Visa flags rising in-person fraud

Payments Dive

OCTOBER 6, 2022

The card behemoth said it’s observing an increase in in-person fraud now that U.S. consumers are returning to their pre-pandemic shopping habits.

Payments Dive

OCTOBER 6, 2022

The card behemoth said it’s observing an increase in in-person fraud now that U.S. consumers are returning to their pre-pandemic shopping habits.

BankInovation

OCTOBER 6, 2022

Banc of California acquired digital payments platform Deepstack Technologies on September 15 in a $24 million cash and stock deal that will expand its business into payment processing in a move to provide customers with detailed insights and tips to streamline their spending. The $8 billion Santa Ana, Calif.-based bank will use Deepstack’s API-driven payments […].

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

OCTOBER 6, 2022

The international standard-setting organization finalized a new specification for contactless and mobile payments, but adoption of the new approach by merchants may be slow-going.

BankInovation

OCTOBER 6, 2022

Financial institutions are implementing biometric solutions that can add layers of security, reduce fraud and provide a better understanding of client experience, however banks must integrate these solutions carefully, keeping compliance front and center and staying aware of fraud since the technology isn’t foolproof — not yet at least. In fact, alongside the surge in […].

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

OCTOBER 6, 2022

New frictionless convenience stores are coming to airports in Los Angeles and Dallas, continuing a trend that has gained steam since last summer.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

TheGuardian

OCTOBER 6, 2022

Chancellor’s meeting with high street lenders comes amid mounting concern over fallout from rising loan rates High street bank bosses will tell the chancellor, Kwasi Kwarteng, that they have growing concerns over the state of the UK’s mortgage market when they gather at Number 11 Downing Street on Thursday. The meeting – which is expected to be attended by chief executives, including Alison Rose of NatWest, Charlie Nunn of Lloyds Banking Group, Ian Stuart at HSBC UK, Mike Regnier at Santander an

CFPB Monitor

OCTOBER 6, 2022

The CFPB, in a notice published in the Federal Register on September 27, 2022 , announced that it was rescinding its No-Action Letter and Compliance Assistance Sandbox policies (Policies). The rescission was effective on September 30, 2022. In the notice, the CFPB stated: The CFPB determined that the Policies do not advance their stated objective of facilitation consumer-beneficial innovation.

TheGuardian

OCTOBER 6, 2022

Ailing Swiss bank’s share price has collapsed after being hit by series of crises Credit Suisse, the investment bank whose shares plummeted to record lows this week over fears it could be on the brink of collapse , is selling the five-star Savoy hotel in the centre of Zurich for as much as 400m Swiss francs (£361m). The bank, whose stock has fallen by more than 40% in the past six months, said on Thursday it had put the 184-year-old hotel on Paradeplatz in the heart of the city’s financial distr

CFPB Monitor

OCTOBER 6, 2022

On September 29, 2002, the Consumer Financial Protection Bureau (“CFPB”) filed a complaint against online lender MoneyLion Technologies, Inc, and several dozen of its subsidiaries (collectively, “MoneyLion”), alleging violations of the Military Lending Act (“MLA). The complaint alleges that MoneyLion (i) overcharged servicemember and their dependents by imposing fees that, together with stated interest rates, exceeded the MLA’s 36% Military Annual Percentage Rate (“MAPR”), (ii) failed to provid

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

Jack Henry

OCTOBER 6, 2022

I think we can all relate to wanting (and needing) to be more efficient in our everyday lives. Whether it’s at home, at work, or simply running errands, it can feel like the to-do list keeps growing while our bandwidth continues to shrink. It turns out this is not an ideal combination (may or may not be speaking from personal experience), although it has become more and more common – especially in the world of financial services.

CFPB Monitor

OCTOBER 6, 2022

A California state court has overruled the demurrer filed by Opportunity Financial, LLC (OppFi) to the cross-complaint filed by the California Department of Financial Protection and Innovation (DFPI) in which OppFi asked the court to reject the DFPI’s “true lender” challenge. In its cross-complaint, the DFPI alleges that California usury law applies to loans made through OppFi’s partnership with FinWise Bank (Bank) because OppFi, and not the Bank, was the “true lender.”.

