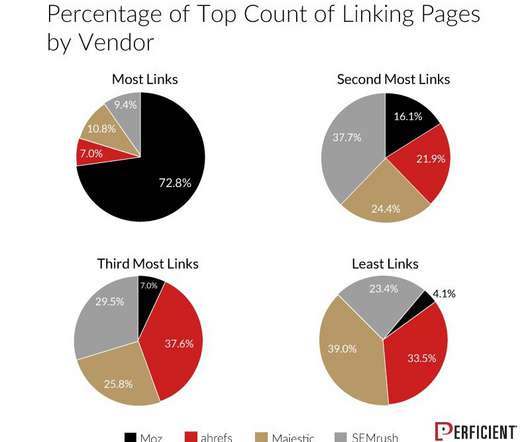

Study: Who Has the Largest Index of Links?

Perficient

JANUARY 26, 2021

An essential part of any strong SEO program is having third parties link to your site. In addition to the SEO benefits, getting linked to by third parties is also a great way to build your brand and stay highly visible across the web. For this reason, using backlinking tools is important. Getting access to more link data is generally good, but which tool provider has the largest index?

Let's personalize your content