreign and domestic investment might address long-term challenges. Barbara Pianese reports.

The Paypers

JULY 29, 2022

UK-based Shieldpay has partnered with Western Union Business Solutions (WUBS) to implement Foreign Exchange capabilities on international transactions.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

JULY 29, 2022

UAE-based BNPL provider Postpay has rolled out express checkout for in the Gulf Cooperation Council for frictionless ecommerce.

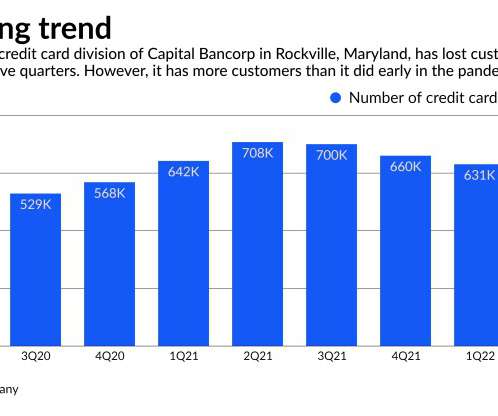

American Banker

JULY 29, 2022

The Paypers

JULY 29, 2022

The White House has announced the formation of a new Economic Opportunity Coalition (EOC) to address economic disparities and accelerate economic opportunity in underserved communities.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content