The virtual banking brew in Asia

Chris Skinner

JANUARY 20, 2020

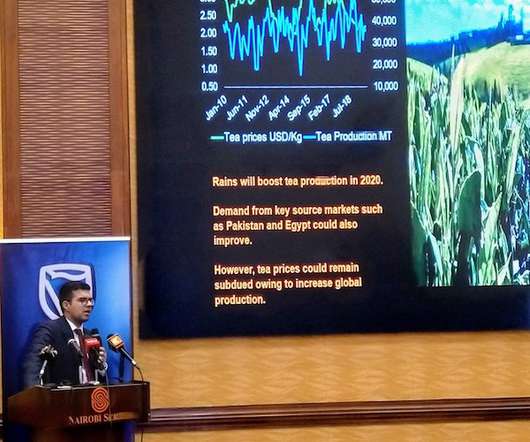

Varun Mittal, Associate Partner with EY, recently posted a couple of interesting slides about the launch of virtual banking licences to encourage challenger banks in Asia. If you’re not aware, there’s a great deal of digital banking activity across Asia. It’s not just in China, but there are notable things … The post The virtual banking brew in Asia appeared first on Chris Skinner's blog.

Let's personalize your content