Hip On HIPAA: How Do We Deliver Better Front-End Experiences

Perficient

MARCH 8, 2021

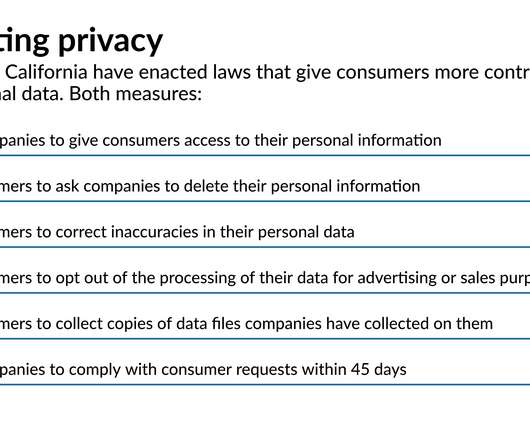

The other day a question came up on what extra due diligence do we need to do as we adhere to HIPAA compliance requirements. My first thought was that, of course, we do comply by embracing that extra due diligence in everything we deliver. But of course, the devil is in the details. Those details get a little thorny when you create a good experience without crossing the line and sharing any information.

Let's personalize your content