Credit popularity doesn’t displace cash: Fed report

Payments Dive

MAY 23, 2023

Credit cards were the most used payment method last year in the U.S., but cash demand remains stable, a Fed report showed.

Payments Dive

MAY 23, 2023

Credit cards were the most used payment method last year in the U.S., but cash demand remains stable, a Fed report showed.

South State Correspondent

MAY 23, 2023

Lending is getting riskier. Due to higher rates, inflation, and a slowing economy, the three essential credit metrics – probabilities of default (POD), POD rate of change, and POD volatility- have all materially increased from 2022. In this article, we look at what is happening at the state level, look at 30 common industries where credit risk is rising, and 30 industries where credit risk is the lowest.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MAY 23, 2023

The move is part of PayPal’s plan to lean on Venmo to lure more users.

Gonzobanker

MAY 23, 2023

Bank leaders are working overtime to defend their performance and relevancy. The historic deposit runs on several niched regional banks have woken up bankers and their investors, regulators and policymakers to the threats that liquidity flows place on the entire industry. Taking a step back and looking into reported financial data for Q1 2023, a few key insights appear: The banking industry lost a remarkable $1.1 trillion or 5.5% of total deposits from March 31, 2022, to March 31, 2023 – obvious

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

ATM Marketplace

MAY 23, 2023

Banking automation is here to stay. However, banks also have to deal with questions of how automation can impact their brand image and the customer experience. They also have to find the balance between delivering cutting edge technology while still keeping the personal touch.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

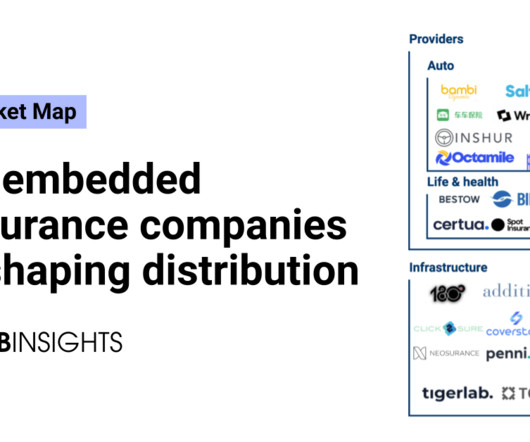

CB Insights

MAY 23, 2023

Embedded insurance — the integration of insurance into a digital product on a third-party platform or marketplace — is becoming more popular as a way to boost revenues and improve customer experiences. For consumers, these products can provide faster, more convenient, and more accessible insurance options. For insurers, embedded insurance can enable more product personalization (e.g. using payroll provider data for pay-as-you-go workers comp), improve underwriting accuracy (e.g. usin

CFPB Monitor

MAY 23, 2023

On May 17, 2023, the U.S. Department of Education (ED) released a Notice of Proposed Rulemaking intended to increase transparency regarding the costs and financial outcomes of postsecondary programs. The centerpiece of the proposed regulations is a Gainful Employment (“GE”) Rule, which would terminate access to federal financial aid for career training programs that fail to meet federal benchmarks.

William Mills

MAY 23, 2023

Public relations programs will always vary based on a fintech’s unique goals and market position. But, whether it’s a startup or a more established company, with one competitor or hundreds, organizations’ public relations programs should focus on a three-pronged approach: building brand awareness, educating key audiences and establishing credibility.

The Paypers

MAY 23, 2023

Ecommerce platform Lazada Group has launched ladasolutions.com, an e-learning website that offers bite-sized, self guided courses on Lazada Sponsored Solutions (LSS) to anyone.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

MAY 23, 2023

QED Investors, the financial technology-focused venture firm that was an early backer of Credit Karma, has raised $925 million for two new funds. The firm, based in Alexandria, Virginia, said it has closed on $650 million for its early stage fund and $275 million for what it calls an early growth-stage fund.

The Paypers

MAY 23, 2023

Meta has been fined with EUR 1.2 billion by regulators from the European Union for violating EU privacy laws by transferring personal data of Facebook users to servers in the US.

BankInovation

MAY 23, 2023

The digital wallet market is saturated and has several established players, but this has not stopped new competitors from entering the space. Despite being one of the late arrivals to the space, Paze, a digital wallet being launched by a consortium of banks, including U.S.

The Paypers

MAY 23, 2023

UK-based bank NatWest has launched Tap to Pay on Android, a new service for customers to accept in-person contactless payments on their own phone devices.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

BankInovation

MAY 23, 2023

Wells Fargo Head of Global Treasury Management Payments and Transaction Services John Hunter is focused on simplifying the bank’s experiences with cloud, AI and machine learning. The San Francisco-based bank invested $9.4 billion in technology in Q1, launched Wells Fargo Vantage digital banking platform and continues to look to AI for opportunities within the bank.

The Paypers

MAY 23, 2023

The Monetary Authority of Singapore has launched the financial sector artificial intelligence and data analytics (AIDA) talent development programme.

ATM Marketplace

MAY 23, 2023

More than just processing a payment transaction, Ren Payments is a pathway to innovation, allowing our customers to keep pace in an ever-changing financial environment by providing modern technology with total freedom.

The Paypers

MAY 23, 2023

US-based Amazon ’s palm-scanning payment technology, Amazon One, has been updated with age-verification capabilities to improve user convenience.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

Qudos Bank

MAY 23, 2023

Are you in your 30s, or on your way there? Your 30s can be an exciting point in your life, as it’s a time of change for many. However, some changes require financial security which can empower you to take considered risks, to help you get ahead. We’ve put together some helpful financial tips, designed to assist people just like you to help improve your financial situation and take control of your income/expenses. 1.

The Paypers

MAY 23, 2023

Jamaican officials have confirmed the development of a digital marketplace that aims to promote the adoption of the JAM-DEX central bank digital currency (CBDC).

The Banker

MAY 23, 2023

Rebuilding Ukraine, Uzbekistan’s gradual opening up and sub-Saharan Africa dominated the agenda at this year’s EBRD meeting in Samarkand. Anita Hawser reports.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

MAY 23, 2023

Kiwi has secured USD 75 million credit facility and USD 4.5 million in pre-series A funding to aid consumers in building credit history and financial literacy.

The Paypers

MAY 23, 2023

Switzerland-based software company Netcetera has invested in its digital banking offerings and in the expansion of its product portfolio in the region.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content