Zip ditches Sezzle BNPL buyout

Payments Dive

JULY 12, 2022

The Australian company will pay $11 million to Sezzle after it dropped a plan to purchase the Minneapolis-based company in the face of “macroeconomic and market conditions.

Payments Dive

JULY 12, 2022

The Australian company will pay $11 million to Sezzle after it dropped a plan to purchase the Minneapolis-based company in the face of “macroeconomic and market conditions.

Perficient

JULY 12, 2022

Across financial services – industries such as banking, wealth management, and insurance – the need for greater personalization has been a theme for several years. Fueled by consumers’ willingness to share their data in return for timely and relevant experiences, personalization requires continually learning about the customer and applying this knowledge into the relationship and creating authentic, individualized experiences.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JULY 12, 2022

Public transport is expected to become a driver of contactless payment usage, especially as environmentally conscious commuters get on board, suggested a survey by card network company Visa.

Accenture

JULY 12, 2022

There’s no denying that the fintech space is a major source of disruptive new ideas in payments. It’s why we keep a close eye on fintech news in this blog. It’s also why the trend we’re about to discuss is so intriguing. Fintechs are usually founded by entrepreneurs—people who want to change the world in…. The post The curious case of payments fintech frenemies appeared first on Accenture Banking Blog.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

JULY 12, 2022

The Birmingham, Alabama-based fintech says there is room to grow in the $8 trillion market for business-to-business payment software services.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

JULY 12, 2022

The corporate spend management startup, which has raised $63 million in capital, is trying to balance “growing too fast and making sure we are not under-servicing our clients,” said CEO Oded Zehavi.

Bobsguide

JULY 12, 2022

ATMIA, the leading non-profit trade association representing the entire global ATM industry, has announced Auriga as the winner of the “Improving the Costs of Cash White Paper” contest. Auriga’s “The Cash Management Crunch Resolved by Auriga” white paper was acknowledged for its insights into cash management optimisation. The contest encouraged the global ATM industry to advocate for the future of cash.

Payments Dive

JULY 12, 2022

“Rather than competing with one another, banks and fintechs are increasingly partnering,” writes Modern Treasury CEO Dimitri Dadiomov.

BankInovation

JULY 12, 2022

U.K.-based fintech GoHenry, which provides pre-paid debit cards and a financial education app for children, this week announced its acquisition of France-based startup Pixpay, a challenger bank for tweens and teens. Terms of the deal were not disclosed. The deal will afford GoHenry the opportunity to expand into Europe, Dean Brauer, co-founder and president of […].

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

CFPB Monitor

JULY 12, 2022

The CFPB has agreed to a March 31, 2023 deadline for issuing a final rule implementing the small business data requirements of Section 1071 of the Dodd-Frank Act. Section 1071 amended the ECOA, subject to rules adopted by the Bureau, to require financial institutions to collect and report certain data in connection with credit applications made by small businesses, including women- or minority-owned small businesses.

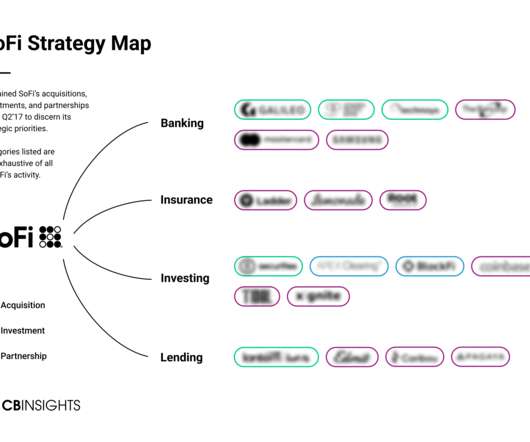

CB Insights

JULY 12, 2022

Consumer-facing finance company SoFi has traditionally been known for its lending services. The company went public in 2021, and now has a market cap of over $5B, even amid 2022’s widespread slump in tech stocks. <span data-sheets-value='{"1":2,"2":"<div class="cbi-cta-shortcode-wrapper"><div class="cbi-cta-shortcode-content"></div><div class="cbi-cta-shortcode-forms" ><div class="cta has-desktop&#

CFPB Monitor

JULY 12, 2022

A new report by the CFPB uses over five million credit records from one of the three nationwide consumer reporting agencies to examine how credit card companies have used credit line decreases throughout the Great Recession and the early stages of the COVID-19 pandemic. As a general trend, the report found issuers used credit line decreases during broad economic downturns as a way to decrease overall risk.

Cisco

JULY 12, 2022

Regulatory requirements are a key operational concern that we hear about from our financial customers. As a key provider of technology for mission-critical financial system infrastructures across the globe, Cisco is held to the highest levels of scrutiny in the financial services regulatory audit chain. We have helped customers navigate the complex requirements and landscape to help keep them protected, when 100% of their business, relies on our equipment in the value chain.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

CFPB Monitor

JULY 12, 2022

In a new advisory opinion , the CFPB addresses the Fair Credit Reporting Act’s permissible purpose requirement as it applies to both consumer reporting agencies and users of consumer reports. Consumer reporting agencies. FCRA Section 604(a) enumerates the circumstances under which a consumer reporting agency (CRA) may provide a consumer report to a user.

BankInovation

JULY 12, 2022

Goldman Sachs Transaction Banking recently partnered with capital markets technology derivatives services provider Derivative Path to offer regional and community banks access to in-house foreign exchange (FX) capabilities in markets they historically did not have access to. The partnership closes the gap between major Wall Street firms and regional and community banks by targeting small […].

CFPB Monitor

JULY 12, 2022

The CFPB has posted new job openings for technologists to work with its supervision and enforcement teams. The CFPB is seeking experts in data science, software engineering, product design, product management, and user experience (UX). The job postings indicate that the CFPB is willing to invest significant resources in building its understanding of and capability to challenge the use of newer and emerging technologies by consumer financial service providers.

BankInovation

JULY 12, 2022

Technology billionaire Romesh Wadhwani’s artificial intelligence software company agreed to buy BAE Systems Plc’s financial crime detection business, NetReveal. Terms of the deal weren’t disclosed, but SymphonyAI Chief Executive Officer Sanjay Dhawan said in an interview that it was his company’s biggest to date and would help it sell more software to financial institutions.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

JULY 12, 2022

India-based fintech startup ePayLater has recently announced the expansion of its retailer and neighbourhood store user base in two more regions in the country, including tier 2 and 3 cities.

The Paypers

JULY 12, 2022

Union Bank of India (UBI) has rolled out a Metaverse Virtual Lounge and Open Banking Sandbox environment, according to mint.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

JULY 12, 2022

Global payments solution provider BPC has been chosen as a strategic partner by NanoPay Mexico to implement its SmartVista anti-fraud solution to safeguard credit card transactions.

The Paypers

JULY 12, 2022

UK-based digital lending marketplace Freedom Finance has released a report finding that the retail store and online credit sector experienced its fastest ever start to a year in 2022.

American Banker

JULY 12, 2022

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content