Explained | The current banking crisis in the US and Europe

BankBazaar

APRIL 19, 2023

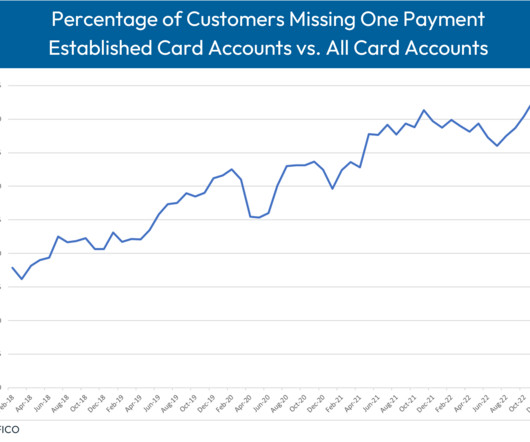

The Federal Reserve began raising interest rates rapidly to combat inflation in the USA, and banks’ portfolio started to lose significant value owing to the largest investments they had made. Amid the financial uncertainties, Silicon Valley Bank (SVB) collapsed in March this year, sending shockwaves across the global financial markets. The fear grew stronger after the failure of Signature Bank as investors and customers were apprehensive of a major financial crisis.

Let's personalize your content