What will the world be like when #coronavirus ends? (Part Two)

Chris Skinner

APRIL 30, 2020

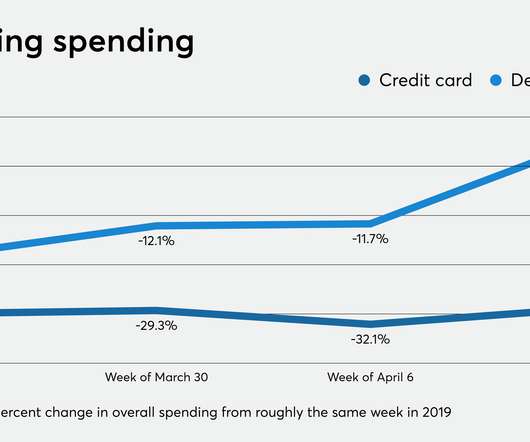

I hesitate to write that headline – after all, none of knows when or even if this pandemic will end – but what I do know is that, in this time of crisis, there are lots of things changing: our beliefs, our priorities, our views, our relationships. I sat down … The post What will the world be like when #coronavirus ends? (Part Two) appeared first on Chris Skinner's blog.

Let's personalize your content