Charles Potts: Unlocking better customer connections

Independent Banker

FEBRUARY 28, 2022

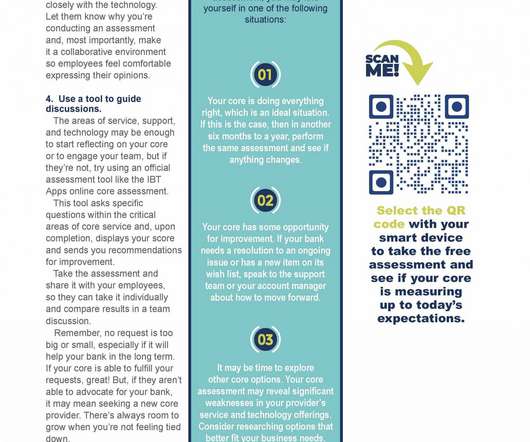

By Charles Potts, ICBA. Innovation is a priority for ICBA. That’s why we’ve spent the past three years educating community bankers on the why of innovation: why bankers should be thinking about innovation, why innovation is a top priority in a digital-first environment and why now is the time to act. We are now exploring the how: how ICBA can help community bankers drive growth through innovation, and how community bankers can better engage new and existing customers.

Let's personalize your content