Listen: Weekly Wrap discussion on how Temenos is accelerating innovation

BankInovation

NOVEMBER 19, 2021

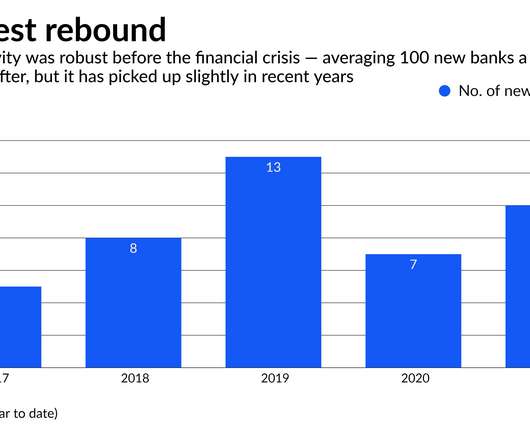

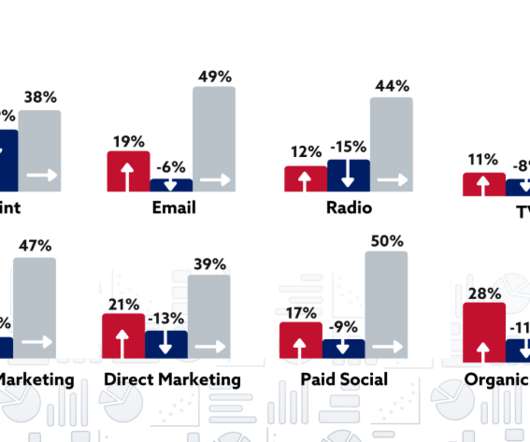

In this week’s “Weekly Wrap” podcast, the Bank Automation News team discusses some of the latest from core and digital banking solutions provider Temenos gleaned from its SCALE developer conference, where the company showcased how it is fostering innovation and bringing new fintech ideas to market faster. In a similar vein, the team addresses the […].

Let's personalize your content