Federal Reserve Releases Bank’s Annual CCAR Stress Test Results

Perficient

JULY 8, 2021

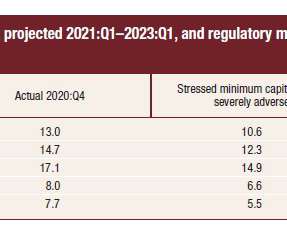

The Federal Reserve released in late June the results of its annual bank stress tests. The Fed’s Comprehensive Capital Analysis and Review (“CCAR”) stress tests are designed to ensure that large banks can lend to households and businesses even in a severe recession. The annual exercise evaluates large banks’ resilience by estimating their loan losses, revenue, and capital levels—which provide a cushion against losses—under hypothetical recession scenarios that extend nine

Let's personalize your content