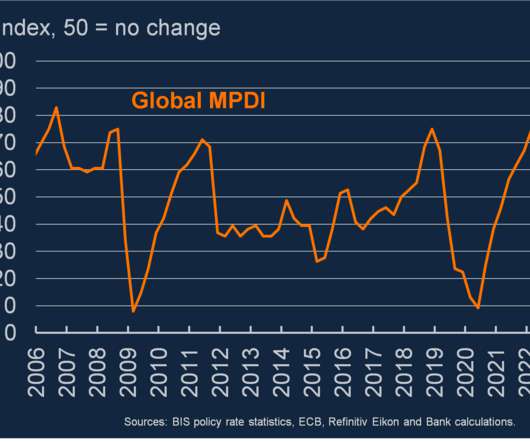

BankUnderground

OCTOBER 6, 2022

Shaheen Bhikhu and Thomas Viegas. Central banks respond to inflation by setting interest rates in order to achieve domestic price stability. Occasionally, economic shocks are global in nature and so monetary policy can move in tandem across the world. But how common have directional changes in monetary policy been across the world over recent decades?

CFPB Monitor

OCTOBER 6, 2022

On October 4, 2022, the Consumer Financial Protection Bureau (CFPB) entered into a consent order with Choice Money, a New York nonbank remittance transfer provider involving violations of the Remittance Transfer Rule (“Remittance Rule”), Subpart B of Regulation E, 12 C.F.R. §§ 1005.30 to 1005.36, and the Consumer Financial Protection Act. The CFPB alleged that Choice Money failed to comply with disclosure requirements for the Pre-Payment disclosure and the Receipt disclosure set out in the Remit

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

OCTOBER 6, 2022

US-Based Allied Market Research has released a new report, revealing that the Open Banking market is expected to be worth USD 123.7 bln in 2031.

CFPB Monitor

OCTOBER 6, 2022

After discussing what the Metaverse is and its possible uses by providers of legal and other services, we look at an array of legal issues that should be considered by lawyers and their clients operating in the Metaverse or contemplating doing so. Issues discussed include privacy rights of users of Metaverse platforms, data security, moderation of content, preservation of data for litigation, e-discovery implications such as what information is discoverable and access to user communications, an

Ublocal

OCTOBER 6, 2022

Starting your own business is an incredibly exciting moment in your life, whether you’ve ventured into business ownership before, or if this is your first time setting up shop. From the first spark of an idea to the day you open your doors to the public, there’s plenty to keep you busy along the way. If you’re thinking about starting a small business in Vermont or New Hampshire, Union Bank is here to support your entrepreneurial dreams.

Bussman Advisory

OCTOBER 6, 2022

FinTech Ecosystem Insights by Bussmann Advisory is our weekly newsletter with over 40’000 subscribers across different social media channels, summarizing relevant news and reports related to ecosystems around disruptive technologies, highlighting key updates from the industry as well as our portfolio companies: JPMorgan’s UK digital bank app outage locks customers out SWIFT completes tokenization interoperability trial with SETL, Clearstream, Northern Trust BlackRock launches EU blockchain

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

OCTOBER 6, 2022

European Union lawmakers have reportedly given their final approval to its ecommerce-focused regulation – The Digital Services Act.

The Paypers

OCTOBER 6, 2022

The Australian Competition and Consumer Commission (ACCC) is set to organise ‘Internet sweeps’ to identify companies that make false environmental and sustainability claims, also called greenwashing.

The Banker

OCTOBER 6, 2022

While the removal of the bonus cap aims to reinvigorate the country’s status as a financial centre, implementation of the change presents many hurdles. Analysis by Kate Pumfrey and Jack Prettejohn of Allen & Overy.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

OCTOBER 6, 2022

Raiffeisen Bank International has signed a partnership agreement with treasury fintech FinLync to provide cash management services via corporate bank APIs.

The Paypers

OCTOBER 6, 2022

Mastercard. has debuted a new piece of software called Crypto Secure, that helps banks identify and cut off transactions from fraud-prone crypto exchanges.

American Banker

OCTOBER 6, 2022

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content