Rebeca Romero Rainey: Focusing on our communities

Independent Banker

APRIL 1, 2021

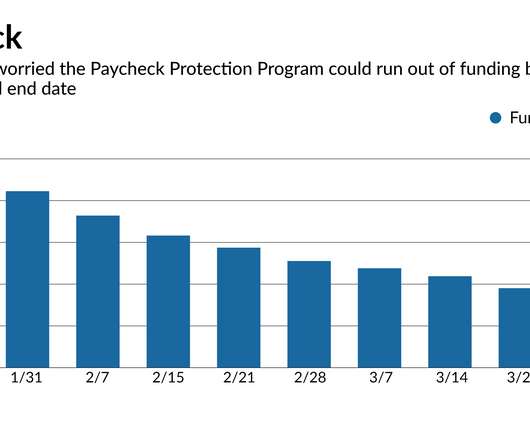

Photo by Robert Severi. Unlike our credit union counterparts, we pay taxes, and those tax dollars are spent at home to ensure our communities grow. The more things change, the more they remain the same. As we kick off Community Banking Month, I can’t help but reflect on that statement and the changes of this past year. While we have been challenged far beyond our wildest dreams, community banks have stayed the course in keeping the focus on our communities.

Let's personalize your content