My Experiences with Live Connection Mode: Power BI

Perficient

AUGUST 22, 2022

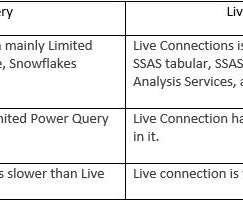

Live Connection Mode: Power BI. Live Connection is one of the connection modes to connect the data source into Power BI, just like Import and Direct Query. As of now, some of the cloud data sources we can connect through Power BI Live Connection are: Azure Analysis Services. SQL Server Analysis Services Tabular. SQL Server Analysis Service Multi-Dimensional.

Let's personalize your content