GonzoBanker’s Post-Pandemic Customer Care Playbook

Gonzobanker

JUNE 25, 2021

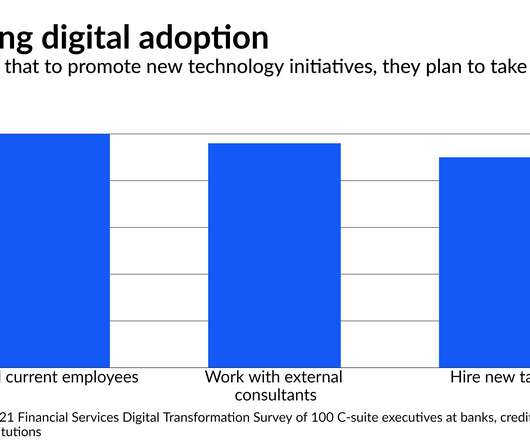

Transform your customer care function from a back-office cost center to a 21 st century competitive advantage. The COVID-19 pandemic permanently changed consumer banking preferences. Over the past year and a half, customers learned that although they may have been mandated to stay at home, they did not have to accept being told how to do their banking.

Let's personalize your content