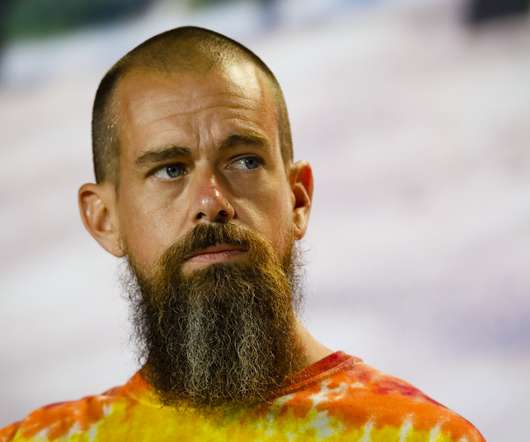

5 key tech takeaways from Mastercard CEO

BankInovation

NOVEMBER 4, 2021

Creating the “next big thing” is no longer enough to address an unsolved problem — banks and fintechs also need to ensure that they’re earning customers’ trust. That means ensuring data is kept private and secure, said Mastercard CEO Michael Miebach this week. Miebach gave the fireside chat at Commerce Summit, a virtual event hosted […].

Let's personalize your content