Fed will continue supporting PPP loans until June 30

(Full story

CFPB throws mortgage market another curveball

(Full story

Outsider emerges as top contender to lead OCC

(Full story

SoFi buying small California bank for $22.3 million

(Full story

Too many small banks are 'digital have-nots': FDIC innovation chief

(Full story

Fears of a backlog as PPP deadline looms

(Full story

Huntington's Harmening set to take helm at Associated

(Full story

Bank CEO sought meeting with Trump while eyeing job, prosecutors say

(Full story

State data privacy laws pose compliance headaches for banks

(Full story

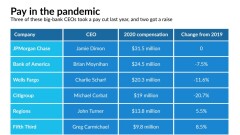

Megabanks rein in CEO pay. Expect others to follow.

(Full story