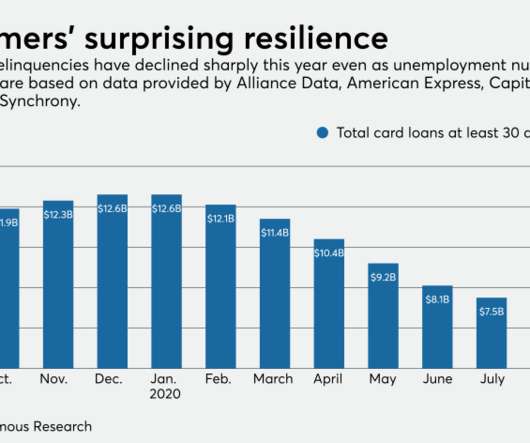

How much longer will consumer credit hold up?

American Banker

NOVEMBER 2, 2020

Payment rates for auto lenders and credit card issuers have remained strong despite a spike in unemployment. Whether these trends continue into 2021 will depend largely on the actions of Congress and the pace of medical advances.

Let's personalize your content