The rush to digitalisation post-pandemic

Chris Skinner

MARCH 17, 2020

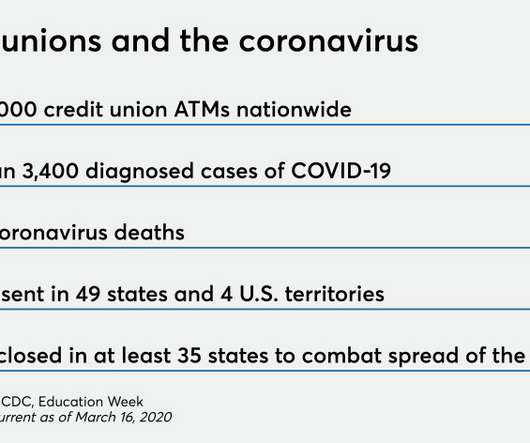

I’m getting a lot of people asking questions about what I think the coronavirus will mean long-term in the financial markets, so I’ve tried to jump forward to look back. Obviously, the big thing about a pandemic is that people are being told to stop meeting each other. Conferences, events, … The post The rush to digitalisation post-pandemic appeared first on Chris Skinner's blog.

Let's personalize your content