Tag Heuer accepts crypto as payment

Payments Dive

MAY 24, 2022

CEO Frédéric Arnault suggested cryptocurrency fluctuations are a risk companies will need to take on if they allow this form of payment.

Payments Dive

MAY 24, 2022

CEO Frédéric Arnault suggested cryptocurrency fluctuations are a risk companies will need to take on if they allow this form of payment.

BankInovation

MAY 24, 2022

Half of JPMorgan Chase’s total infrastructure spend is on the cloud, the bank announced Monday during its 2022 Investor Day. Investors were left scratching their heads in January when the $4 trillion global bank announced it would increase its 2022 tech spend by 20%. During Monday’s 2022 Investor Day, which included a 20-minute technology presentation […].

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MAY 24, 2022

Klarna, a major buy now-pay later player and Europe's highest value fintech, has "re-evaluated" its business and made "really tough decisions" that include cutting 10% of its workforce, the CEO said.

BankInovation

MAY 24, 2022

After years of stop-start evolution, the market boom that open-banking advocates have been waiting for appears to be underway. The potential of this sector is as large as it is untapped with the sector projected to be worth $43.15 billion by 2026, equivalent to an annual growth rate from 2019 upwards of 24%. Open banking […].

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

MAY 24, 2022

Billtrust, which focuses on the accounts receivable side of B2B payments, has acquired two European companies in recent months and plans to continue snapping up other firms.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

TheGuardian

MAY 24, 2022

Warning follows first Bank of England climate stress tests on seven largest lenders UK banks and insurers will end up shouldering nearly £340bn worth of climate-related losses by 2050, unless action is taken to curb rising temperatures and sea levels, the Bank of England has warned. The numbers emerged from the Bank’s first climate stress tests on seven of the UK’s largest lenders.

FICO

MAY 24, 2022

How does environment affect you in your job? You might ask the question; how do environmental issues impact you in your job? You might be in the risk part of the business or collections. Or you might be dealing with customer servicing or digital engagement. So how does this connect with you? In 2022, most companies have some environmental policy around what they're doing and they're sharing this with their shareholders, the stakeholders of their organizations.

TheGuardian

MAY 24, 2022

Prominent Scottish merchant banker who was a dedicated promoter of cultural life and the arts in his homeland Sir Angus Grossart, who has died aged 85, was one of the great panjandrums of Scottish public life; a successful and wealthy merchant banker who devoted much effort to promoting the arts and without whose imprimatur no major fundraising cause was seemingly complete.

ABA Community Banking

MAY 24, 2022

FDIC-insured banks and savings associations earned $59.7 billion in the first quarter of 2022, a 22.2% decrease from the year prior, the agency reported yesterday in its Quarterly Banking Profile. The post FDIC: Increase in provision expense drives bank net income down appeared first on ABA Banking Journal.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

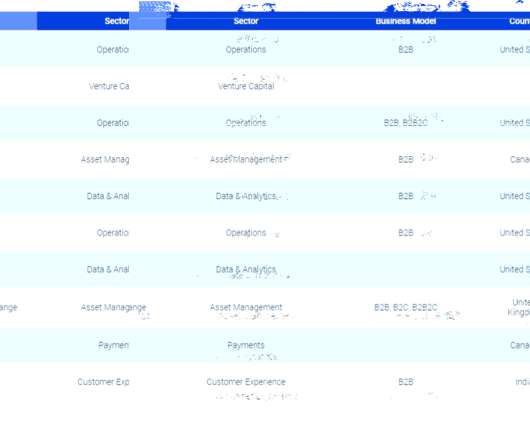

CB Insights

MAY 24, 2022

Velocity Global , a workforce management platform, has raised $400M in a Series B. The round drew participation from Eldridge and Norwest Venture Partners. <span data-sheets-value='{"1":2,"2":"<div class="cbi-cta-shortcode-wrapper"><div class="cbi-cta-shortcode-content"></div><div class="cbi-cta-shortcode-forms" ><div class="cta has-desktop"><div class="cta-desktop center-copy ">&

The Paypers

MAY 24, 2022

UK-based payments specialist allpay has partnered with Payzone to add an additional 12,500 stores across UK where customers can pay bills using cash.

The Paypers

MAY 24, 2022

Global payments processor Mastercard has announced a strategic partnership with two fintechs, i2C and One Global , to enhance its presence in the Middle East and North Africa region.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

MAY 24, 2022

US-based fintech Splitit has partnered with BlueSnap to augment the Buy Now, Pay Later (BNPL) checkout experience and jointly target key verticals.

The Paypers

MAY 24, 2022

Nuapay ( EML Payments Limited 's Open Banking business), has connected to banks in another 20 countries in Europe.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

MAY 24, 2022

People's Bank of China and regulators have urged the nation’s lenders to step up support for the real economy and meet credit demand.

The Paypers

MAY 24, 2022

Open Banking platform Yapily has partnered with B2B Buy Now, Pay Later (BNPL) startup Two , enabling merchants to offer BNPL services to their business customers instantly at checkout.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

MAY 24, 2022

A Postbank digital study has shown that 6 out of 10 Germans are already making contactless payments with their smartphone or card.

American Banker

MAY 24, 2022

The Paypers

MAY 24, 2022

Germany-based cloud accounting software and invoicing programme provider Billomat and smart billing company aifinyo have announced completing their merger which was announced in March 2022.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content