How the pandemic accelerated digital payments innovation

Accenture

MAY 24, 2021

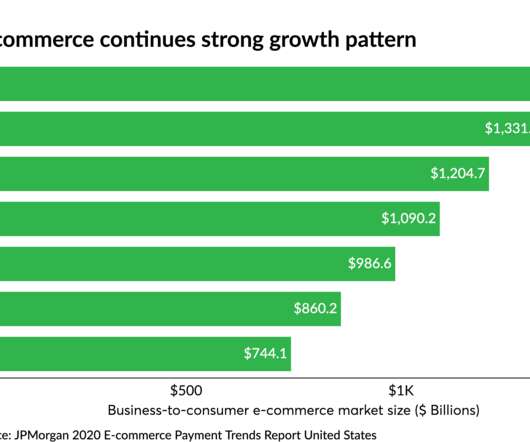

The COVID-19 pandemic has pushed digital payments into a new era as businesses around the world were forced to switch quickly from in-store to online. As more and more consumers started to shop online, embedding the payments experience in customer journeys and managing payments infrastructure have become extremely important to businesses in virtually every industry.….

Let's personalize your content