Banking’s digital shift: Decision time for payments players

Accenture

OCTOBER 5, 2021

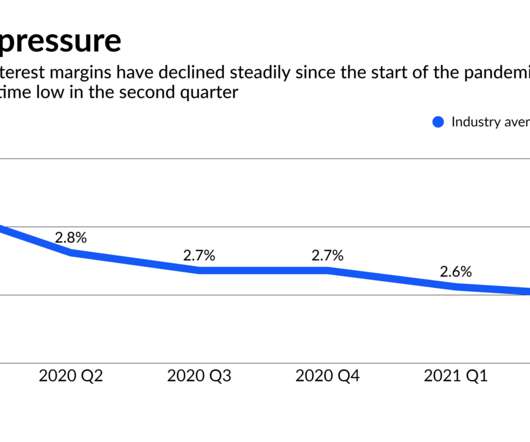

The pace of change in payments right now might seem overwhelming. The pandemic has supercharged the trend towards contactless, online and instant payments. Contactless payments, for instance, grew 150% from March 2019. This is just the start. In the next 10 years, almost 2.7 trillion transactions, worth $48 trillion, are projected to shift from cash….

Let's personalize your content